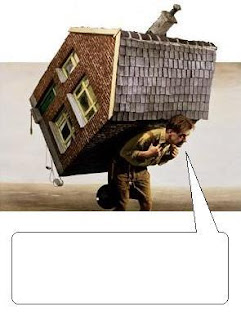

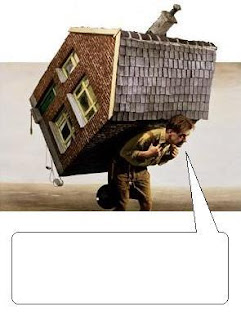

By request. Post whatever you want (just keep it clean and relevant). Let the graphic be your inspiration.

By request. Post whatever you want (just keep it clean and relevant). Let the graphic be your inspiration.

A place for residents of Marin County, CA and others to express their views regarding the real estate bubble and in particular the Marin real estate market

Friday, February 29, 2008

Open Thread

By request. Post whatever you want (just keep it clean and relevant). Let the graphic be your inspiration.

By request. Post whatever you want (just keep it clean and relevant). Let the graphic be your inspiration.

Sunday, February 24, 2008

The Absurdity That Is Marin RE

Do you remember this POS in Forest Knolls (also blogged here)? It was first listed for $449,000 at least as far back as February, 2006 (when I first blogged it). It then dropped price to $399,000 in March, 2007. No surprise, it is still on the market. Here is some info from the current listing (click on the image for a larger view):

What I find amusing about this is:

A) The sellers raised the price to $425,000 hoping to reel in a last brain-dead Marin wannabe and finally had to lower the price back down to the mid-$300Ks and yet the "price reduction" still did not convince a buyer to pull the trigger;

B) the agent and/or seller decided "staging" it, in this case putting some cheap furniture in this shack, would somehow make it more appealing (here is the interior shot from back in February, 2006 for comparison).

Note to realtor: a turd is still a turd no matter how much you polish it (and even if it is in Marin).

Do you know of any humorous Marin RE listings that should be featured on this blog? Do you have any juicy Marin RE stories to tell? Send them in!

What I find amusing about this is:

A) The sellers raised the price to $425,000 hoping to reel in a last brain-dead Marin wannabe and finally had to lower the price back down to the mid-$300Ks and yet the "price reduction" still did not convince a buyer to pull the trigger;

B) the agent and/or seller decided "staging" it, in this case putting some cheap furniture in this shack, would somehow make it more appealing (here is the interior shot from back in February, 2006 for comparison).

Note to realtor: a turd is still a turd no matter how much you polish it (and even if it is in Marin).

* * *

And how do you like this price reduction? It sure made my day (thanks to a reader for sending this in):

Do you know of any humorous Marin RE listings that should be featured on this blog? Do you have any juicy Marin RE stories to tell? Send them in!

Monday, February 11, 2008

Coming to Terms?

I can't believe my eyes. Does this mean we are not as "special" as we thought we were?

I can't believe my eyes. Does this mean we are not as "special" as we thought we were?From the Marin IJ:

As our economy falters because of the housing bubble and the erosion of the dollar’s value, there is less faith in this country’s economic soundness by our creditor nations.And this in the Sonoma Press Democrat:

A clear lesson is that we have for too long been living far beyond our means as a people and as a nation. We can no longer consume so much more in value than we produce.

Many in Marin are lamenting that real estate prices are skidding. We are ‘losing money.’ If we’re honest, we know that much of the equity in our overvalued real estate is ‘funny money’ based not on real values but on the speculative furor of the past decade.

Losing some of our shaky home equity is not the medicine we want. But perhaps it’s needed. It’s as true as ever that it’s better to live within our means and not go too much in debt - especially if it’s for all the wrong reasons.

"The entire real estate debacle is the fault of everybody that was involved. And it was all about greed and speed... The brokers wanted their commission. The lenders wanted their premiums. The borrowers wanted their homes."

Tuesday, February 05, 2008

A Scam to Benefit the Wealthy

This from our own SF Chronicle.

This from our own SF Chronicle.Why should tax payers pay for a mortgage interest rate break (resulting from the proposed increase of the loan limits for Fannie Mae and Freddie Mac) that will benefit only the wealthy minority of this country? Why should "fly over" states be required to pay their tax dollars to support mortgages for our over-priced houses here on the West Coast? As much as the proposed increase in loan limits will personally benefit me, the fact is that I chose to live in an expensive area of America; it is neither right nor fair that people who do not live in crazy-stupid expensive areas should subsidize my choice. If anything, it is those of us who live along the west and east coasts, who have these high mortgages, and who will benefit from the proposed increase in loan limits who should be paying an increased tax and who should bear the responsibility of bailing out Freddie and Fannie when they ultimately fail due to assuming such a massive increase in risky loans.

