I found this referenced over at Ben's blog:

I found this referenced over at Ben's blog:Those considering buying into the real estate 'soft landing' scenario ought to think twice. There will soon be over $1 trillion of adjustable mortgage payments increasing beyond the payment capacity of the borrower. Many borrowers, upon realizing that the monthly payment is about to adjust, will go searching for loan programs similar to their original loan.I hear the piper and he wants to be paid. If Bay Area housing sale prices are to increase or even stay where they are either wages/salaries have to increase by a whole lot over a relatively short period of time or access to easy credit (a big part of which requires being able to state what ever you can get away with vis-à-vis income) must be maintained or made even easier. Many here in the Bay Area have had to make use of lying about their income on their stated income loans. Many others are dependent on other sorts of "toxic" loans. What happens when people cannot lie on their stated income loans? A whole lot fewer Bay Aryans can qualify for a loan, that's what. What happens when a whole lot fewer people can qualify for a loan? A whole lot fewer sales. The move-up chain begins to break down. What do sellers have to do to sell their houses? Lower the price down to where people can now get loans or wait for years and years for the selling environment to improve or bury a lot of St. Joseph statues or pray that an army of rich [insert your favorite foreign nationality] come in and swoop up properties. Good luck with that.

New 'guidance,' handed down by the Office of Federal Housing Enterprise Oversight Committee, requires…the borrower must now qualify as if the adjustable loan had already changed to the highest rate possible under the loan program.

It has been estimated that 90% of all people who obtained these 'stated' income loans lied on their mortgage application about how much they made. On October 1, 2006, the IRS updated their capacity to respond to lenders' requests verifying borrowers' 'stated' income. In short, what used to take months to respond to will now take two days. Inside of 48 hours, the 'stated' income will be verified as false. How will these people qualify then?

According to RealtyTrac, lenders who foreclose on a property in Ohio get 57% of appraised value when they sell the property. That amounts to a 43% hit on principal!

Consider the inevitable: You have buyers in the market with a choice of inventory, which do you think they'll buy? A lender-owned property at a big discount or one owned by a private party for near full price?

In California, unsold inventory has grown by over 100% in one year. Thus far, there has been limited price damage because almost all of the properties for sale have been privately owned. In 2007, that will change. The new inventory for sale will consist of lender-owned properties, builder auctions, and short sales. All of these sellers will be selling to a less motivated, smaller group of less-able-to-qualify buyers.

Oh, but wait. California is moving towards cracking down on the stated income loan. What will Bay Aryans do?

California lawmakers on Wednesday began considering restrictions on unorthodox mortgage-lending practices that have allowed hundreds of thousands of Californians to buy homes they otherwise could not afford.And it will only get worse. More than $1 trillion of adjustable rate mortgages will reset in 2007 and given the Bay Area's dependence on "toxic" and "liar's" loans, I bet we will be one of the regions to be hit the hardest.

'The exposure to these sorts of products, the growth, is unprecedented,' Raphael Bostic, an associate professor at the University of Southern California School of Policy, Planning and Development, told a Senate committee. 'The regulatory oversight of these types of practices is relatively lax.'

In September, five federal regulatory agencies issued guidelines calling on federally regulated lenders to better gauge borrowers' ability to pay before using the nontraditional loans. California is considering similar rules for state-regulated lenders, as have 24 other states, said Sen. Michael Machado.

About 60 percent of sub-prime loans in California those given to the highest-risk borrowers allowed them to pay only the interest or gave them that option on an adjustable rate mortgage, the Federal Deposit Insurance Corporation estimated. Many of those borrowers are at risk of losing their homes as the market continues to stagnate, witnesses said during Wednesday's hearing.

About 12.5 percent of riskier mortgages nationwide were delinquent by last fall. Nearly 1 million homeowners nationwide either lost their homes or missed monthly payments from July to September, according to the Mortgage Bankers Association.

'The market did not save them,' testified Pam Canada, executive director of Neighborhood Works Home Ownership Center in Sacramento. 'This was a nightmare with no happy ending.'

'We've already seen a dramatic increase in foreclosures here in California,' said Paul Leonard, California director of the Durham, N.C.-based consumer advocacy center.

I've got my hard-hat. Do you have yours?

15 comments:

I go to Ben's blog often and had to read this one twice because I got such enjoyment doing so. To me, this is the single most important piece of legislation being considered in recent years.

If passed, it will also be the last straw holding prices up. The results will be immediate: Over half of all California 'buyers' will be out of luck in terms of options available to them that had allowed such individuals the ability to 'buy' period.

