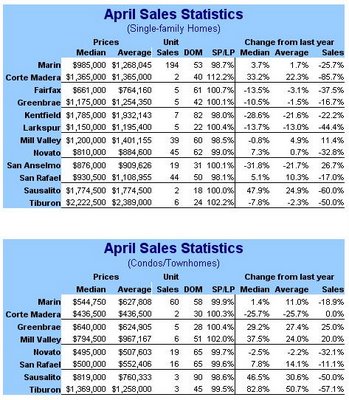

Home Prices Dip in AprilPercent sales for SFR for all of Marin were down -25.7% year-over-year -- ouch!

The median price for single-family homes in Marin County fell 1.5% in April to $985,000. Year-over-year, the median price was up 3.7%. The average price fell 4.6% to $1,268,045, up 1.7% over last April.

This is just more evidence that the so-called "spring rally" in Marin is more like a "spring flop".

And don't get your hopes up for May either as the Marin Heat Index is not suggesting that May will be any better. But sellers are trying to do the right thing, bless their little (greedy) hearts -- as of today 29.1% of all listings are marked as "price reduced" according to ZipRealty but those reductions are a joke; it's going to take more than a measely 5-10% price reduction.

I'll do the usual charts in a later post. But looking at the above data tables I think these reported SFR statistics may be meaningless. I mean, just look at some of the sample sizes... in 7 out of 11 Marin markets the number of units sold was less than 10, some as low as 2. Sheesh. I mean, if you exclude the two towns that look most aberrant (with only 2 sales each) -- Corte Madera and Sausalito -- then the median year-over-year sales price is down -10.5% and the average sales price is down -5.25% year-over-year in that table.

But if these results can be believed, then it makes me wonder: Is this the best that it is going to be? I mean, this is supposed to be the hot, hot, hot selling season and everyone wants to live here, right? What happens as increasing interest rates work their way further into the system? Tighter lending standards? Even the Marin IJ has turned a bit negative and is bemoaning Marin's shameful unaffordability.

Anyway, I'll put the graphs together later but frankly I don't see much point in it; this thing is coming apart.

2 comments:

mill valley rocks

Post a Comment