Well, it seems Wall Street finally 'gets it'. It's fun-duh-mental they say. There is a housing bubble, it was caused by irresponsibly lax lending practices (I won't even use the word "standards"), and it can only end badly.

Well, it seems Wall Street finally 'gets it'. It's fun-duh-mental they say. There is a housing bubble, it was caused by irresponsibly lax lending practices (I won't even use the word "standards"), and it can only end badly.What happens to the housing market when no one can squeeze into a mortgage at these ridiculously high house prices when they can no longer get a no money down, no doc, adjustable rate aka "toxic" loan (which comprised about 80% of the loans issued in the Bay Area last year)? What happens when house appreciation falls below the rate of inflation and people can no longer use their houses like an ATM? What happens as all those ARMs reset? What happens as foreclosures continue to rise?

Unless the entire US financial system is at risk of collapse, there sure as hell better not be a bailout of the lenders or the borrowers IMO. There is no way that I want my tax dollars bailing out those damn fools who took out these insane loans and are now finding out that they could not really afford their overpriced POS afterall and that, surprise, surprise, they are actually responsible for their debt. And why should we bail out the idiots who made those loans in the first place to people who they knew full well were not suitable for them?

I hate Mondays.

Some choice quotes:

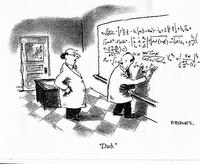

Lo and behold, housing is a concern on Wall Street. Even the stock market’s cheerleaders have had to acquiesce. The fact is, any economist worth his salt has been concerned for 15 months. That’s how long new-home inventories have been hitting record highs.

Maybe what we should be asking is how inventories, of both new and existing homes, grew to their current records. The answer gets to the root cause of the housing bubble, the credit binge.

Consider that only one of the 53 banks surveyed by the Federal Reserve through the three months ended in April said it had tightened lending standards. About 10 percent had the gumption to loosen standards further. With no lending standards to speak of, it’s been almost impossible to corral the speculation that drove sales and home prices to their bubbly heights.

At issue are nontraditional mortgages that carry adjustable rates or allow the balances to grow with time. (Hint to lenders: Loans are actually supposed to be paid down.) The fact that such nontraditional terms now account for one in five mortgages outstanding suggests someone’s let the fox into the chicken house.

2 comments:

Regarding the "credit binge", does anyone else recall seeing consumer spending habits upgrade years ago? There was a period of time when "luxury" items became the norm for consumers; it reflected on your high standards. Fast-forward to today, where many people have completely lost perspective as to their needs--and what is actually affordable to them. Companies have happily played along, positioning their products to gratify these "needs," while offshoring for pennies on the retail dollar. $2K for a bicycle? No worries; buy it on credit, etc.

Given these established conditions, Is it any wonder people now find themselves in this real estate mess? Many people have been trained to think this way since their first paycheck. I have to wonder if the US will ever get it--or simply find another scheme, bubble, or piggy bank to tap until dry.

peterbob -

That's dire. If your prediction comes to pass, then I suggest a class action law suit by all non-bubble entrants vs. the Federal government.

Post a Comment