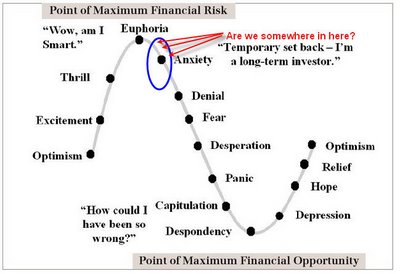

Did anyone learn a thing from the Nascrash of 2000? If so, what? Once again, it's as if everyone seems to think they can get out at or near the top. Not only is that mathematically impossible, I get the strong feeling that most players are not even aware of the enormous rise in risks even as there are clear signs that the global liquidity ship is beginning to sink.From Mish's Global Economic Trend Analysis.

1 comment:

hemorrhoid --

No worries. And thanks for explaining why you chose that handle (vis. your follow-up post on Patrick.net). I've wondered about it.

Post a Comment