How Low Will It Go?

Some choice quotes from

this article found on the superb

Charles Hugh Smith blog:

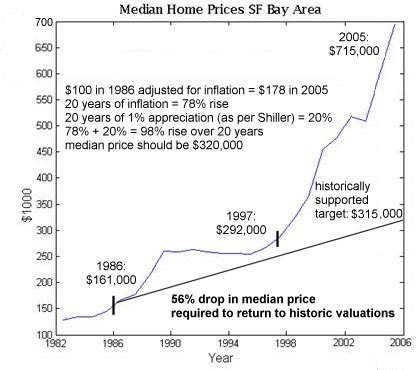

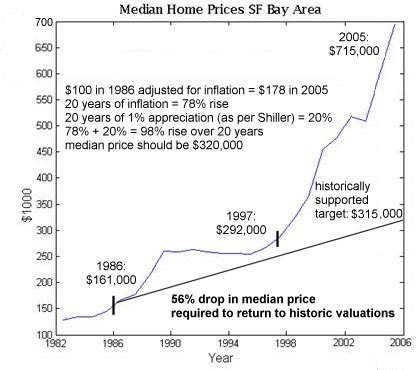

Let's go over the numbers. According to the Bureau of Labor Statistics, $100 in 1986 equals $178 in today's (devalued) money. To that 78% rise due to inflation we add Shiller's 1% per year appreciation in "real" terms, which adds up to a historically supported value 98% above the 1986 median price of $161,000. In other words, a reversion to the historic mean will bring Bay Area median prices down from $715,000 to around $315,000--a decline of $400,000.

This is the inescapable conclusion of Shiller's analysis and historical trends dating back to the 19th century. It cannot be denied; but you can of course retreat into denial. Sadly, that's what most investors did back in the dot-com heyday. As stocks tumbled, every brief uptick was embraced as the "bounce back" to the good old days, and every such bounce was a sucker's rally, leading only to further precipitous declines.

Some choice quotes from this article found on the superb Charles Hugh Smith blog:

Some choice quotes from this article found on the superb Charles Hugh Smith blog:

8 comments:

Wow! Great chart, great article!! Thanks.

If prices simply flatten out (which is Marin's only possibility), how long before current prices meet economic support? I know Marin can weather any storm, even 20 years of flat sales. Someone will buy that $3M Belvedere lagoon tract home--eventually.

a price/time chart must be logarithmic to be visually accurate

As I have learned from comments left on this blog, such as yours, I agree. Unfortunately, it's not my chart.

Great data Marinite. I have detected a change in the wind lately. Been interviewing quite a few folks lately... some who have been in the silly valley area for a long time... and recently we landed some pretty big fish who were perfectly willing to make a move here because they think the timing is right to watch the crash and be poised to take advantage of it.

Of the locals... overwhelmingly these candidates believe whole heartedly that the market is starting its slow slide to a long bottom below. All but 1 out of 15 candidates are homeowners.

I tell you... last month this was NOT the sentiment at all.

Something has changed...

On the other hand, what matters more to people: the absolute amount of money that must be paid (after correction for inflation) or the percentage change in the amount of money to be paid? In the former case, a linear scale seems appropriate and in the latter a logarithmic scale is appropriate.

For example, when the visual system detects an edge in the visual scene all that matters is that one side of the edge is 10% brighter than the other, darker side. It doesn't matter if it is 1,000 quanta on one side vs. 1,100 quanta or 1,000,000 vs. 1,100,000 quanta (at least as long as you are within the linear portion of the psychometric function). So a logarithmic scale makes sense. If what mattered was the absolute brightness in terms of number of quanta then a linear scale is best. (Sorry, but vision science is what I know best.)

rejunkie -

Thanks for the correction. I contacted the author of the article and sent along your comments (also the one about the logarithmic scale).

So in the end your calculations say the drop is not from $700k to $315k but from $700k to $350k. Either way that's a nasty drop and I doubt anyone would feel any better about it.

Logarithmic or not, it's rather easy to see there's a severe housing problem. Although I must admit that until about 2002, I thought housing prices were due to our continued economic success. Despite the dot-bomb, the area had obviously bounced back.

That seemed to be the general consensus, until confidence gave way to a gnawing sense of dread an alarm. To some, fear mobilized them to action: "buy before you're priced out forever". Others, alarmed by the growing disparity of house prices to wages, wanted to understand what was happening, particularly in light of the tech bubble.

Now in 2006, what is the consensus: we understand what's happening--and some of us think it's great, or we're nervously sweeping our pennies together to buy--before we're doomed as "bitter renters" forever? Or perhaps by now we'll cast a knowing, jaded eye towards the time-worn "get in now" realtor line?

ah Fred, we have that in common. I was just telling my sister how middle aged I feel because after a stressful week I like nothing more than digging in the dirt and planting pretty things and pulling weeds. The teenage daughter doesn't quite feel the meditativeness of it all and kvetches about it when I make her do it with me. ;-)

Post a Comment