UPDATE:

Vision RE's results are now in. They are worth checking out. I inserted them into the original post.

* * *

I've been waiting for

Vision RE to post their results for December and so that's why I've been holding off on this post. Well, still nothing. I'll update this post as soon as their data comes in.

* * *

Here is my summary of the results for December, 2006 for Marin:

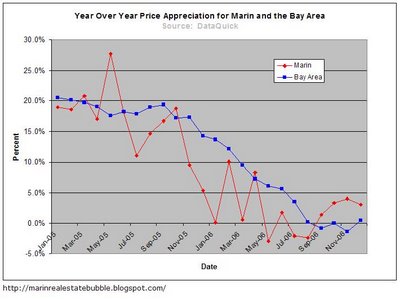

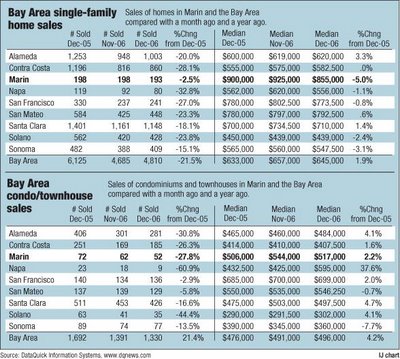

DataQuick's compilation of everything that sold in December shows that Marin prices were up a whole 3.1% whereas sales dropped -13.4% compared to December, 2005:

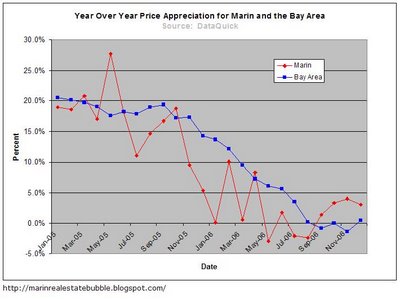

Here is the same data as above except plotted and compared to past months' data:

The

Marin IJ pays for

DataQuick's data and so they get to see how specific categories of properties are performing.

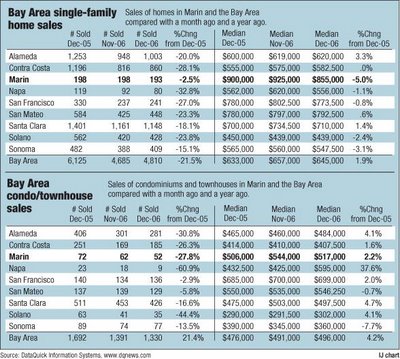

According to the ever-bullish IJ, Marin's SFRs lost 5% of their value compared to what they were worth a year ago even though the actual number of sales in December, 2006 was essentially unchanged from December, 2005:

From the

IJ article (emphasis mine):

The median price of a single-family home in Marin slipped to $855,000 in December, down 5 percent from the previous year and about 8 percent from November...

The December decline was the steepest in the nine-county Bay Area, where prices remained lodged in a generally flat pattern...

I thought that couldn't happen in Marin. Anyway...

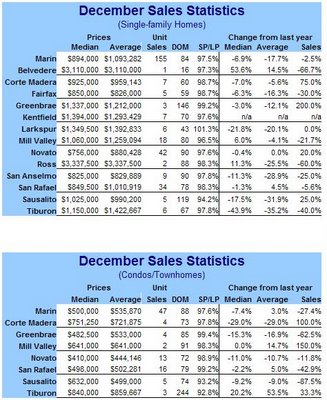

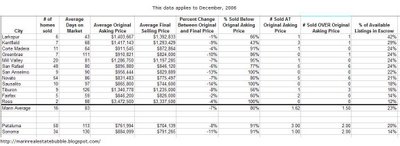

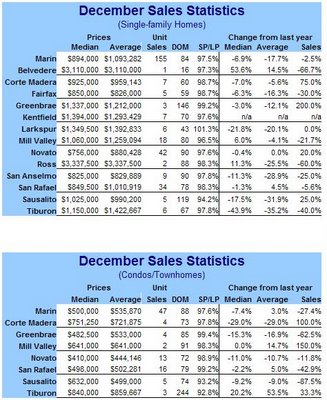

Here are

Vision RE's results for December, 2006 -- median price for Marin down -6.9% and the average price down -17.7% (both year-over-year) yet sales activity was barely different from December, 2005. But before you wet your pants, keep in mind that theirs is a sampling of Marin:

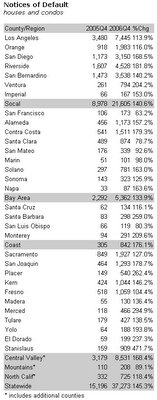

Home sales in Marin County last year declined for the second year in a row: dropping 16.6% from 2005. Home sales were at their lowest level since 2001. Condo sales also fell for the second year in a row: down 23.6%.

