The Mess That Greenspan Made blog has the scoop on the disturbing rise in foreclosure activity in California. Marin's notices of default have basically doubled. (I thought that couldn't happen in Marin. Weren't we supposed to be immune or some such? Something about wealthy folks and how financially savvy we are all supposed to be.)

The Mess That Greenspan Made blog has the scoop on the disturbing rise in foreclosure activity in California. Marin's notices of default have basically doubled. (I thought that couldn't happen in Marin. Weren't we supposed to be immune or some such? Something about wealthy folks and how financially savvy we are all supposed to be.)The Marin IJ had this to say:

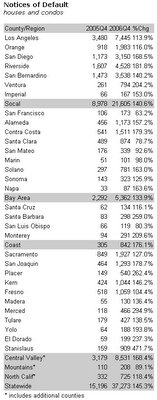

The number of mortgage default notices nearly doubled in Marin County in the fourth quarter of last year, mirroring an escalation in foreclosure activity throughout California, according to data released Wednesday.Keep in mind that around 70-80% of all loans made in Marin and the Bay Area at large in 2006 were likely of the "exotic" type (and don't forget about the "85% are liars loans" post).

Marin had 101 default notices during the quarter, up from 51 in the last quarter of 2005, according to DataQuick Information Systems, a La Jolla-based research firm.

The numbers continue an upward trend in the county, which had 89 default notices in the third quarter of last year, up from 56 in the previous third quarter of 2005...

Across the nine-county Bay Area, fourth-quarter default notices rose 134 percent between 2005 and 2006, from 2,292 to 5,362. Contra Costa County led the pack at 179 percent, followed by Napa County at 164 percent and Solano County at 163 percent.

"Several factors are at play here," said Marshall Prentice, president of DataQuick. "The numbers last year and the year before were very low because of strong sales and appreciation. Also, most defaults occur a year or two after the loan was made, so we're in a period where the loan pool is at risk."

Ok, so notices of default have doubled in Marin and yet the massive number of crazy loans from 2006 haven't even begun to reset yet. How much worse is it going to get?

But no worries, right? I mean DataQuick is fond of saying:

"Indicators of market distress are still at a moderate level. Financing with adjustable-rate mortgages is flat. Foreclosure activity is rising but is still in the normal range."Do you believe them?

Here's one reason why not to be so quick to believe DataQuick -- apparently, DataQuick includes foreclosures as sales when they calculate their stats for public consumption and they say they are not going to change what they admit is an error. Athena, over at the excellent Sonoma Housing Bubble blog, has the scoop.

And if that wasn't bad enough, nationally (so including markets that have not participated in the specu-frenzy), existing house sales this past year were the lowest that they have been in the last 24 years! And yet David Lereah says we’ve hit the bottom. I wonder if future historians will mark this point in time as the pinnacle of maximum denial.

Anyway, I guess it is high-time to resurrect this appropriately updated picture, first published on this blog:

11 comments:

Marinite, thanks for showing the truth.

The mind control RE media have been telling us that we have to buy.

Now there is so much sorrow.

So much more sorrow to come.

I send this message to all potential buyers........

WAIT!@

I wanted to post an unrelated reply but about an idea I had while reading a book last night. Perhaps this could be a post by itself?

I'm sure all of you have heard of the G.I. bill, a piece of legislation passed in 1944 for returning servicemen, who obviously deserved help from government. If you read more about what this bill did, it is the most significant bill passed in that era and was most responsible for ringing in an era of overall stability, healthy growth, and a prosperous middle class. Returning soldiers were given college tuition, unemployment, and interestingly enough- money and zero interest loans for homes.

Many of these homes were in suburbs and were built on a factory scale: concrete slabs, prefab walls, and manufactured windows, doors, appliances, and siding. This was revolutionary because it brought the price of housing down to a level where just about anyone could afford to buy. Some of these early suburbs had been built under government contract for housing dock workers, factory workers, and so on. By the 50's, this home building technology was perfected.

here is an excerpt from an article:

"An important provision of the G.I. Bill was low interest, zero down payment home loans for servicemen. This enabled millions of American families to move out of urban apartments and into suburban homes. Prior to the war the suburbs tended to be the homes of the wealthy and upper class.

