The September, 2006

results are out from

DataQuick:

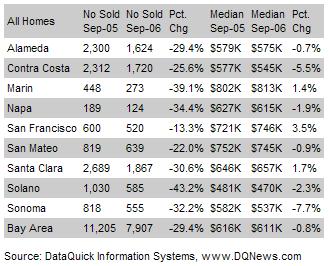

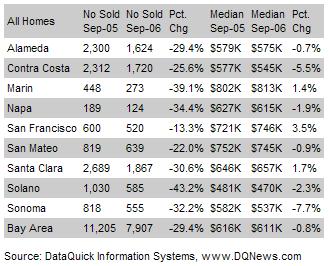

Bay Area home prices fell on a year-over-year basis for the first time in more than four years last month. Sales were at their lowest level in five years, a real estate information service reported.

‘The last time prices dropped in the Bay Area was after the dotcom bust...The turn in the Bay Area's economy was arguably more severe back then. This time around there isn't really any economic distress. ‘It simply looks like the real estate market’s momentum last year and earlier this year pushed prices beyond their equilibrium point and the market is reestablishing its balance,’ said Marshall Prentice, DataQuick president.

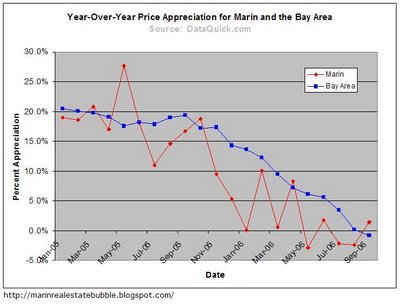

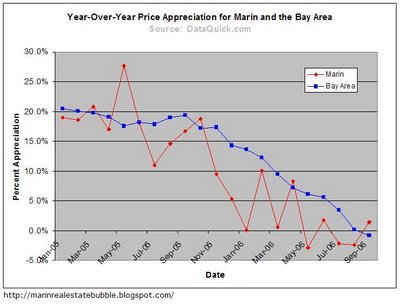

The following table and graph shows median price appreciation and percent change in sales for most property types combined (e.g., houses, condos, etc.) according to

DataQuick:

In addition to the eye-popping year-over-year -39% decline in percentage sales, according to the

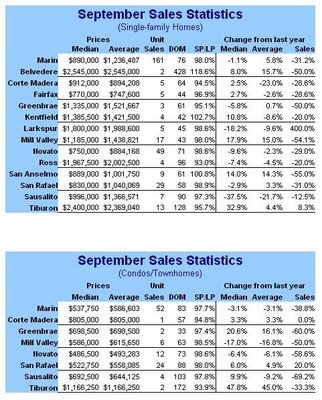

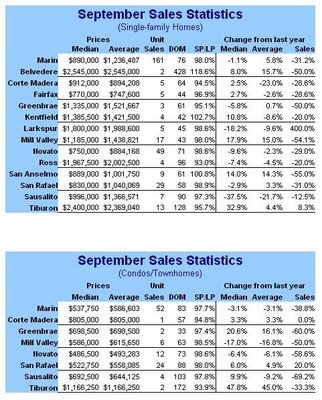

Marin IJ's DataQuick report Marin single-family houses depreciated -3.3% year-over-year in September:

The median price of existing single-family homes in Marin County fell 3.3 percent from September 2005 to September 2006...Marin's single-family home median was $869,000 last month, down from $899,000 in September 2005, according to DataQuick Information Systems, based in La Jolla.

Marin's decline was even more pronounced when compared with August, when the median single-family home price was $920,000. But DataQuick noted that an August-to-September drop is a seasonal commonality.

The overall number of homes sold in Marin declined 39 percent from September 2005, showing a persistently difficult market for sellers.

"We're going to see every county go a little bit negative within the next three or four months," said DataQuick analyst John Karevoll.

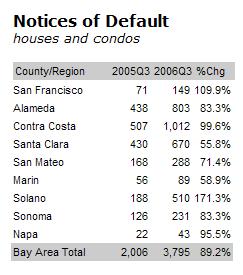

I also noticed that when talking about "market distress" this time around

DataQuick has, for the first time since I've been reading these reports, changed their wording from

"Indicators of market distress are still largely absent"

to

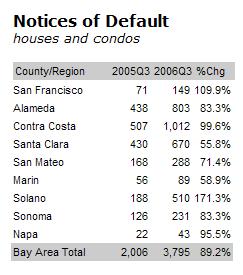

"Indicators of market distress are still at a moderate level"

Hmmm... Well, they are

reporting a steep increase in default activity with notices of default in Marin up nearly 59% year-over-year (not surprisingly, that's lower than most other Bay Area counties):

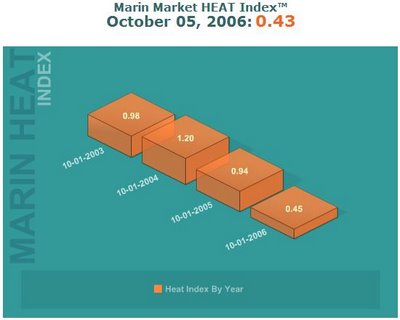

Here's what

Vision RE sees:

I think agent Liz McCarthy's

comments in her newsletter for this month are spot on. Basically, only the nicest of the nice houses in the best locations in Marin are selling (and thus keeping price appreciation hovering around 0%); everything else is languishing. Once the sellers of the languishing houses get real, watch out below:

The best way to describe the current Marin Real Estate Marketing is “interesting.” 2 weeks ago I know of a great San Anselmo property that went into contract just 4 days after it was put on the market for well over asking. This was a great family house in a popular neighborhood. What does the future look like? I feel that homes that are priced correctly, in desirable neighborhoods, in move-in condition are still selling quickly. Homes that are priced for last year’s market (over-priced), that are not in optimum selling condition or that have major drawbacks are sitting on the market.

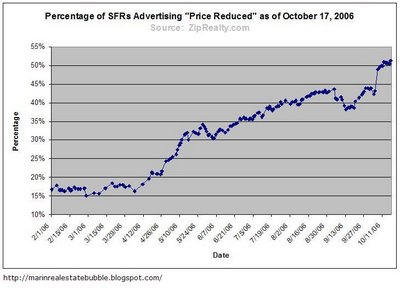

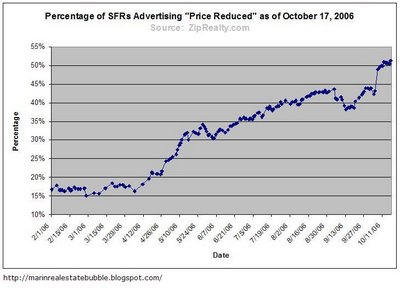

Below is that graph I show rather often showing the percentage of SFRs currently on the market that are advertising "price reduced" from their original asking price (source:

ZipRealty). This graph is more about seller psychology as it references asking prices as opposed to actual sale prices.

Here's Thornberg's take on the latest housing data as quoted in the

Chronicle:

Across the state, inventory more than doubled in the past year. Bay Area home prices fell last month for the first time in more than four years. ‘This is an enormous real estate bubble, bigger than we’ve ever seen,’ said economist Christopher Thornberg. ‘You’ve got to pay the piper.’

And from

Reuters:

‘Buyers have finally taken off their rose-colored glasses. Once interest rates started to go up that made the housing market slow, which in turn made buyers wonder if this is the right time to buy,’ said Cynthia Kroll, senior regional economist at the University of California, Berkeley.

Take off the "

rose-colored glasses" and "

pay the piper" indeed.

See Ben Jones' excellent

summary of the reporting on the September California results (and

here).