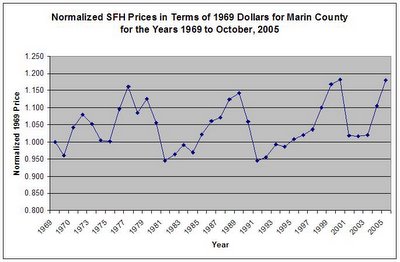

So I asked myself the question "Is it really true that single family house (SFH) prices in Marin don't drop?" The existence of inflation makes answering this question difficult -- something today will cost more in terms of the absolute number of dollar bills you have to pay for it than what that same something cost during a previous year. So what I did was to take each year's mean house price in Marin County, adjust it for inflation to what it would be in terms of 1969 dollars (the earliest year for which I have SFH price data), and then normalized all of the resulting adjusted SFH prices to the 1969 price level. Unfortunately, the government-reported core inflation rate is highly suspect of late (if you want to read about how wonky is the calculation of the Consumer Price Index, then search this blog for the relevant articles as it does a most excellent deconstruction of the CPI). Also, I am not a financial analyst or anything like that so if what I've done is conceptually flawed in some way, please forgive me and please tell me how to do it right. But this seems to make sense. Below is the result:

If what I've done is correct, then as you can see from the above graph, prices in Marin do in fact fall and have done so in a big way on at least four occasions since 1969. The largest price fall was roughly 20% and the quickest price fall was within a single year.

7 comments:

Well, you didn't hedonically adjust the numbers. If anything, that would push them down over time.

Of course the dry rot and other aging factors on Marin's realestate tend to work the other way, since each year the average age of marin housing stock is getting older (just like marins non-spanish speaking population).

The CPI data has lots of problems, that is for sure.

by_palladium -

I don't understand your point.

Of course the dry rot and other aging factors on Marin's realestate tend to work the other way, since each year the average age of marin housing stock is getting older

That's right...if you were anywhere around the big storm on Friday night, you'll know how the weather takes a relentless seasonal toll on your Marin home.

In fact, maintaining our home in Marin has proven to be far more work than our old home in Seattle.

Water Water and MORE Water...... all those Napa, Petaluma, and other properties UNDER WATER! Prior to the WATER you would that thought the only thing going up was the property prices in Napa and Sonoma!

NOW THIS! Good old Mother Nature sends a deluge to knock some sense into the arrogant heads of the CUTE CROWD! OUCH! One would have thought it would have been an earthquake.... In a way, water damage is so much more devastating to the VALUE of the properties.....

Such an event can color the perceptions of potiential purchasers...... AND IT WILL!

Those high prices just washed down the swollen rivers and creeks........

Sure, just like New Orleans, where speculation has gone through the roof and prices in nearby Baton Rouge have nearly doubled since Katrina. Or NYC, which has been on a tear since 9/11.

Natural disasters have only shown to be a temporary effect, if any at all. Prices continued to go up for another year after the Loma Prieta earthquake.

Although, this is a pretty forceful reminder not to buy in a flood zone.

You said the magic word: SPECULATORS! And as we all know, speculators have a tendancy to get burned..... or WET!

What put the pin in the Florida land Bubble of the Twenties was a devistating hurricane. It took time but it did the trick. The 1000+ flooded homes and businesses in Napa will look far less attractive than they did before the flood. Just imagine the twin joy of Flood and Earthquake insurance!!!!!!

Over time, what constitutes a "median" house is probably not the same, in terms of size or quality, so you may not be comparing likes across time.

For example, if all the "upgrades" that are made to these properties over time are cumulative, then one would expect the median price to increase by the "value added" of the upgrades. The other side of that process is a house as a wasting asset - the median house gets older every year when there is no or limited new construction.

So, net net, I am not sure which effect is greater.

Further, I am guessing that a 1979 median house is smaller and crappier than a median house of today. Just a guess, but new construction today is almost always better than new construction of 20 years ago. This effect would constantly move your median house price up...

Lastly, I need to review my CPI calcs, but I think that they include imputed rental value....I would have to think about how that would affect the picture.

At any rate, thanks for the calculation. One more piece of evidence that builds my case for not purchasing in marin.

Post a Comment