The lame, pseudo-contrarian argument that people like to pander about which claims that 'there cannot be a housing bubble if everyone knows there is a bubble' is bogus because

so few people are aware that there is a bubble.

"... [a] National Association of Realtors... poll found that only 23% of respondents had heard of a housing bubble, and that lots of people didn't even understand the "bubble" part of the question."

People are just in a state of profound denial typical of the end of an asset bubble:

"It's obvious that no one likes to hear comparisons between home prices today and the stock market bubble that burst in 2000. The obvious differences between real estate and equity shares duly noted, there is one undeniable and disturbing similarity, to wit: During the stock market bubble, traditional valuations did not matter to shareholders. Valuation matters only if you believe that the stock's price should reflect the worth (or value) of the company. But stock investors could have cared less about value. They were willing to pay outrageous prices because they believed a greater fool would pay a more outrageous price later on."

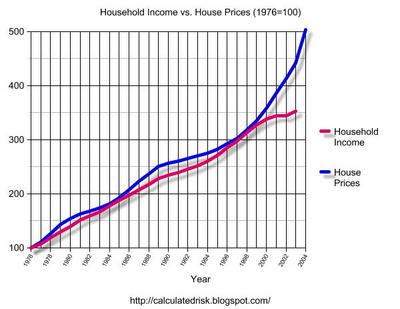

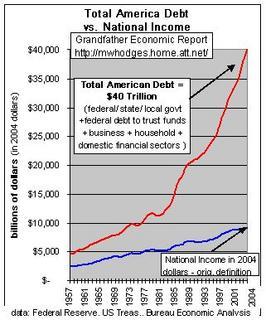

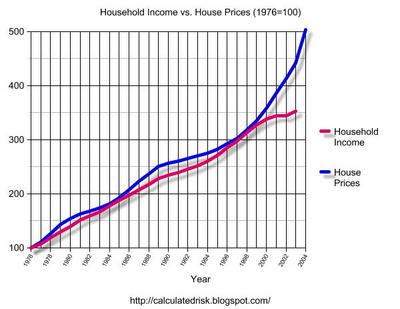

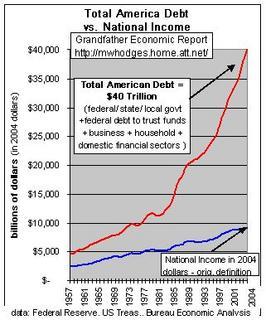

The argument that we are experiencing a housing bubble is nicely made by the following two graphics (

source of first graphic; I've lost track of the source of the second):

No comments:

Post a Comment