The 30-year mortgage rates have been trending down:

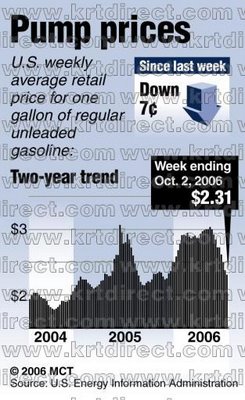

Gasoline prices have dropped like a rock:

And yet house prices are still falling.

We even have the NAR and CAR comparing unadjusted numbers (which tend to be too high) to adjusted numbers (which are almost always adjusted downward these days) so as to try and spin bad news into good news.

I'll avoid giving serious mention to economic manipulation prior to the elections and just say that I think this is simply confirmation of the power of popular psychology on markets (which is kind of a dumb thing to say since markets are nothing more than mass psychology) -- you can print all the funny money you want; you can manipulate interest rates until you are blue in the face; when the mob makes up its mind, look out.

Tinfoil hat on.

Just imagine what would happen if the manipulators had to stop their manipulating and people were still sour on the markets. The Powers That Be are no doubt hoping that they can twist around the mass psychology of Boobus Americanus so that when interest rates go back up, gasoline gets costlier again, etc. everyone will be in their newly re-manufactured spend-spend-spend mindset.

It makes me sick to watch.

Tinfoil hat off.

14 comments:

Or are those with resetting ARMs being given a last chance to refi into a long-term mortgage so that even if they won't be able to sell their overpriced pos for a profit they at least won't have to foreclose.

"MORE BREAD!

MORE CIRCUSES!

MORE BREAD!

MORE CIRCUSES!

MORE BREAD!

MORE CIRCUSES!!!!!"

"The Powers That Be are no doubt hoping that they can twist around the mass psychology of Boobus Americanus so that when interest rates go back up, gasoline gets costlier again, etc. everyone will be in their newly re-manufactured spend-spend-spend mindset."

If only our government were so well coordinated as to be able to pull something like that off..

How about this story on SFGate ( http://www.sfgate.com/cgi-bin/article.cgi?file=/chronicle/archive/2006/10/05/BUGPLLICBL1.DTL&type=business ) where economy.com predicts single digit growth in home values for Marin?

Yeah, the tin-foil hat crowd will love this line of thinking. Who is "manipulating" the world economic stage, the illuminati? Yeah like 30 year fixed mortgages are going to save the FB's.

Perhaps there might be some pushing from government forces, but I would like to see some data reference to it. Otherwise as indicated by most, the market is not surprising anyone right now.

Alas on the RE market - it is true that the flurry of hype that created the bubble is gone. Lower rates are not going to change that tomorrow.

You folks are way too serious.

I made the sarcasm more obvious just for you.

Whever said anything about Illuminati?

Why is it so hard to believe that the markets are manipulated or at least can be manipulated? Isn't that exactly what Greenspan was known for and what he feared and so why he resorted to such inscrutable talk? Isn't that what the Fed does for chrissakes? Isn't that what the President does when he talks buddy-buddy behind closed doors with a trading partner? Talking markets up and down is nothing new

Here's some flagrant manipulation -

http://www.financialsense.com/fsu/editorials/nystrom/2006/1002.html

Permabulls put the "bull" in bullshit.

this market is toast.rates for 30 year fixed with 20% down are irrelevant in california when 70% of the loans the last 2 years were i/o or other exotics,and the average downpayment was 2%.too many people are underwater,rates on seconds are at double digits,and vitally,the attitude has changed.

Don't forget the stricter lending guidelines that just went into effect. Plus, there's been an enormous amount of negative MSM about "exotic" mortgages and how they are ticking time bombs. A year ago, anything to get into the market was considered smart, but not anymore. And who is left who can actually afford traditional, fixed financing? Fixed rates have been so, so cheap for the last few years and folks still went for IO/ARMs.

"The 30-year mortgage rates have been trending down"

Looks like the banks are trying to pump mortgage sales volume, but is it working? Locally, that heat index gives a clue.

[tinfoil>

What's up with the dow jones? Trying to score a last dying gasp of underhanded interventionalism before the inevitable depression? Naturally, if the DJIA is at 20,000 by this time next year along with all the homebuilder stocks and cramer is hailed as an economic genius now won't I be eating my words!

[/tinfoil>

the new lender guidelines,not standards,won't have an immediate affect.i attended a lender presentation today where it was still 95% financing with a 500 fico score and stated income.do the people who buy mbs based on the garbage loans held to any standards of fiduciary duty? even the most cursory due diligence would cause anyone with a lick of sense to run away,what happened to the "prudent man" standard? without what amounts to gross negligence,at the least,there never would have been a market for this paper.gaaah!bring me my rope!

It's a good point as to who is buying all this MBS? For sure a lot of foreign investors have found their excess savings dollars into these funds, but so have a lot of US banks, REITs, and other security investment houses.

The mortgage lender secondary market apparently still a thriving place to my suprise as well. Here's the thing, all of them do risk assesments with sample data, and the statistical math to prove a purchase size.

However if increasing amounts of 30/60 late pays and foreclosures occurs through 2007, I am sure more will be heard of the underperforming MBS market. Again though the complex irony is that the US MBS market is I think one of the single largest places the world can put there money into. It's a Trillion dollar market, and it must be that as long as people feel in a macro way the economy is up and paying salaries (it does), then they don't think the FB's of the bubble are as serious enough to move away from.

However aother question with the rise in the capital stock markets of late is that it seems there are bounds of cash looking for a place to call home for awhile - so is any of this moving away from MBS and RE?

I wish I knew all this, since then I probably would be living in the south of france and racing cars.

We Marinites don't go for 30-year fixed mortgages so what do we care? We go for the variable rates.

Post a Comment