http://hollisterfreelance.com/opinion/contentview.asp?c=162499

What a bunch of wishful thinking, lies, and misinformation. Where to begin...?

1. Well, the article claims that the rate of foreclosures is not likely to increase significantly in California because "buyers who stretch themselves to the limit for their next move are unlikely ever to default on the new higher payments. For one thing, down payments are often so high that buyers feel there is no way they can walk away from their houses, no matter how onerous the interest, tax and insurance bills may become."

Huh? That doesn't even make sense. If you can't pay, then you can't pay. Period. It doesn't matter how big your down payment was. Besides, here in Marin and elsewhere in California you can rent the equivalent house for half of what it would cost you on a monthly basis to buy. Why buy and assume all the risk and cost (tax, maintenance, insurance) when you can rent? But I digress.

Second, according to LoanPerformance more than 60% of all new house purchases in California were interest-only loans with minimal to no down payment. This is a seven-fold increase since 2002. Nationally, the percentage of mortgages with interest-only loans is half the California rate. 82% of all real estate loans in the Bay Area are adjustable. Frightening. What happens when all those low rates convert to higher rates?

Third, we haven't seen anything yet. The reason foreclosures are still relatively low here in California is because people are "flipping" properties before their payments get too large. As the housing market and price appreciation slows and it takes longer and longer to sell (as is happening right now in Marin (but that will have to wait for a future post)), those increased mortgage rates built in to ARMs and IO loans will start to kick in. If people are not willing to lower their sale price to well below their break-even point, then expect the foreclosure rate to skyrocket in the near future. Otherwise, prices will drop precipitously (they are already falling in Marin). Although the fear of being priced out of a market is strong (and ridiculous as the way markets work is that prices cannot go beyond reach because if they did the market would self-destruct; markets are self-correcting entities; think regression to the mean), the willingness to postpone a purchase so as to get it for cheaper later during periods of falling prices is also very strong.

Fourth, roughly 40% of all houses purchased in 2004-05 were for speculative reasons (see below) -- second or third houses, vacation houses, etc. People are far more willing to walk away from such properties than the house they actually reside in.

Fifth, more than 40% of all mortgage loans in 2004 were of the "creative" type -- interest-only, zero-down, etc. With so little of their own, personal wealth committed to a property, the argument that people will resist selling so as not to lose their initial down-payment is erroneous.

2. Ok, the article says "When interest rates rise, housing prices will drop because buyers will no longer be able to afford the monthly payments, states a longstanding financial “law.” But the Federal Reserve Board has virtually tripled interest rates in the last year and real estate prices stay up."

This is just plain dishonest else the author is so ill informed as to wholly discredit himself. Here's why. The Fed only controls short-term interest rates, not long-term rates which are the rates that affect mortgage lending rates. In other words, yes, the Fed has tripled short-term rates but long-term rates have not gone up as expected (due to international buying of US debt, which is now waning; but this will also have to wait for a future post) so people are still able to get those crazy IO and ARM loans. The fact is that when long-term rates go up, mortgage rates will go up in response. When the mortgage rates go up the same loan will cost you more each month to service. Unless some new creative loan product comes out to counter the increase in long-term lending rates, selling prices will have to come down to the point where people are willing to pay them. Given that mortgage lending rates are at historic lows, their upside potential is far greater then their downside. So if mortgage rates change, bet on the side of their going up, not down.

3. Then there is the argument that demand is greater because the population is increasing. That is true of the state, but not the Bay Area. The Bay Area's population is actually decreasing due to job loss (mostly in the tech industry where many of the jobs have moved to other states and over seas). Didn't we just hear in the news that eight schools in a south bay county closed due to the massive reduction in the number of children? In other works, families are leaving. It's so bad that the Santa Clara school district had to resort to "teacher ghettos" -- low rent apartments only for teachers because housing is so unaffordable. The shame of it. But don't count on any action taking place in Marin as it has become a land of "not in my backyard" and "if it isn't happening here, then I'm not going to worry about it" mantailities.

There is also a shortage of first-time buyers. According to the California Association of Realtors, the percentage of Bay Area buyers who could afford a median-price house in the region plunged from 20% in July 2003 to 14% in July 2004; it is expected to be reduced by another 2% this year.

Further, according to the National Association of Realtors, 36% of all houses purchased in 2004 were for reasons of speculation and investment, not as primary residences. They were second or third houses, vacation properties, investments, for rental income, etc. According to two realtor friends of mine here in Marin, this number is more like 42% in Marin County. So speculation and investment are now driving demand, not population growth. This sort of demand is extremely tenuous as people are far more willing to quickly put such properties on the market. Thus, when the market psychology turns, expect a flood of properties. When the supply is so high, prices are forced down.

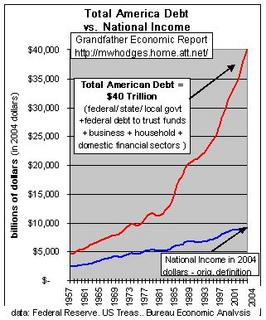

4. The article concludes with "and inland prices likely will keep rising indefinitely...". That's just plain absurd. Do the math. This can only be true as long as people's sources of income rise to compensate; incomes have most definitely not been rising:

Nor are savings increasing:

No comments:

Post a Comment