From the SF Chronicle:

"The Bay Area housing market cooled in October, as home sales declined for the seventh consecutive month and prices softened amid a steady rise in interest rates."You tell me which outcome is the more likely one:

"The industry slowdown comes as rising interest rates increase the cost of home ownership. For the 10th consecutive week, the nationwide average for 30-year fixed-rate mortgages rose this week, this time to 6.37 percent -- the highest level in more than two years, according a report from mortgage giant Freddie Mac."

"The rise in interest rates was on the minds of Adam and Kathleen Bunshoft on Wednesday night as the newly married couple checked out a luxury two-bedroom condo on the 2900 block of Anza Street in San Francisco listed for $689,000."

""It's causing me to think about waiting,'' said Adam Bunshoft, a 35-year-old sales executive who has been looking for a two-bedroom home or condo."

""I don't get the feeling that prices have declined," he said. "Homeowners are seeking prices that are in line with comps (comparable listings) of homes that sold a few months ago.''"

"John Karevoll, an analyst with DataQuick, said that is exactly what happens at the end of a real estate cycle. "We always see people trying to game the peak -- trying to get the most for their properties,'' he said."

"In effect, the market had been robust because house seekers who would have waited to buy purchased this year instead because of low interest rates. "We were stealing (housing activity) from the future,'' he said."

"Tapan Munroe, an economist and director for LECG, a worldwide consulting firm, agreed. "Sales are flattening, and prices are also going down a bit, but I doubt very much it is a bursting of a bubble. It's more like a slowdown and a soft landing.''"

"The biggest drop in housing activity occurred in Napa County, where the number of homes sold fell 12.5 percent."

Well, there is this prediction from an honest realtor:

"Yes, we have started on the down leg of the typical 'Bell Curve' and the probability of surpassing our approximate 20 percent drop in San Diego home values experienced from 1990 through 1996, seems assured. Plus, as real estate trends seem to start in the West and then move east, any U.S. real estate market that experienced huge price appreciation the past five years, will experience the same depreciation in real estate residential values."

"...due to the huge home appreciation all San Diego real estate has seen, with the average home up 100 percent in the past 5 years, combined with the boom in 100 percent adjustable/interest only loans, the stage is set for what is sure to be mind-numbing depreciation."

4 comments:

Tapan Munroe, an economist and director for LECG, a worldwide consulting firm, agreed. "Sales are flattening, and prices are also going down a bit, but I doubt very much it is a bursting of a bubble. It's more like a slowdown and a soft landing.''"

*********

Who are these guys saying this kind of stuff? I would have expected a little "more" from LECG.

Have they been paying attention?This is just the begining. Anybody who talks of a flattening in the present tense is clueless.

Yes, it's flat for the moment - but that's about it.

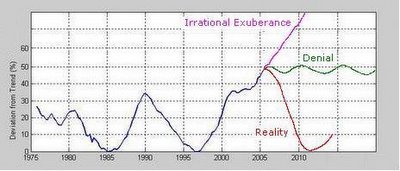

That chart says it all - great work. It's a great comparison of what the three "viewpoints" are and puts them in a graphical perspective.

love that graph.

For the record, that chart is not mine. It was sent in by a reader. I just used it (with permission) in a previous post and vandalized it (without permission) for the current post. Here is the link to that reader's website:

http://tinyurl.com/8vyxy

Nice to see a possible future correction played against history. Does anyone else expect the bottom to dip below trend this time?

Post a Comment