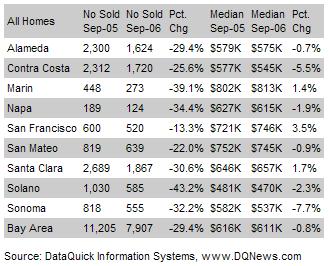

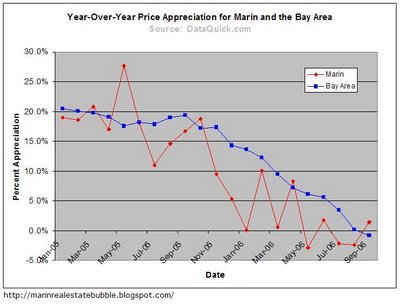

Bay Area home prices fell on a year-over-year basis for the first time in more than four years last month. Sales were at their lowest level in five years, a real estate information service reported.The following table and graph shows median price appreciation and percent change in sales for most property types combined (e.g., houses, condos, etc.) according to DataQuick:

‘The last time prices dropped in the Bay Area was after the dotcom bust...The turn in the Bay Area's economy was arguably more severe back then. This time around there isn't really any economic distress. ‘It simply looks like the real estate market’s momentum last year and earlier this year pushed prices beyond their equilibrium point and the market is reestablishing its balance,’ said Marshall Prentice, DataQuick president.

In addition to the eye-popping year-over-year -39% decline in percentage sales, according to the Marin IJ's DataQuick report Marin single-family houses depreciated -3.3% year-over-year in September:

In addition to the eye-popping year-over-year -39% decline in percentage sales, according to the Marin IJ's DataQuick report Marin single-family houses depreciated -3.3% year-over-year in September:The median price of existing single-family homes in Marin County fell 3.3 percent from September 2005 to September 2006...Marin's single-family home median was $869,000 last month, down from $899,000 in September 2005, according to DataQuick Information Systems, based in La Jolla.I also noticed that when talking about "market distress" this time around DataQuick has, for the first time since I've been reading these reports, changed their wording from

Marin's decline was even more pronounced when compared with August, when the median single-family home price was $920,000. But DataQuick noted that an August-to-September drop is a seasonal commonality.

The overall number of homes sold in Marin declined 39 percent from September 2005, showing a persistently difficult market for sellers.

"We're going to see every county go a little bit negative within the next three or four months," said DataQuick analyst John Karevoll.

"Indicators of market distress are still largely absent"to

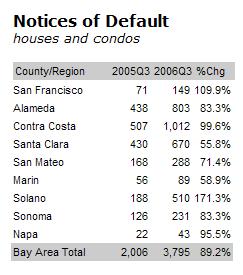

"Indicators of market distress are still at a moderate level"Hmmm... Well, they are reporting a steep increase in default activity with notices of default in Marin up nearly 59% year-over-year (not surprisingly, that's lower than most other Bay Area counties):

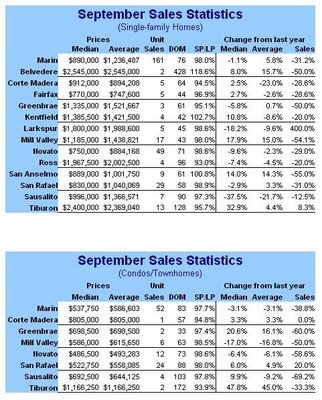

Here's what Vision RE sees:

Here's what Vision RE sees: I think agent Liz McCarthy's comments in her newsletter for this month are spot on. Basically, only the nicest of the nice houses in the best locations in Marin are selling (and thus keeping price appreciation hovering around 0%); everything else is languishing. Once the sellers of the languishing houses get real, watch out below:

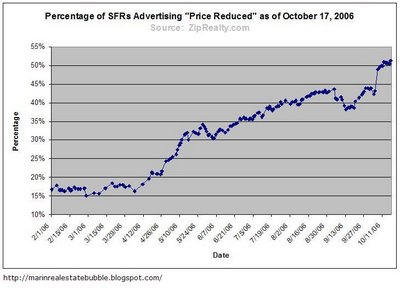

I think agent Liz McCarthy's comments in her newsletter for this month are spot on. Basically, only the nicest of the nice houses in the best locations in Marin are selling (and thus keeping price appreciation hovering around 0%); everything else is languishing. Once the sellers of the languishing houses get real, watch out below:The best way to describe the current Marin Real Estate Marketing is “interesting.” 2 weeks ago I know of a great San Anselmo property that went into contract just 4 days after it was put on the market for well over asking. This was a great family house in a popular neighborhood. What does the future look like? I feel that homes that are priced correctly, in desirable neighborhoods, in move-in condition are still selling quickly. Homes that are priced for last year’s market (over-priced), that are not in optimum selling condition or that have major drawbacks are sitting on the market.Below is that graph I show rather often showing the percentage of SFRs currently on the market that are advertising "price reduced" from their original asking price (source: ZipRealty). This graph is more about seller psychology as it references asking prices as opposed to actual sale prices.

