It's old news now and it's not specific to Marin, but I couldn't resist this article in USA Today if for no other reason than Lereah's comments at the end:

It's old news now and it's not specific to Marin, but I couldn't resist this article in USA Today if for no other reason than Lereah's comments at the end:Home prices are projected to fall for the rest of the year, the National Association of Realtors said Monday, with sellers being forced to accept a new reality: Buyers now wield the power, with the supply of homes for sale at a 13-year high.A nation-wide price drop is truly noteworthy.

The median-priced U.S. single-family detached home... fell 1.7% in August to $225,700, compared with a year ago. The decline is no doubt jarring to sellers, who haven't seen prices fall nationally since April 1995. The price drop was also sharp, the second-steepest in 38 years.

"The housing bubble has burst; this is just the confirmation," says Joel Naroff of Naroff Economic Advisors.

...the pace of the downturn has surprised several economists, including Ian Shepherdson of High Frequency Economics. "The speed of the collapse has been astonishing," Shepherdson says. "This time last year, single-family home prices were up 16.4%. With inventory still rising, there is no chance of any short-term relief. Prices and volumes have a long way to fall."

Anyway, then some words of new-found wisdom from our buddy David Lereah:

To bring buyers back into the market, sellers simply have to lower their prices, said David Lereah, the NAR's chief economist.I think I just threw up a little bit.

Lereah has repeatedly cut his forecast for the housing market this year and says he's now unsure how deep the correction will turn out.

"If we have prices drop for the rest of the year and sales also continue to drop, then we will have a bad situation in housing of balloons popping rather than air coming out," Lereah said.

Either way, he says, "It's a buyer's market."

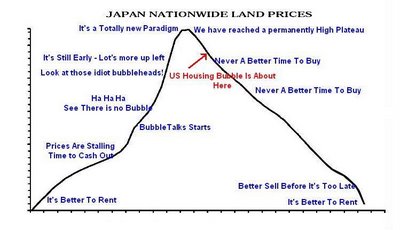

IMO what Lereah meant to say there at the end is 'sellers are screwed'. Ah, and he's talking about 'popping balloon' now. I can't wait for when he utters "bubble". And he doesn't know where the bottom is? Maybe this will give him a clue:

5 comments:

I wonder if RE's have any idea of how many really stubborn buyers they have created out there...really stubborn. My own good agent said in SF "there is nothing tolerable out there."

Top 40 hits of...

1929 -- "Happy Days Are Here Again"

1931 -- "I've Got Five Dollars"

1933 -- "Brother, Can You Spare a Dime?"

lereah will be fine,when his gig is over at nar,he can become a white house spokesman.

Probably for Hillary Clinton. ;8-p

Fred,

This is a game in which the winners are those who lose less than the losers. This charade doesn't create winners because ultimately, the economy will suffer.

Get it?

Post a Comment