- - -

The latest Case-Shiller Index; perhaps the best authoritative measure of the housing markets (PDF can be obtained here): SFGate.com had this to say:

SFGate.com had this to say:In the San Francisco area, which Case-Shiller defines as the counties of San Francisco, Alameda, Contra Costa, Marin, San Francisco and San Mateo, the one-year price decline from March 2007 stood at 20.2 percent. The decline from February to March was 3.5 percent.Here's what the Economist had to say (emphasis mine):

The Bay Area’s year-over-year price slump was the sixth steepest of 20 major metropolitan areas tracked by the index.

"Prices are falling because they were too high - ridiculously high," said Christopher Thornberg, principal of Beacon Economics in San Francisco. "They’re now in the process of going back to a more normal level. Frankly, that’s a good thing."

Thornberg said he thinks prices could return to year 2000 levels.

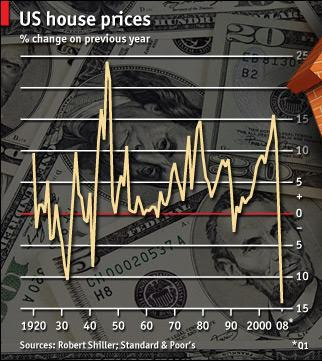

AS HOUSE prices in America continue their rapid descent, market-watchers are having to cast back ever further for gloomy comparisons. The latest S&P/Case-Shiller national house-price index, published this week, showed a slump of 14.1% in the year to the first quarter, the worst since the index began 20 years ago. Now Robert Shiller, an economist at Yale University and co-inventor of the index, has compiled a version that stretches back over a century. This shows that the latest fall in nominal prices is already much bigger than the 10.5% drop in 1932, the worst point of the Depression. And things are even worse than they look. In the deflationary 1930s house prices declined less in real terms. Today inflation is running at a brisk pace, so property prices have fallen by a staggering 18% in real terms over the past year.