So the way I see it, it might take awhile to pass this law, at which point prices will be down somewhat. With passage, prices will plummet and correct hopefully to fundamental levels.

I've been saying for years that Real Estate is a crucial part of the economy. As such, it too needs regulation. There were a lot of people that got taken advantage of, market data that was twisted and turned into whatever the industry wanted, and loans that had no business being given to people that had no business buying.

I say that California needs to get on the ball and pass this bill right now. Not next year, not next month, but as soon as possible.

anonymous-

Agree with you 100% on your point. Do you know the real motivation behind the legislation?

Oh give me a break. Did any of you bother to look at the author's web site? Seems he's got a pretty fair interest in prices dropping, given his main line of work and all. But wishing doesn't make it so.

As for the first comment on this string, has anyone actually read the proposed legislation to see how much "regulation" it proposes? I seriously doubt the language would support your theory about price decline and eventual plummeting. Think for 30 seconds about the state of the economy were your predictions to come true. There would be mass chaos at both the state and federal levels. Do you honestly believe that all of our career politicians, lobbyists and huge corporate players with billions at stake would let the market collapse like that?

I agree that it costs way too much to live in Marin, but holding on to some notion about plummeting prices like that is just silly.

Not silly, anon 8:19.

I think you have missed a big part of the pie.

This is a castle built on sand.

I'm not predicting a crash.

Prices will sag and sag and drop and sag.

No more 20% no more 10%.

More like -5% -11% etc.

This is good for the economy!

Enjoy!

Definitions for "plummet"...

intr.v. plum·met·ed, plum·met·ing, plum·mets

To fall straight down; plunge.

To decline suddenly and steeply: Stock prices plummeted.

So what is it you're really saying, and what are you really basing it on?...

Again, I'm not saying I like the prices now, but don't mislead people with faulty reasoning.

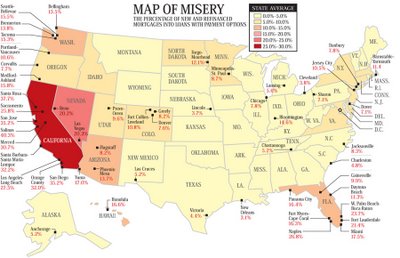

Recall the Map of Misery:

http://tinyurl.com/ypscvf

CA is addicted to and to a very large extent dependent upon easy credit and lax lending standards. That's what makes this proposed legistlation so interesting.

If only it were that simple.

Before you get too excited about that little $2m cottage in Ross you've had your eye on, consider the facts. Think about the people who took out liar loans/sub-prime loans to begin with: they're poor(er) and most of them don't live in Marin, or in desirable neighborhoods, for that matter. If you look at the detailed info on foreclosures in the Bay Area, 85% to 90% are in places like Oakland, Excelsior and Bayview/Hunters Point in San Francisco and the like. The majority of people who bought homes in the $1m+ range had the money to do so. They have access to things like dual six-figure incomes, stock options, investment portfolios and credit at low rates from reputable lenders to keep themselves afloat during hard times.

It was the poor and lower income folks who got screwed by predatory lending, and it will be the poor who get screwed in the legislation. They're the ones who will be priced out and forced to rent forever. I'm not saying the legislation is wrong or that prices won't drop a bit, but I think you need a closer look at demographic data on a city-by-city, county-by-county basis. I also agree with the poster who mentions the economic fallout from the kind of scenario you paint here. Politicians will do everything to prevent a crash. Notice how the Fed hasn't raised rates significantly in a dog's life? Ever wonder why?

I am afraid that your argument about the new legislation only affecting the low-end is faulty. If first-time buyers are gone, this will take the entire move-up chain down, starting from Oakland and all the way up to Palo Alto and Tiburon.

I know more than a few people in Marin who have taken out IO loans, two who have stated rediculous incomes on 'liar's' loans in Marin. One of my mother's friends, whose income is less than $3k/month, did an IO loan for a $1.5 mill condo in De Silva Island three years ago. Her son says she will likely default since she cannot sell for what she paid and her rates reset this year. Yes, there are wealthy people in Marin who are like you describe...who make so much they can care less about loan types or rate resets. But there is a large group who is being affected already...defaults in marin have already doubled and we are just getting started. And then there is the move-up chain which breaks down.

"Oh give me a break. Did any of you bother to look at the author's web site? Seems he's got a pretty fair interest in prices dropping, given his main line of work and all. But wishing doesn't make it so.

