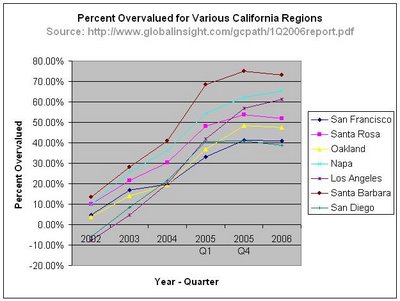

A study released last week by Global Insight and National City Corporation titled House Prices in America concludes that in 71 metropolitan areas representing 39 percent of the total value of single family homes in the country those homes were extremely overvalued in the first quarter of 2006. This is an increase from the fourth quarter of 2005 when 64 markets representing 36 percent of national home value earned this designation. It is even more striking to compare the most recent data to the first quarter of 2004 when this same study deemed that overvaluation was insignificant and only three metropolitan areas and only 1 percent of all single family home values were thought to be out of line with reality. The study's designers consider that areas where home prices are in excess of 34 percent over what they determine to be real prices are excessively overvalued.Here's the summary:

Here's a graph derived from the data in Appendix A for some California regions:

According to this report, today's $779,700 house in San Francisco, were it not overvalued, would cost $461,582.

3 comments:

"According to this report, today's $779,700 house in San Francisco, were it not overvalued, would cost $461,582."

******

Hmmm.... should the homebuying masses regain their senses, it's a good thing some of you gardeners have that 40% cushion for the forthcoming reversion to the mean!

Marinite, thanks for passing along this fantastic report. I think Appendix C is particularly worth reading about the last downturn.

Sixty-six price corrections are observed over the past 20-year period and are ranked by starting date.

The median, or typical, price correction is 17 percent.

The median, or typical, degree of overvaluation prior to a correction is 34 percent.

The median, or typical, duration of a correction is 14 quarters.

"a lot of readers/bloggers like to compare stocks to RE"

"Went to Stinson Sunday, great day... gotta love God's Country."

Fred,

I have to agree with you on both points! I'm at Stinson right now (have a 2nd home here) and as usual it is unbelievably beautiful. I won't comment on what I paid for this house (five years ago) because I'm sure it would sound at least semi-crazy. But I can say, to me, I am getting my money's worth!

Post a Comment