Here's Thornberg's take on the latest housing data as quoted in the Chronicle:

Here's Thornberg's take on the latest housing data as quoted in the Chronicle:Across the state, inventory more than doubled in the past year. Bay Area home prices fell last month for the first time in more than four years. ‘This is an enormous real estate bubble, bigger than we’ve ever seen,’ said economist Christopher Thornberg. ‘You’ve got to pay the piper.’And from Reuters:

‘Buyers have finally taken off their rose-colored glasses. Once interest rates started to go up that made the housing market slow, which in turn made buyers wonder if this is the right time to buy,’ said Cynthia Kroll, senior regional economist at the University of California, Berkeley.Take off the "rose-colored glasses" and "pay the piper" indeed.

See Ben Jones' excellent summary of the reporting on the September California results (and here).

17 comments:

thank you.

This was a huge bubble day, with front page coverage in both the SF Chronicle and the Marin IJ. I cannot imagine WHO in their right mind would move forward with a home purchase. And I loved Chris Thornberg's comment, even that landed on the Chronicle's front page and was "boxed in" in big bold type where the article continued. Impossible to miss. At some point this will have to sink in. Will be interesting to see if sales volume just continues to go off the cliff.

Wow!!!! 3.3%!!!.....When do we get 33%???!!!

But wait a second... if I read the whole article further down it also says:

"But overall, when condo sales were factored in, median home prices in Marin County EDGED UP 1.4 percent in September over the previous year. The overall median home price in Marin, including single-family homes and condos, was $813,000 in September, up from $802,000 in September 2005."

This is very confusing and contradictory. It says that median home prices WENT UP if we include condos into the mix. Why wouldn't we add condos into the mix?!?

I wish the IJ or the Bubble would tell me what this really means. It doesn't seem to support the headline or a bubble bursting.

And if well-priced homes are selling with multiple offers...doesn't that mean that if I price my home well, it will sell? I'm okay with not pricing it at last year's prices. I will happily price it at prices from just 2 years ago!

My home has gone up in value every year for the last 20 years that I've owned it.

anon 6:35,except last year.if you price at mid 04 prices,you will likely get offers now.if you are going to sell,you would be well advised to price 25k or so below the most recent comp,and hope.see the explanation of median price marinite links to.you are getting a lot more home for your $ now than you did a tear ago,and the trend is accelerating.

"Wow!!!! 3.3%!!!.....When do we get 33%???!!! "

You mean all at once? Try never. -33% will be cumulative

-33% will be cumulative

So, if it took 1 year to go down 3.3% (if declines remain linear, for example) it will take almost 10 years to go down 33% ?

I hope things go down faster, because I don't want to wait that long!

Thanks again for the tables, charts and graphs, marinite!

anonymous #786,111 -

How do you know your house went up in value every single year for 20 years?

Is it priced in real-time online or daily in the newspaper, like the shares of your favorite stock?

Or did someone knock on your door every New Years' Day morning and make an offer for more than the guy who did same the year before?

I'm just wondering how this works.

"...I don't want to wait that long!"

Most likely, it's going to be a slow grind downward; that's how it works. Especially in markets where sellers slowly warm to down market realities. However, could the rise in defaults push that market down more quickly than the usual 5-7 years? In either event, I'm not sure I'll hang out in California long enough for that to happen.

Still plenty of Greater fools in the city :'( , with sales down only a meager 13% trailing everywhere else.

Thank you so much for posting this info.

wow, over 3% median price increase for San Francisco. that is definitely on the way down from what I have seen going to open houses.

http://housingarmageddon.blogspot.com/

Maybe I'm in denial as a homeowner but this data doesn't strike me as all that bad. If average Marin home values shot up double digit percents every year for the last 4 or 5 years and they're only falling 3% this year, I'm still way ahead of the game. 3% barely scratches the surface of the average appreciation from just last year.

And to answer the question about my home value for the last 20 years - I just checked the same kind of information printed here. The IJ does a story on home prices every year and I have followed it. I assume that if the average prices have gone up every year, so likely did the value of my house. Is that not true?

My view is that all the stories in the IJ and Chronicle over the last few months seem to make an exception about Marin. As the rest of country starts to fall, we seem to be last in line. That's a good thing, isn't it?

Maybe I'm crazy but I'm starting to think this may be the time to buy another property. There are so many on the market now. If I could pick up something 5% to 10% below asking today and prices did continue to fall, I would still be okay as long as prices start to rise again in a few years. If I hold onto the property for 10 years, aren't I more likely to make money in the long run and get some good tax benefits in the meantime?

Someone tell me how my logic is flawed...

Boy! Did you see the stats on the increase in rent rates for the bay area?? WOW! Sorry bout that, gang!

Renting currently costs little more than 50% of the after-tax cost of buying and holding in the Bay Area. Even if recent increases in rent continue apace, it's going to take a looooong time for them to become anywhere near comparable.

"Someone tell me how my logic is flawed... "

Well, in the last downturn it took around ten years for prices to recover their '89 real value (and about 7 (?) nominally). Given that prices are now far more detached from rents/incomes than they were at the last peak, it's certainly plausible that this downturn might be longer and deeper than the previous one.

"...this may be the time to buy another property. There are so many on the market now. If I could pick up something 5% to 10% below asking today

Well, give it a try! I'm sure Marin can't get more than a -10% haircut. Just see...you'll be happy when prices pick up again next Spring!

it's going to take a looooong time for them to become anywhere near comparable.

Notably with all that excess housing inventory and impending defaults, of which some will become rentals. I've acutally heard some suggest that rents will rise to meet mortgage costs, which defies all the research blogs like this provide.

Post a Comment