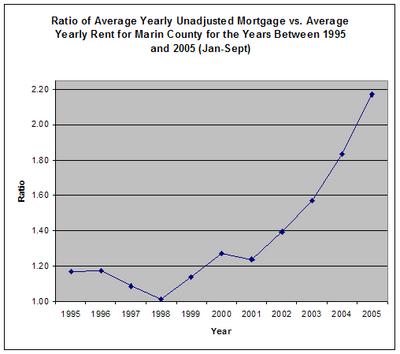

Below is a graph showing the ratio of the average unadjusted yearly cost of a mortgage vs. the average yearly rent in Marin County for the years ranging between 1995 and 2005, inclusive. For the 2005 mortgage data I used the average sales price for the months of January to September, inclusive.

The way I calculated this needs some explanation. For average yearly unadjusted mortgage I just took the average house price and divided it by 30, as in 30 years (no adjustments for maintenance costs or insurance costs or interest on the loan or an assumed down payment or property tax, etc.). For average yearly rent I took the average monthly rent and multiplied it by 12 (except for the 2005 data where I multiplied by 9). I then divided the two resulting numbers for each year.

I know it is rough and amateurish but I just wanted to know what the graph would look like. If anyone can tell me how to come up with a better estimate for yearly cost of a mortgage, please let me know.

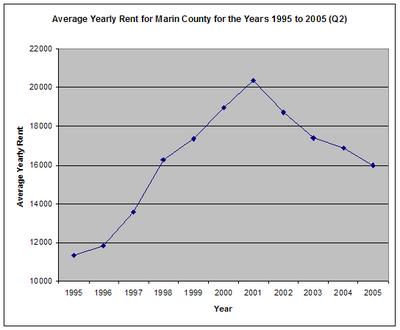

The following graph shows the average yearly rent for Marin County between the years 1995 to 2005, inclusive:

8 comments:

Interesting...that might suggest that any positive return on investment (rent) becomes increasingly dubious after 2001, dare we say before?

Those "intangibles" aside, home ownership for any reason (especially Marin) is hard to justify in recent years. For instance, calculating a mortgage for the current median Marin home ($950K), I find the cost is roughly $2.25M over 30 years. That's 20% down @ 6% fixed, including taxes. Estimating the average rent for a comparable home is difficult over those 30, but I'll guessing it would be far less than $6200/mo! Also note that renters don't pay for property maintenance, which could easily be another $100K over 30 years.

Then there's the opportunity cost of all that money. For instance, if your home rental averaged $3500 over 30 years, you would have roughly $1M at your disposal to actually invest, versus the alleged "investment" of owning the home. Sure, you own a home after 30 years, but is the overall cost currently worth the final value? And at today's prices, I doubt few improvements will be reflected in resale down the road.

Does one's location or wealth really matter, when it's clearly obvious that currently home ownership is not a sound financial decision? Perhas some are so wealthy they don't care, but I suspect most Marinites work hard for their money, and don't intend to throw it away simply for the pleasures (and trials) of home ownership.

Excellent points.

I think the whole argument made by housing bulls vis-a-vis owning a house after 30 years (or whatever the term of the loan is) is almost completely irrelevant these days. Why? Because how many people actually live in the same house after 30 years these days? Sure, it used to be people lived in their house after paying it off. But not anymore. Who could afford to.

BTW, when I was going over the rental data for Marin I found some shocking info...something like 36% of Marin residents are at or below the poverty line or making minmum wage or something like that. Don't quote me because I am going off my memory, but it was a shocking number. The point being only a small fraction of Marin residents are truely wealthy. Others just borrow their wealth. Other are neither.

I will try and locate that info again and post it.

something like 36% of Marin residents are at or below the poverty line or making minmum wage or something like that.

That's shocking, if true! Still, anyone working a retail/service job in the Bay Area must under tremendous financial stress, even as a renter. I'm sure many consider leaving, just as professionals do. If this goes on much longer, our local economy is in trouble.

Another shocking stat I saw today was the CAR affordability index, in particular for Sonoma county, where the percentage that can own a median-priced home is now 7%--that's seven percent!

If Marin (at 11%) is due for a RE correction, Sonoma @7% is much more so.

Of course I cannot find the reference I was originally talking about so I retract my previous statement. But I did find this:

According to this about 60% of Marin County is "Low Income" as of 2000:

http://tinyurl.com/97bvn

According to this the average income of folks in Marin City is 24% lower than the national median income:

http://tinyurl.com/7ofcn

This article says for 2004 "More than 22 percent of Marin households don't earn enough money to pay for basic necessities such as housing, child care, food and health care":

http://tinyurl.com/cjy4d

Very interesting graphs - I appreciate you taking the time, even if you feel they are "amateurish". I especially liked your one of several weeks ago with median income vs. median price since (was it?) 1980.

BTW - what is your rent "ratio." Earlier today I think I calculated that mine is about 383 (house cost/monthly rent). Under "normal" times I've figured it should be 240.

I'm not sure what that means? Could it be my neighborhood is (383/240 = ) 60% overvalued? Seems unlikely.

Here is the poverty data for Marin, the highest per cap income in the USA (from Wikipedia):

"6.60% of the population and 3.70% of families are below the poverty line. Out of the total population, 6.90% of those under the age of 18 and 4.50% of those 65 and older are living below the poverty line.

Marin County has the highest per capita income of any county in the United States."

BTW - what is your rent "ratio."

Are you referring to that ratio mentioned in that Motley Fool article (http://tinyurl.com/84pyb)?

I tried it out on my data and I got numbers that were between 500 and 700 and so I figured that I had to be doing it wrong. I divided the average monthly rent into the average total sale price of houses. Is that right? I can still post the resulting plot but since I don't really know what it means I am hesitant to make it public. But if not and if the 150-200 "rule" is correct, then Marin houses are like 3x over priced. Which kinda makes sense as 10 years ago houses here were 1/3 what they are now.

Yes, I meant the Fool methodology, which I'm not sure is the best way to think about it. I like my ex-landlord's way - which is 20x annual rent.

So my place now:

Fool's method = $680K

ex-landlord's at 20x annual rent = $816K

ex-landlord's at 25x annual rent =

$1.02 million

Market price = ~$1.3 million

Somewhere between $816K and the $1 million would feel right to me in a market slowdown. But what do I know?

I know that using the Fool method (market price/monthly rent) I can compute the ratio they talk about:

Market price = 383x

Ex-landlord 20x = 240x

Ex-landlord 25x = 300x

Maybe for the Bay Area, Fool "rule" of 150 to 200x monthly rent doesn't apply? Maybe it should be 300x?

If so my place is still way overvalued.

I would be somewhat surprised if you were in the 500-700 range, but then again, maybe not - especially the way Marin home prices have gone in recent years and considering the fact that the Bay Area hasn't seen rent increases of any significance in five years.

I looked at renting in Marin in the last year a few times, and it surprised me how much cheaper than the City it is - where rents are way off from a few years ago. I'm moving to a place in the City next month that rented for ~25% more in 2001.

I think you are correct, Marinite. I rent a SFH and my ratio is about 500. Admittedly, I have a good deal, but not a extraordinary deal compared to what I see out there.

Post a Comment