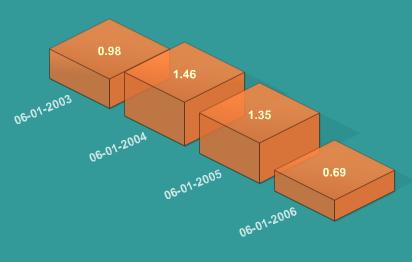

Keep in mind that the index works like so:

Keep in mind that the index works like so:- "High Demand" -- Index > 1.25

- "Balanced Demand" -- Index ~= 1.0

- "Low Demand" -- Index < 0.8

The realtor who is responsible for this index has this to say about today's market:

- Rising interest rates that are forcing significant numbers of people to rent rather than buy. This is pushing rental rates higher in Marin.

- Entry level homes in Marin are the most impacted in the shift to a Buyers Market. Entry level categories of property now have high levels of available inventory, and all signs of the buying frenzy of recent times has vanished.

- All price categories below $2Mill have significantly lower HEAT Index levels than previous years.

- On the same date two years ago (June 1, 2004), the overall Marin HEAT Index was 212% higher than the Index for today.

- The $2Mill-$4Mill market segment is the most stable and vibrant price segment of the HEAT Index.

- The $2-4Mill Index today is actually slightly higher than the Index for the less than $600,000 properties. This is a huge change from just a few months ago, and reflects the differentiated impacts of interest rate increases on entry level homes (high impact) and multi-million dollar homes (modest impact).

- Condos, Novato, and San Rafael Index readings are significantly lower than their readings for this date on prior years.

Naturally "rising interest rates... are forcing significant numbers of people to rent rather than buy". No surprise there either as renting has become much cheaper in Marin than "owning" and will likely continue to be so for a while at least (and the inventory of rentals might actually increase as some house sellers fail to sell and are forced to rent their units out so as to mitigate costs).

But what is a surprise is that interest rates have only risen a little and yet they are already hurting Marin's market. Just wait! It's only going to get worse -- Bernanke has as recently as today told us that there are more rate hikes to come:

“Although the anticipated slowdown in growth is underway, financial markets shouldn’t question the inflation-fighting credentials of the Federal Reserve Bank, Chairman Ben Bernanke said Monday. ‘There is a strong consensus’ among FOMC members to keep inflation low, Bernanke told an international banking forum here.”And according to this the rate hikes are not ending anytime soon:

“Recent core inflation readings ‘have been higher in recent months’ and ‘has reached a level that, if sustained, would be at or above the upper end of the range that many economists, including myself, would consider consistent with price stability and the promotion of maximum long-run growth,’ Bernanke said.”

“These core readings ‘are unwelcome developments,’ he said. ‘Therefore, the FOMC will be vigilant to ensure that the recent pattern of elevated monthly core inflation readings is not sustained,’ Bernanke said.”

“Households’ fanciful notions of their financial health could soon awake to the reality of the longest Federal Reserve rate-hiking campaign in more than 25 years.And then there is this which suggests that interest rate hikes are just icing on the cake:

The speculative housing craze is crashing from its own excesses, not Federal Reserve action.Strictly my opinion and not advice --> So what is your typical Marin buyer thinking given the above? If I were in the market looking to buy a house in Marin it would seem to me that holding off on buying would be the far more sensible thing to do as the deals will only get better for the buyer and the property tax that I would have to pay year after year after year after year...etc... would be less and thus the cumulative savings on property tax would be very large. And since appreciation rates are coming to a standstill, and in some cases are negative, and inventory is high there's no rush to buy. And should I need to move for whatever unforeseen reason I wouldn't want to get trapped with a huge mortgage that would be very difficult to get out of without still owing the bank after the sale. But that's just me.

This is the first nationwide housing bubble since the 1920s, and it's driven by three nationwide forces: low interest rates, loose lending practices and the desperate search for a stock substitute after the 2000--02 debacle.

A house-price collapse will be far worse than the 2000--02 bear market on Wall Street and will bring a serious global recession. Half of households own stocks or mutual funds, but 69% own homes. The resulting unemployment will kill many subprime borrowers' ability to make payments.

1 comment:

Good point. Thanks junkie.

Post a Comment