Here's a worthwhile

article by Bill Bonner. Some choice quotes:

"In California, the typical person lives in a box with neither grace nor charm. But it is worth $522,000, according to the latest figures. The man figures he is half way to being a millionaire. He might as well spend a little of his fortune, he believes, before it gets away from him. And so he "takes out" what Benson calls the "phony equity" and uses it to improve his standard of living. Which is to say, he spends money. Whether the spending actually improves his quality of life or not is hard to say. Until now, he didn't have to worry about it. The money was almost free. It came without work or sacrifice. Getting rid of it as fast as possible only seemed appropriate.

But there's nothing quite as expensive as free money. Home ownership has reached a record 69% in the U.S. Trouble is, the homeowners don't own much. Most houses are heavily mortgaged. As many as one in ten "homeowners" have no financial stake in their houses. A typical mortgage payment for a typical California house is over $3,000 a month. You would need an income of $122,000 per year to get a conventional loan for that amount. Not many people earn that much; it's more than twice as much as the median family income. That's why many people are spending half their income on shelter. But as long as prices rise, they don't worry about it.

It's when prices stop rising that real values show up. Then, the homeowner has only the expenses...and the debt...to think about. Then he begins to wonder what it's really worth to him to live there.

How much? We don't know. But the value of the typical California house is probably much less than today's asking prices."

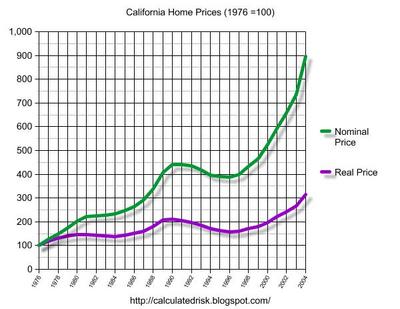

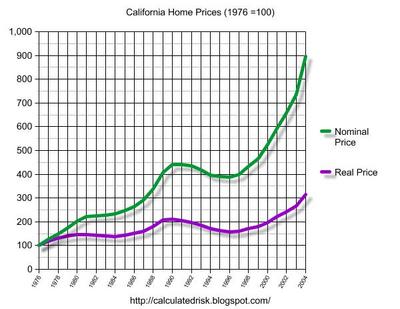

Here's a chart from the blog

CalculatedRisk which shows just how little California houses are worth relative to their sales price ("real price" is the "nominal price" adjusted for inflation less Shelter):

No comments:

Post a Comment