So sayeth the C.A.R.:

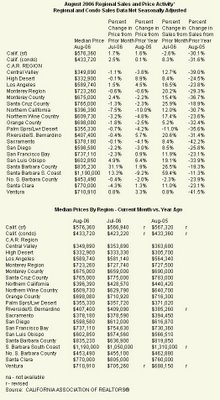

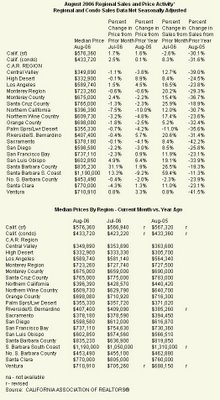

Home sales decreased 30.1 percent in August in California compared with the same period a year ago, while the median price of an existing home increased 1.6 percent, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) reported today.

“We experienced the greatest year-to-year sales decline last month since August 1982, when sales fell 30.4 percent,” said C.A.R. President Vince Malta. “This is another indication that we’re in the initial stages of a long-anticipated adjustment in the market.

Anticipated by who exactly? Not the C.A.R. At least not publicly. And what do you mean exactly by "initial stages"? This "adjustment" will last years.

“Buyers today have a much greater selection of properties from which to choose, while some sellers are still clinging to price expectations that are no longer valid in today’s market,” he said.

Sounds

familiar.

“Although the median price in the state and in several regions hit an all-time record in August, we expect softer prices toward the end of the year,” said C.A.R. Vice President and Chief Economist Leslie Appleton-Young. “The median price typically peaks somewhere between June and August before declining toward the end of the year. Some areas of the state already have experienced year-to-year declines for more than two months. This is in stark contrast to the past several years when there were constant double-digit increases. The long-term trend remains to be seen.”

Sounds familiar. Below is their charted data:

9 comments:

ah yes,david lereah also speaks of "the expected correction"but i haven't heard much about his problem with identity theft...apparently someone wrote a book using his name,full of misleading information,some of which directly contradicts what he is now saying!one hell of a lawsuit there,baby.i wonder how many lawyers are calling him and offering to take the case on contingency?

"We think the housing market has now hit bottom."

Actual quote from Lereah today. Let's hold him accountable.

Isn't it nice for DL to assure us that after five years of historically unprecedented increases, we just have to get through the next few months, sell off the inventory glut and everything will be fine again. What a relief.

Does anyone know how much exposure the writers of PMI policies are facing? I know their industry group has been calling houses overvalued for the last couple of years. Any way they could push for lending reform?

- Robb

I guess the real question is how many FB's there really are - and certainly how many are there in Marin?

I wonder if there will be a retraction of homes on the market towards the holiday season, and how much that will pick up will be interesting. I also wonde how many of the homes on the market are just fishers looking to grab because they see it going down versus how many really must sell.

"Does anyone know how much exposure the writers of PMI policies are facing? I know their industry group has been calling houses overvalued for the last couple of years. Any way they could push for lending reform?"

They have...a letter written by someone in PMI was circling the blogs a while back...strongly expressing their thoughts on current dangerous state of mortgage lending, etc....

ANYONE notice in the CAR data tabulation, the small, little error regarding Santa Barbara South Coast price appreciation?

"ANYONE notice in the CAR data tabulation, the small, little error regarding Santa Barbara South Coast price appreciation?"

Oops, my mistake...no error there. But wow...-9.2% YOY drop...even SB prime is not immune.

-9.2% YOY drop...even SB prime is not immune.

And if anyone recalls, the local pundits were trumpeting SB's bust-proof market due to the "uniqueness" of the place--smugly confident a downturn could not happen here.

Sound familiar?

SoCal has a lot of weight to shed.

Post a Comment