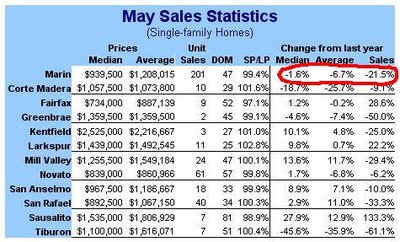

Are those actually minus signs in front of some of those price "gains" in their chart? That can't be right because everyone knows that prices in Marin always go up (ok, to be fair, this is not the first time Marin house prices have gone negative). Who wants to bet that DataQuick's May report on appreciation in Marin will be down close to 0%?

Anyway, here's their low-down:

Year-over-year sales were off 21.5%.

The median price for homes fell 4.6% from April to $939,500, a year-over-year decline of 1.6%. The median price is now down 8.7% from the peak price of $1,029,250 reached in June 2005.

...on one hand we have prices dropping, on the other hand, homes are selling faster and for closer to their asking price. Another item to note is that inventory has almost doubled since January. It’s a strange market that is still in transition.

Roughly 32% of all listings are marked as "price reduced" according to ZipRealty. I'll show the chart of that as well as others in a later post.

Roughly 32% of all listings are marked as "price reduced" according to ZipRealty. I'll show the chart of that as well as others in a later post."It’s a strange market that is still in transition". That's for sure. It's transitioning downward: percent sales way down, inventory nearly doubling, a third of sellers offering price reductions, negative year-over-year "appreciation". Does that sound like a strong Marin market? The effects of increasing interest rates are only just beginning to be felt.

1 comment:

The reason that average days on market (DOM) increased

You mean "decreased", right?

Yeah, a ton of new houses were added to the listings in the last two or three weeks. Amazing.

Post a Comment