How Will History Judge This Man?

...Alan Greenspan is either depraved or a fool and, of the two, I am not sure which I feel worse about as describing the man who was at the helm of the monetary bobsled during the longest stretch of paper credit expansion the world has ever seen.

Let’s play ‘connect the dots’:

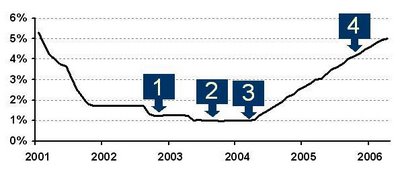

1. In December 2002, private bankers warned Greenspan that consumers were taking on worrisome amounts of debt and that an unsustainable, interest rate driven housing bubble was fueling this behavior (page 22 of this linked document [PDF]).

2. In July of 2003 Greenspan lowered interest rates to one-percent (as in 0%, or one-point-oh), an emergency rate, and held it there for over a year (see chart below).

3. In February of 2004 Greenspan advised Americans that they’d be better off with adjustable rate mortgages (ARMs) than they would with fixed rate mortgages.

4. In October of 2005, the new bankruptcy law, largely written by private banking lobbyists and insiders, was passed.

Here’s how those data points look when plotted out on a chart of short-term interest rates:

To summarize; (1) Mr. Greenspan was warned that he was igniting an unsustainable asset bubble, (2) he threw more gasoline on the fire, (3) he then advised consumers to switch to ARMs right before what he knew (for certain) would be a protracted period of rising interest rates, and then (4) kept mum while bankers worked feverishly to pass bankruptcy legislation that was indisputably banking-friendly but a consumer nightmare.

To summarize; (1) Mr. Greenspan was warned that he was igniting an unsustainable asset bubble, (2) he threw more gasoline on the fire, (3) he then advised consumers to switch to ARMs right before what he knew (for certain) would be a protracted period of rising interest rates, and then (4) kept mum while bankers worked feverishly to pass bankruptcy legislation that was indisputably banking-friendly but a consumer nightmare.

Now here’s the interesting part about the story. To consumers, Adjustable Rate Mortgages (ARMs) are good or bad depending on whether interest rates are rising or falling. When interest rates fall the ARM adjusts down with them. The reverse is true when rates are rising...

But when we refer to the four data points in the chart above, we observe that Mr. Greenspan advised consumers to take advantage of ARMs right before the onset of what he knew would be a multi-year rate hiking campaign. Obviously he advised people to do the exact opposite of what they should have done.

Source.

To summarize; (1) Mr. Greenspan was warned that he was igniting an unsustainable asset bubble, (2) he threw more gasoline on the fire, (3) he then advised consumers to switch to ARMs right before what he knew (for certain) would be a protracted period of rising interest rates, and then (4) kept mum while bankers worked feverishly to pass bankruptcy legislation that was indisputably banking-friendly but a consumer nightmare.

11 comments:

Yeah Greenspan SUCKS! What did he ever do for us? Well, he managed the US economy through:

*the 1987 stock market crash just 2 months after getting the job.

*the aisian currency crash

*the argentinian debt crisis

*the Russian financial crisis

* the Long Term Capital Management collapse (shich nearly brought the US financial system to its knees in the late late 90s)

You continue to parse his performance based on on very thin slice of the US economy. That is a bad metric for gauging performance. Akin to judging a police officer's total effectiveness on the job by seeing how many spedding tickets they distribute.

BTW, the link to your 3rd point is broken. If you try it from the blogger who originally wrote the piece it links to a paid article.

I would guess though that Greenspan's advice was nowhere near as clearcut as you portray it to be. I might be wrong, but he was habitually guarded and obtuse in his statements throughout his tenure and I doubt he veered away from that on this point.

Yeah Greenspan SUCKS! What did he ever do for us? Well, he managed the US economy through:

*the 1987 stock market crash just 2 months after getting the job.

*the aisian currency crash

*the argentinian debt crisis

*the Russian financial crisis

* the Long Term Capital Management collapse (shich nearly brought the US financial system to its knees in the late late 90s)

You continue to parse his performance based on on very thin slice of the US economy. That is a bad metric for gauging performance. Akin to judging a police officer's total effectiveness on the job by seeing how many spedding tickets they distribute.

