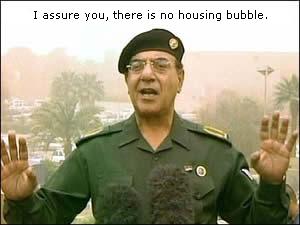

Everyone stay calm, click your heels together three times, and then repeat after me "there is no real estate bubble".

Everyone stay calm, click your heels together three times, and then repeat after me "there is no real estate bubble".According to the California Association of Realtors:

The median price of an existing home in California in December increased 15.6 percent and sales decreased 17.6 percent compared with the same period a year ago, the California Association of REALTORS® (C.A.R.) reported today.

“Sales fell last month compared with December 2004’s record-setting pace, prompted by consumers’ concerns about rising interest rates,” said C.A.R. President Vince Malta. “The last few months of 2005 marked the first time since mid-2004 that the fixed-rate mortgage was above 6 percent on a sustained basis and the adjustable-rate mortgage was above 5 percent for three months in a row.

“Consumers also were rattled by both the spike in energy costs and the hurricanes late last year,” he said. “Looking ahead, we expect those concerns to impact transactions completed in January as well.”

Closed escrow sales of existing, single-family detached homes in California totaled 531,910 in December at a seasonally adjusted annualized rate, according to information collected by C.A.R. from more than 90 local REALTOR® associations statewide. Statewide home resale activity decreased 17.6 percent from the 645,860 sales pace recorded in December 2004.

12 comments:

We have em on the run now.......

Hilarious picture and caption... I'm still laughing.

Thats an awesome graphic. LOL!

Yes, well, my MS Paint skills are rather advanced if I don't say so myself.

Has anyone else noticed a general persistence of belief that the bubble doesn't exist?

Despite the fact the "bubble" is now discussed in national news and mainstream press, many family and friends are pretty confident the current situation is simply an extension of past history. In other words, "I assure you, there's no housing bubble; our property will keep going up, up, up!"

Of course, we've educated ourselves past such self-serving conclusions. But, it impressed on me how much the general public may be surprised by a downturn. Will there be a noticeable crash, or a long-term burnoff of equity that eventually affects market confidence? I suspect the latter scenario, and when "the public" finally realizes their equity is toast, it will be far too late to do anything.

Quoting reskeptic:

"Despite the fact the 'bubble' is now discussed in national news and mainstream press, many family and friends are pretty confident the current situation is simply an extension of past history. In other words, 'I assure you, there's no housing bubble; our property will keep going up, up, up!'"

*********

The reminds of an interview I read in the fall of 2000 or so. Or perhaps it was early in 2001. It was somebody from Fast Company or Wired or one those (or maybe even the SF Chronicle), talking with Tim Draper, one of the venture "idiots" the Bay Area is so famous for (of Draper, Fisher and that other young guy who's recently glommed onto nano-techno-babble things combined with biotech).

There was this fascinating air to the discussion. The questioner was saying something like "can you believe it? We hear rumor that some dotcoms are running out of money and have laid off people - what do you think of that?!"

And Draper says something like, "I'll hire 'em. I'll take 'em all! I have no fear."

I took it as a way of him remaining bullish in the face of what would soon be a very different environment for venture investors, among perhaps millions of others. But he was essentially nonplussed.

It was as if he was saying, along with all the others who believed it, that because the NASDAQ was just at 5,000 in April (though it had already started retreating significantly by the fall of 2000) - it would soon turn around, right itself and that in some not too many years distant it would be at 10,000. And that no one would, should (or could, for his interests) lose their confidence about this.

I'll never forget that.

[And all you who want to keep reminding that stocks and housing are like apples and oranges - save your energy; I know, they are different. While the NASDAQ sits at half its April 2000 value today, I don't expect or am saying housing will be at half its value in five or six years; what I'm saying is that they both are markets that go through cycles and there are always going to be people who will believe whatever it is they believe in the face of incontrovertible evidence. Even so called "experts" - some who are clueless and some who remain "optimistic" because for financial or other reasons they cannot be otherwise.]

And all you who want to keep reminding that stocks and housing are like apples and oranges - save your energy; I know, they are different.

What the 'apple and oranges' folks fail to realize is that the investor psychology is the same. It used to be that houses were not generally considered investments and so it really was 'apples vs oranges'. But today houses are thought of as investments and hence the housing investment frenzy. The psychology is the same.

Comparing Stocks and Housing is dumb, even if you try to add your disclaimer. The fact that this blog supports such comparisons hurts its validity.

All markets have trends, that is all that needs to be said.

Comparing the Tech bubble to the housing bubble makes 0 sense.

It makes sense because it is happening in the same place and with the same enthusiasm. Parallels are everywhere in all industrys...Think Mcdonalds is in the burger business? Think again. Try Real Estate.

My in-laws question my investment stratagey to move my money from California to Texas. I don't own in Marin but in Napa, rent here in Marin. Anyhow, they keep telling me and my wife that we should buy here..."look at the last few years...can't you see how much you'll make?" They really don't believe that it'll happen. Even though they have lived in Walnut Creek ( same house ) since 1980. "oh yeah, the market went down, but it comes back" well thanks! I'll file for BK in the meantime. They have all their retirement funds in their house...I hope they don't have to use it.

Comparing the Tech bubble to the housing bubble makes 0 sense.

Investor psychology is the same.

They have all their retirement funds in their house...

Case in point.

anon said:

"All markets have trends, that is all that needs to be said."

***********

To be accurate, perhaps we should also mention the housing market trend is now _down_.

So, as amended, all that needs to be said:

"All markets have trends, and the housing market trend is now down."

Great Visual!

I think that all the talk coming out of the real estate industry about "soft landing" and "things are different" and "real estate prices have never gone down" can be summed up by the phrase:

PAINTING THE TURD!

They are simply

PAINTING THE TURD!

And the sooner the public realizes it the better. (Although I think the public is 4 years late!)

LOL

Eric in DC

Post a Comment