- - -

The latest Case-Shiller Index; perhaps the best authoritative measure of the housing markets (PDF can be obtained here): SFGate.com had this to say:

SFGate.com had this to say:In the San Francisco area, which Case-Shiller defines as the counties of San Francisco, Alameda, Contra Costa, Marin, San Francisco and San Mateo, the one-year price decline from March 2007 stood at 20.2 percent. The decline from February to March was 3.5 percent.Here's what the Economist had to say (emphasis mine):

The Bay Area’s year-over-year price slump was the sixth steepest of 20 major metropolitan areas tracked by the index.

"Prices are falling because they were too high - ridiculously high," said Christopher Thornberg, principal of Beacon Economics in San Francisco. "They’re now in the process of going back to a more normal level. Frankly, that’s a good thing."

Thornberg said he thinks prices could return to year 2000 levels.

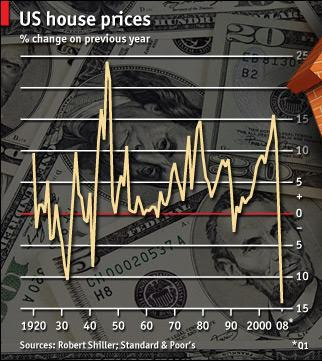

AS HOUSE prices in America continue their rapid descent, market-watchers are having to cast back ever further for gloomy comparisons. The latest S&P/Case-Shiller national house-price index, published this week, showed a slump of 14.1% in the year to the first quarter, the worst since the index began 20 years ago. Now Robert Shiller, an economist at Yale University and co-inventor of the index, has compiled a version that stretches back over a century. This shows that the latest fall in nominal prices is already much bigger than the 10.5% drop in 1932, the worst point of the Depression. And things are even worse than they look. In the deflationary 1930s house prices declined less in real terms. Today inflation is running at a brisk pace, so property prices have fallen by a staggering 18% in real terms over the past year.

11 comments:

That sure says something if SFBay's YoY was in the same ballpark as Miami or LV--two severely speculator-pumped markets. I'm sure people recall the spreads in Forbes, etc. during the heyday extolling the W.Coast RE market--people took the bait.

And of course the Chronicle saw fit to bury this article in the Business section again. And the 20% price drop in the Bay Area was deep within the article, certainly not in the opening paragraph. And the headline was "US Home Prices Plunge", as if it wasn't even Bay Area specific.

The last big article they ran "A Glimmer of Hope" was of course front page news...the uptick in sales (due to foreclosures, of course), like we've never seen one from March to April before.

Anything to keep the kool-aid flowing, I guess.

Anything to keep the kool-aid flowing, I guess.

Suckers are born every minute. The real estate industry (and their tools like papers) knows this.

And people wonder why I mainly quote the most relevant parts of an article; the parts the publishers try to bury or hide.

Depending on where you were in Marin, home prices doubled or tripled during the boom years. Yeah, that's "normal."

Even with the median down 20%, there's still a long way to go before they're back in line with income. I think 1999-2000 could indeed be possible.

And with record high inflation, people will have that much less to devote to a monthly mortgage, let alone a hefty down payment. Every month it gets harder to save as the cost of everything goes up.

I think that most recent graph has staggering implications when you consider the likely impact on our greater credit-pumped, retail-dependent economy of the past few decades.

I went to a few opens Sunday.

I was told that we have hit the bottom.

Prices will only go up now.

Is there a RE info distribution center that these folks subscribe to?

I found great consistency in their sales talk.

We have hit the bottom and interest rates will only go up.

This is the prime opportunity for a buyer.

I am seeing Sale Pending signs, so I guess the pep talk is working.

Sigh

I've seen a lot of "sales pending" signs go back to "for sale" signs. That's bad. Keep in mind that prices cannot drop if houses don't sell.

I've seen a lot of "sales pending" signs go back to "for sale" signs.

Hmm...buyers couldn't ultimately qualify for the mort? Guess that means...lower the price! LOL.

Let's hear it for Williamsport! (must be all the Little Leaguers every August...)

Somehow, Marin did not escape the worst (best?) category on the foreclosure map!

"Spike in Foreclosure Goes Beyond Subprime"

http://graphics8.nytimes.com/images/2008/06/01/business/0601-sbn-TOWN.gif

Or:

http://tinyurl.com/4ep9fy

*****

The Trouble in Housing Trickles Up

By NELSON D. SCHWARTZ

Published: June 1, 2008

Greensboro, N.C.

Sara D. Davis for The New York Times

"WHEN Brandt and Tiffany Schneider put their brick colonial on the market for $1.2 million last April, they had every reason to be optimistic. The home, three years old and in a suburban neighborhood here, features a two-story great room with a stone fireplace and a leafy backyard. The couple’s agent told them she would be shocked if it didn’t sell within 30 days. After all, the Schneiders had owned five previous homes over the past decade, all of which had sold in the first month for more than the couple had paid."

http://www.nytimes.com/2008/06/01/business/01town.html

Or:

http://tinyurl.com/6yejo4

Thanks Jack, I guess I should add that graphic to the Marin archive that is this blog.

Just across the bridge in Pt. Richmond, prices are faring a little better. I discovered a new web site, www.pointrichmondrealestate.com, that revealed some genuine waterfront properties that are attractive in any market --bubble or not!

Post a Comment