It is rare for a real estate agent to actually admit that maybe things in the housing market won't be as rosy as they have recently been. And it's usually laced with understatement and wishful thinking. But here in la-la-land, aka Marin, it's notable:

"'There are three things we have been seeing which make us believe that the market is calming down a bit,' says Perotti from his office in Larkspur's restaurant district. 'The price per square foot for a home is beginning to drop in Marin. As in the rest of the state, we are also seeing an increase in the average number of days a house stays on the market, which indicates the overall market is slowing a bit. The other thing is more of an educated guess, but you have to know that these interest rates will rise in the next year, and that move will take some buyers out of the market.'"

"The only segment of the market that has slowed is over $2 million. If it is $550,000 or under, it flies." [Last year, if it was under $900K it flew. So now it's if it's under $550K?! I have personally seen $2 million houses drop 40-50% both this year and last.]

"We are doing a lot of training with our staff right now, getting them ready for 'The Talk."

La-la land for sure:

"We are seeing a different buyer in the market now. They want the low interest rate, the low payment, but they don't really think about what it is going to take to pay it off. They just want into the market and seem to think that it is all going to work out."

Wishful thinking and denial:

"Most everyone agrees that the Fed will not raise interest rates any higher than a point over the next year; they are being very careful," he says. "And even anticipating a raise, there are still plenty of buyers out there who want to get into the market. At this point, I don't think a bubble is a concern."

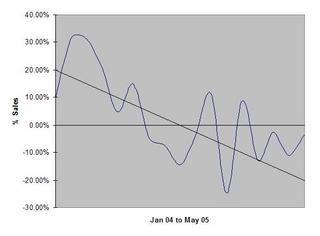

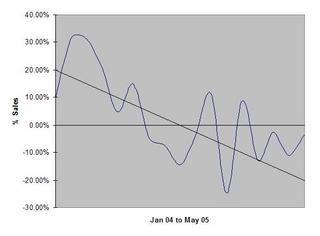

The first indicator of a local real estate market beginning to bust is a reduction in sales volume. Here's Marin County's for the last year (note: this is a real estate industry backed

report, so take it for what it's worth):

No comments:

Post a Comment