BTW, the link to your 3rd point is broken. If you try it from the blogger who originally wrote the piece it links to a paid article.

I would guess though that Greenspan's advice was nowhere near as clearcut as you portray it to be. I might be wrong, but he was habitually guarded and obtuse in his statements throughout his tenure and I doubt he veered away from that on this point.

sorry for the double post

You should take your comments to the writer of the article. marinite wrote just one word.

pothead ---

you do know that there is an entire blog that was originally dedicated to the Greenspans mess?

http://themessthatgreenspanmade.blogspot.com/

Here is the fix to the "broken" link:

http://tinyurl.com/2p2rbd

Here is a link to the speech that Greenspan gave: http://www.federalreserve.gov/boardDocs/speeches/2004/20040223/default.htm

Here is the relevant text from the Greenspan speach:

Mitigating Homeowner Payment Shocks

Rising debt service ratios are a concern if they reflect household financial stress and presage a drop in consumption or a rise in losses by lenders. Most homeowners and renters are aware of the possible difficulties should they lock themselves into a high level of debt payment obligations. Financial institutions might be able to help some households in this regard by looking for ways that households--both renters and homeowners--can shield themselves from unexpected payment shocks.

One way homeowners attempt to manage their payment risk is to use fixed-rate mortgages, which typically allow homeowners to prepay their debt when interest rates fall but do not involve an increase in payments when interest rates rise. Homeowners pay a lot of money for the right to refinance and for the insurance against increasing mortgage payments. Calculations by market analysts of the "option adjusted spread" on mortgages suggest that the cost of these benefits conferred by fixed-rate mortgages can range from 0.5 percent to 1.2 percent, raising homeowners' annual after-tax mortgage payments by several thousand dollars. Indeed, recent research within the Federal Reserve suggests that many homeowners might have saved tens of thousands of dollars had they held adjustable-rate mortgages rather than fixed-rate mortgages during the past decade, though this would not have been the case, of course, had interest rates trended sharply upward.

American homeowners clearly like the certainty of fixed mortgage payments. This preference is in striking contrast to the situation in some other countries, where adjustable-rate mortgages are far more common and where efforts to introduce American-type fixed-rate mortgages generally have not been successful. Fixed-rate mortgages seem unduly expensive to households in other countries. One possible reason is that these mortgages effectively charge homeowners high fees for protection against rising interest rates and for the right to refinance.

American consumers might benefit if lenders provided greater mortgage product alternatives to the traditional fixed-rate mortgage. To the degree that households are driven by fears of payment shocks but are willing to manage their own interest rate risks, the traditional fixed-rate mortgage may be an expensive method of financing a home.

So after reading this, it sure doesn't look like Greenspan was advocating that people get adjustable rate mortgages in the future, but said that would have been a good deal in the preceding 10 years. Am I missing something?

Always check your sources..

sorry, here is a tiny url:

http://www.tiny.cc/UG1uj

If you read the *whole thing* he is questioning the desirability of the fixed rate mortgage. He is promoting ARMs and other alternatives. Duh! The timing of this statement in the context of what was to come next, of what he knew was going to come next, is suspicious.

what part of "during the past decade" don't you understand? He points out, that there is a premium associated with a fixed rate mortgage. (This is neither a good or a bad thing, it just is) He correctly points out that in the preceeding 10 years you'd have saved some cash with an adjustable. He also points out that this would not be the case if interest rates were going up.

It's classic Greenspan, no clear advice for the future, just a cold and somewhat obtuse assessment of the past numbers.

Pothead, that anon guy is typical of the real problem, which is the irresponsibility of the average American. Greenspan never was that powerful. He had the ability to raise and lower overnight interest rates and that was about it. In theory, he had he ability to impose stringent regulation on banks, but look what happened when he merely suggested some changes to Fannie and Freddie? Yep, Congress basically told him to get lost. And what did Congress do that? Because the constituents who voted these Congressmen into office didn't want anyone to stop the housingn bubble party.

The only way people learn is the hard way. Only when enough people have lost enough money will responsibility return to this country.

Post a Comment