The bill helped to democratize the "American Dream." The G.I. Bill of Rights has since been modified but still remains on the books."

- So in other words, while this bill might have sounded almost socialist, it actually helped usher in an entire generation of Americans that would enjoy a level of living that lasted for several decades- up into the 90's in most metropolitan areas and still in most minor metros. But for areas like the most of the Northeast, Western Pacific, and so on, this dream has just about dwindled and the old class structure is now creeping back in, mainly due to the many aforementioned anti-development laws passed- ironically- by the children of the parents who first benefited from the GI bill.

Home builders are now just like any other business. Like any good business model, they choose to build in large quantities when the prices are high, and cut back when prices fall. In this way they reap maximum profit from choosing to more or less build when prices are most favorable- to them. The laws of supply and demand.

But what does this do to the average consumer? By manipulating the supply, buyers will always foot the bill at an ever higher amount. Construction costs are no different than they were in comparison to the 50's. In fact, it has gotten cheaper. Immigrant labor, cheaper building methods, and cheaper construction methods means that the average house costs less than it did compared to a home built 50 years ago when inflation is thrown in.

So this is where I step in and suggest that while I can't help but feel that the government already slipped up by allowing the low interest rates stay for way too long, there must surely be an answer out there as to how possible government intervention, if not an amendment to the GI bill that would enable a similar effect on the average home buying public as it did in the 50's. Perhaps a reinstatement of such a bill, but passed to be directed towards the general population.In other words, a bill passed for average citizens.

Perhaps the government could contract with builders to have a program of home developments that aren't charitable in nature like the ones we've grown accustomed to, like habitat for humanities, but uniform and compliant with a region.

An assessment of an area's cost of living, economy, neighborhoods, and infrastructure could be made.

thereafter a predetermined cost would be applied to a house that complied with the area's cost of living. The houses in question could be of mixed variety: smaller, medium, and large. These would be set up in a way that all income brackets would have a choice of homes, and if they were successful enough,could move up. Ensuring that a careful check and balance system would be in place that allowed for a careful control of the supplies at all levels would ensure that the upper and medium ends do not compete so heavily with one another that appreciation skyrockets out of control as it has done in the last 5 years.

An even more renegade idea could be widespread government programs that allow the government to award contracts to builders who in turn will produce such aforementioned mix level homes. Their profits would perhaps not be as spectacular, but if tax cuts were given in addition to these contracts, this added incentive would ensure the builders that they would have a reliable form of income. Steady business is always admirable. Probably better than the roller coaster ride these businesses take now. These homes would in turn either be owned partially or entirely by the government who would have bought them from the builder.The government would have made previous agreements with the builder to pay a certain price for a certain home. The average citizen would be paying the government for their loan. The overall quality of the loan would be good and prices would be more immediatly affected by local and national economics. Just as with a bank, if the owner fails to pay, the home is repossessed by the government.

The positive aspect of this system would be that the government would have set the price in advance, hence property values would not be as out of control. Although this may sound outright crazy, it isn't that different from what the GI bill was all about: soldiers borrowing money from the government and buying a home in a development of homes that were all the same, and all the same price. remember- those GI's didn't care as much about property appreciation. They had just fought a war and the idea of pleasant middle class living was a luxury and one that I think many of us here would dearly like to have.

As the latest reports show 10's of thousands of Californians and hundreds of thousands of New Yorkers relocating, this in turn will eventually affect local economics. It would be in the state and country's best interest to assure that housing was at least considered more or less a socially significant concept that needs to somehow be checked up on.Perhaps tax cuts could be made to builders that make an effort to build smaller homes- not just the largest, most oppulant, profit-making ones.

Of course this would probably NEVER pass at all.I realize this is mere fantasy.

But one thing that I read stands out above all this:

The highest level of general contentment and perceived personal satisfaction and self-worth in American history was in 1957, about the time that most Americans had a home of their own, jobs that supported their lives financially,schools that educated their children, and so on. The average home was 700 square feet. The average family had one car and one TV set. They didn't live in a world that we would call "rich" but their lives were stable and positive. They were content. Content people make good citizens.

This is a sad comparison when you see how the average Bay Area citizen lives now, with a never-ending fight with the cost of living, and the reality that if you do buy here, you will likely be older and hence wasting half of your life just to buy what should be available to you as soon as you enter the workforce.

