This graph shows "how strikingly out of step [real house prices are] with the business cycle":

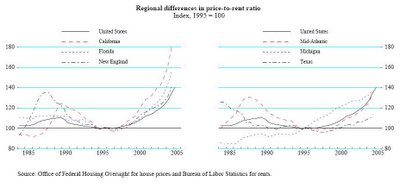

And this one showing price-to-rent ratios demonstrating how overheated the California housing market is relative to the nation as a whole as well as New England and Florida:

And this one showing price-to-rent ratios demonstrating how overheated the California housing market is relative to the nation as a whole as well as New England and Florida:

7 comments:

Wow. Cool graphs. It really is different this time. At least, for now. . . .

congrats on the mention in the paper. Super blog.

Saw the article in the paper and decided to check out your blog. Great information and all true. I've been arguing with my wife and her family on this exact notion and all they keep saying is that Marin's different. They aren't building any more homes.

But when you look at the data, its not the home owners getting rich off their houses, its the realestate agents, mortgage brokers, and banks that keep getting larger returns just by manipulating the values higher and higher.

Great analysis of the data

This blog got mentioned in a paper?!?! Which paper and what did they say? I hope they were nice.

Sheesh! I'm the last to know.

More great graphs - thanks!

The top one is scary.

Just for the record, I did not make those graphs; they are part of the PDF that my post points to.

Just wanted to be clear in case there was any confusion.

I'm glad people find value on this blog.

"They aren't building any more homes."

Actually they are building more homes in Marin; friends just bought one in San Rafael. Oh, and Marin's population is actually going down., as are many SF Bay Towns.

Post a Comment