Here in California such words fall on deaf ears. It is a sad fact that most people support (vote for) that which benefits themselves and not what benefits the general public or what is generally considered good (unless, of course, there is no significant cost to them by voting their conscience). Thus, I fully expect the majority of Californians to support the increase in the GSEs' loan limits as it will benefit most Californians' pocket books (at least in the short term). But what about the rest of America that does not live along one of the two coasts? Why would you support this proposal and why would you be willing to pay your hard earned money to ensure our ridiculously high mortgages?

We don't have to let it happen. We the citizens of this country could stop it if we really wanted to. Now more than ever politicians are listening to the populace. Make yourselves heard.

Congress is about to sell us the biggest fraud in American history... Congress is set to rush through an increase in the mortgage loan limits for Fannie Mae and Freddie Mac (and Federal Housing Administration insurance, too) - from $417,000 to $729,750 - the first step toward a massive financial disaster in which taxpayers will end up paying through the nose.

Contrary to popular myth, Fannie holds a lot of subprime debt, option ARM debt and other dodgy securities... Expansion of Fannie and Freddie's reckless lending is exactly what Congress wants because it's plausibly deniable. Teary-eyed lawmakers can take to the airwaves a year from now and declare: "We had no idea Fannie could go under, but we can't cut and run now. We have to bail out Fannie and Freddie for the good of America! It's going to be a tough slog, but you're getting used to those, no?"

Those same lawmakers won't mention the fact that they get paid far more by real estate lobbyists than they do from our Treasury.

I've spoken with borrowers who stopped making mortgage payments seven or more months ago. None has received a default notice. Defaults may be much higher than banks are letting on. The data lags are growing suspiciously long. Nobody knows what's going on. Seven months without making a single payment! Will Fannie guarantee those loans because they aren't in formal default yet? Nobody wants to know, because if they know, they might be called to testify next year. That's why lawmakers want to raise the limits now and ask questions later.

In support of the economic stimulus bill, Bush will have to face "working American families" and explain that some of their tax money is going to be spent guaranteeing $730,000 mortgages on $1 million homes. It's like some sort of upside-down communism where the poor pay the rich welfare. Why should taxes from families earning $48,000 a year be used to support expensive mortgages in New York, Los Angeles and San Francisco? Welfare for the hungry and homeless is evil, but welfare for million-dollar homeowners facing a tough refi ... well, that's called "helping the economy."

I can imagine the president's radio address playing in the heartland: "We have some families with million-dollar homes on the coasts who are really hurting and so we need you, the working families of America, to stand together with them and help them avoid the kind of home price depreciation that might leave them without a new Lexus for years."

I guess Congress' hope is that median-income families will be too busy using their rebates to buy much-needed groceries to notice that the rich folk are getting way with a new scam.

Don't let me down, my fellow Americans. Let's vote out anyone0 who dares to vote for this scam.

Friday, February 01, 2008

BusinessWeek Says Back To Trend-line

After all their shameless boosterism, BusinessWeek comes out with this. You boys are way behind the curve on this one. But still... this is the most bearish I've seen BusinessWeek in a long time.

So a return to trend-line for housing, a reversal to the mean?! No... really? Who would have thought that? And these guys have Ph.D.s for chrisakes! We're in the wrong career.

Brace yourself: Home prices could sink an additional 25% over the next two or three years, returning values to their 2000 levels in inflation-adjusted terms. That's even with the Federal Reserve's half-percentage-point rate cut on Jan. 30.

While a 25% decline is unprecedented in modern times, some economists are beginning to talk about it. "We now see potential for another 25% to 30% downside over the next two years," says David A. Rosenberg, North American economist for Merrill Lynch (MER), who until recently had expected a much smaller slide.

Shocking though it might seem, a decline of 25% from here would merely reverse the market's spectacular appreciation during the boom. It would put the national price level right back on its long-term growth trend line, a surprisingly modest 0.4% a year after inflation.

Why might housing prices plunge violently from here? Remember the two powerful forces that pushed them up: lax lending standards and the conviction that housing is a fail-safe investment. Now both are working in reverse, depressing demand for housing faster than homebuilders can rein in supply. By reinstituting safeguards such as down payments and proof of income, lenders have disqualified thousands of potential buyers. And many people who do qualify have lost the desire to buy.

Subscribe to:

Posts (Atom)