Call me crazy, but I think there just might be a way that housing could be brought under control. Who knows? perhaps if the miracle we've been waiting for happens and housing prices crash, then ideas like this won't matter anyway.

DataQuick is just like any other rating agency -- overly cautious, not wanting to spread panic and users of corporate or perhaps I should say Fed Speak.

Last year DataQuick would put a similar statement at the end but it said the market had no signs of distress.

Now they are saying there are moderate signs of distress.

In Fed Speak this means "Houston we have a problem" so you need to read how these end of PR statements change over time. If you do this you will see that DataQuick is saying we have a problem. Personally I think they do this to cover their you know what without upsetting the lenders and wall street customers.

I interpret the data to show Marin's default rate as one on the lowest counties in the state....well below average.

As usual, Marin is not hit nearly as hard in this type of downturn.

Marinite, could you show the data on a graph with say a 5 or 10 year history? I think that context would help make the figures relevant. Yes, there is a big jump, in % terms. But without knowing how this compared to the # of foreclosures historically it is hard to tell if the increase is a trainwreck about to happen or just a reversion to the norm.

BTW, thanks for posting again, good food for thought

pothead -

I don't have the time now to dig up data specific to Marin, but check this analysis out:

http://tinyurl.com/3acr2q

Marin does and will follow the same trends as its neighbors, just not as extreme. So I see no reason to question the legitimacy of the above analysis as applied to Marin.

Marinite, thanks for the link. It looks like 2006 is about average for the period from 1992-2006, but it increased like crazy year over year. Be interesting to see how much it spikes this year

"Marin's default rate as one on the lowest counties in the state"

I prefer to compare stats between towns within a county to get a sense of exposure within neighborhoods, versus a county-wide average. Interestingly, while researching last year I found that "prime" areas such as Palo Alto, Los Gatos, Sausalito, Los Altos, etc. have a higher incidence of foreclosure and pre-foreclosure than more modest nabes such as San Jose, Novato, San Rafael, etc. Normally, one would expect residents of "prime" towns to have higher incomes and more financial stability.

This could be a statistical anomaly, or perhaps it's easily explained by human nature: people will gladly overextend themselves to dwell in a position of status, bolstered by the "certainty" they can sell and recover any possible loss. While I'm not suggesting this is the norm, I've heard plenty of stories to suggest that "prime" towns have their own risks.

Foreclosures up 25% in the Seattle area too. Just reported in todays local paper.

Anon with the GI Bill stuff - my hope is that housing will just crash so far that people will be able to buy there own, responsibly that is, and for keeps, not on a one year loan from the bank til they foreclose you and come back for their prperty! It's a great feeling to buy your own house, no help from above.

By the looks of this mess, I think we may get there.

It looks like the main stream media is finally, finally getting on Lereah's case about his shilling.

http://tinyurl.com/ytkgth

It's about friggin' time.

Marinite, this was my favorite part.......

"Conclusion

It's unfair, of course, to single out Lereah's forecasts. He wasn't the only economist who was surprised by the extent of the collapse in housing in 2006; some were just as wrong on the other side by predicting the housing bust would bring down the whole economy.

But Lereah was the only one who presented his opinions alongside an economic indicator that's treated as an objective gauge of the housing market.

Along with his bully pulpit comes extra scrutiny.

Lereah was traveling on Thursday and unavailable to comment.

The senior economist at the NAR, Lawrence Yun, said in an interview the most recent sales trends show almost no movement up or down since August or September.

"In hindsight, we did not anticipate how strong the demand from speculators had been," Yun said of their 2006 forecast. "Now, with the speculators out of the market, and with low mortgage rates and steady job growth, we anticipate an improvement in sales."

It's possible that Lereah may be right, finally. The bottom must come some time, why not now, some 19 months after the bubble peaked?

But it's also possible we could be far from the bottom, as in the housing bust of 1978-1982, when it took 42 months for the market to recover.

If so, it could be a long year for David Lereah."

End quote....

I hope so.

It peeves me that these "pushers" have so much power and clout.

Our little blog is small but mighty.

Keep the faith.

Thanks Marinite.

Post a Comment