As for the first comment on this string, has anyone actually read the proposed legislation to see how much "regulation" it proposes? I seriously doubt the language would support your theory about price decline and eventual plummeting. Think for 30 seconds about the state of the economy were your predictions to come true. There would be mass chaos at both the state and federal levels."

To answer your questions, ben's blog is almost entirely copied and pasted articles written in local and national newspapers and publications. If it was someone just saying that "X will happen because I said so", then it would be a different story. True- his blog is about the "housing bubble" which many homeowners scoff at, but the truth of the matter is that what he publishes is fact.That is why his blog is so great because it isn't biased- it merely presents a national picture/ So take it with a grain of salt.

As far as believing that passing a regulation like this would be detrimental, NOT passing a set of regulatory rules for lenders would be equally, if not more devastating to the economy. To the millions of young and middle income residents, the bubble has already been a disaster. Staying the course an allowing banks, lenders, and financial institutions give loans that do not rely on actual incomes or economics will just further the deterioration of our national economy as it sits, with our HUGE debt. We cannot keep going like this. So take your pick- housing drops say 20-30% for the next 3-5 years, with many who bought at the peak perhaps getting stung in the process, or do nothng about it and allow ourselves to get into even more serious debt, drive away industry, fresh new talent and money.

MOst of the risk modeling being done assumes that the ratio of actual foreclosures to NOD's will not change significantly from historical norms.I do not believe that the current situation is AT ALL analogous to prior real estate downturns.the prevalence of financial products such as ARMS and I/O loans,the casual acceptance of fraud throughout the real estate industry,the fact that millions literally bet the house,the HUGE effect on the economy of this bubble are simply not taken into account by most analysts.and yes Marin will still be considered one of the more desirable areas of the Bay Area,what exactly does that do to insulate Marin from macroenomic changes of this magnitude? As far as regulatios,there are plenty on the books,but no enforcement.

When I referred to the author, I wasn't referring to Ben, or whatever his name is. I was referring to the author who wrote the "article" that Ben posted. That individual happens to be an industry player with a very clear bias in terms of what's good for his business and for his clients. If you consider his piece to be "fact," then there's really nothing more I can say. It's like arguing with someone over their religion. For my part, I find very little in today's media that's not biased, including front page stories in most major daily newspapers. Be discriminating or not - it's your choice.

And for what it's worth, stated income loans have been around a lot longer than this bubble we're in, and they have created huge wealth in this state. The problem, in my humble opinion (not fact, mind you) is that predatory lenders peddled these loans to people who shouldn't have used them. As usual, the rich get richer on the backs of the poor working folks. Oakland will feel this pretty good. Marin probably won't.

I've been digging around to find the bill number and sponsor for this Legislation. It is really important that folks write their representatives in the Legislature to let them know how important such legislation is both for buyers and sellers. These toxic loans hurt everyone and Wall Street's irresponsibilty must be kept in check. Please remember the FDIC insures federal bank deposits so banks that get themselves in trouble will ultimately be bailed out by Mr. and Mrs. Taxpayer.

Any further information on the bill would be helpful.

regardless of where the bias sits, lending practices, the lending and real estate industry, and so on must be more carefully regulated. I agree with you to an extent that people with lower incomes who bought into this will be hurt the most. But at the same time, The people who could 'afford' more than likely reside in the camp of just scraping by. The sad part is that many who buy and can afford to at least make the payments are individuals and families who have terrific jobs and great pay. yet MOST of their income will be going to their mortgages when that same money could have been going towards the economy in the form of spending, community planning and building, and taxation which unfortunately doesn't come out of the pockets of a majority of those who live in marin because the average age in marin is older- hence they are protected by prop 13.

So in the spirit of long term economic progress, by allowing the mortgage and RE industries to adopt such ridiculous financing, hence allowing the bubble to live an additional 3 years has caused an enormous amount of damage and ridden most of the personal wealth many californians could claim in the past.

I applaid any effort to improve loan quality. Bottom line- when you create rules and regulations that put limits that tie incomes to spending maximums, that in effect will cause prices to return to a stabilized unit that matches the rest of the economy. You cannot run an economy like California has for the last 5 years and expect things to be peachy.

I've been digging around to find the bill number and sponsor for this Legislation.

Please send me whatever info you have dug up, as well as any letter you have drafted, and send it to me so that I can publish it as a blog entry so as to give the idea of sending out a letter to our reps greater exposure. Other bloggers will probably follow suit.

Post a Comment