The median price for single-family homes declined for the first time since before we've been keeping track: 1995...

...Marin County home sales were down, year-over-year, every month in 2006: usually by double-digits. The good news is the year-over-year losses turned into single-digits for the last two months of the year.

The median price for condos ended the year at $500,000, the low for the year. Condo sales were up 4.4% in December from November, down 13% year-over-year.

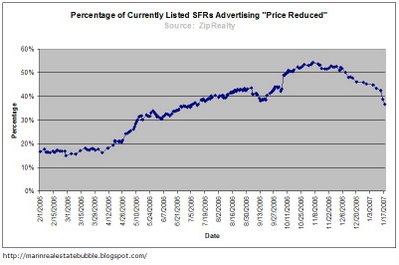

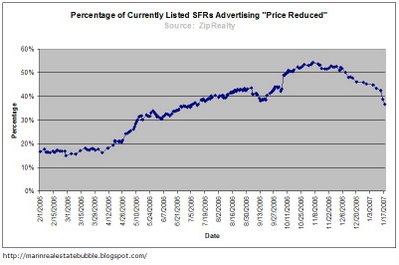

Below is a chart showing the percentage of SFRs currently on the market that are advertising "price reduced". (To those of you who are new to this and similar charts: the way I have been collecting this data is to do a search over all of Marin for any type of detached SFR whose asking price falls within the range of $100K and $10 mill.)

As the following graph shows, the percentage of houses advertising "price reduced" has dropped in line with the steep decline in the number of houses listed during this slow time of the year. Interestingly, the percentage showing "price reduced" appears likely to be significantly higher than it was in December, 2005.

Below is a chart showing Marin foreclosure activity according to

RealtyTrac. I don't have much to say about this data yet as I still do not have much of a feel for how this sort of data changes with time. However, I think the increase in the number of properties in auction and the number reverting to bank ownership is disturbing.

Liz McCarthy

Liz McCarthy (a Marin real estate agent) had this to say about December's results:

Although there are considerably less homes [sic] on the market this month as compared to last month, there are still more than the previous December (898 compared to 622 in December 2005), the percentage of homes in contract went up slightly (very slightly). My feeling is that many of the homes that did not sell have been pulled from the market, anticipating the slower months during the holiday season, or to possibly restart the Days on Market [DOM] clock for that house trying to regenerate interest.

So according to Ms. McCarthy the inventory of houses on the market in December, 2006 was 44% higher than it was in December, 2005 while at the same time the percentage of houses that actually went in contract was essentially unchanged.

Finally, I'll close with a

recent quote from economist Christopher Thornberg in the

SF Chronicle about December, 2006's Bay Area real estate results:

While many in the real estate industry say that the downturn in the housing market is over, economist Christopher Thornberg disagrees. ‘I’m hearing all this nonsense about a soft landing and rebounding in 2007, and that’s just incorrect,’ he said. ‘It just doesn’t work that way — housing cycles when they pop take years to clear out of the system, not months.’

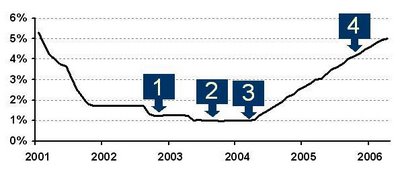

To summarize; (1) Mr. Greenspan was warned that he was igniting an unsustainable asset bubble, (2) he threw more gasoline on the fire, (3) he then advised consumers to switch to ARMs right before what he knew (for certain) would be a protracted period of rising interest rates, and then (4) kept mum while bankers worked feverishly to pass bankruptcy legislation that was indisputably banking-friendly but a consumer nightmare.