Ours is a nation addicted to debt as people have decided that it is the only palatable means available to them to live the high life without actually having to work for it and earning it for themselves; an accomplishment that they could call their own. It used to be that personal debt was shameful. Maybe the new bankruptcy laws will force personal financial ethics back on our culture.

Some choice qoutes:

Debt has become part of our culture, a product of a society bent on self-gratification now and future generations be damned. Like any cultural trend, we are constantly enticed to take part. From the endless pre-approved credit card offers that fill up our mailboxes to the home shopping shows' 'painless' lay-away plans, debt is easier and easier to incur. Wells Fargo advertised a credit card with an "easy-access" line of home equity credit as a way to help pay "for everyday expenses, like gas, groceries, clothes, etc," prompting a CNN reporter to observe that today, it is possible for Americans to "eat their homes."

According to PBS' "Now," personal bankruptcy filings increased 320 percent between 1980 and 2004. As I'm writing this, a baby born in America owes $26,000 dollars worth of national debt. Students graduate today with an average of over $20,000 in student loans and credit card debt, and those who borrowed to pay for a graduate degree come out of school with a median debt of almost $46,000 dollars--up 72 percent since 1997 according to Brendan Koerner, a fellow at the New America Foundation.

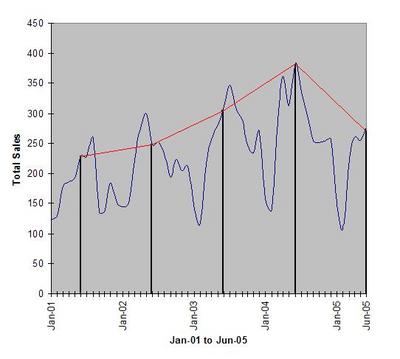

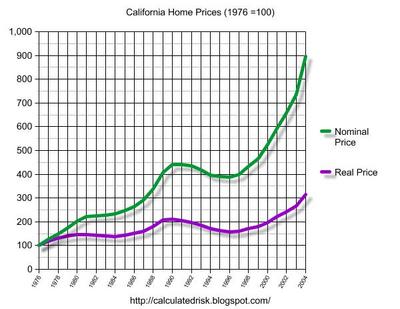

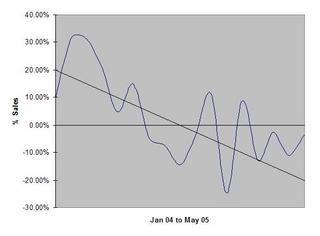

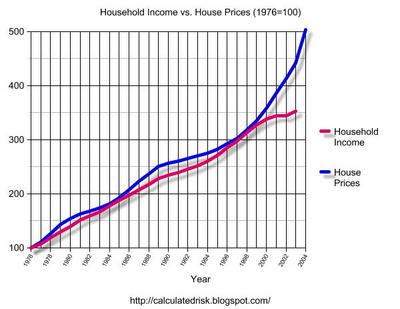

Part of the explosion of personal debt was fueled by mortgage refinancing as people cashed in on low interest rates. But as much as we hear about the real estate boom (President Bush often notes that more Americans own their homes than ever before), the percentage of equity we have in our homes is the lowest it's ever been.

Add to that a consensus that federal spending and perennial tax-cutting are keys to economic growth, with little regard to what kind of spending or which taxes are cut, and you get a perfect, self-reinforcing circle of bad fiscal policy.

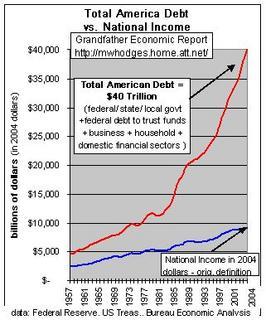

Budget deficits combined with a growing trade deficit and sky-high energy prices create a very real danger of an economic disaster looming on the horizon. Paul Krugman's been warning of this potential "perfect storm" for some time, but he's dismissed by conservative apologists as an "alarmist" and his calls for reform have gotten little traction. In the past year, though, he's been joined by such fringe leftists as the IMF--which warned in a recent report that America's fiscal situation could lead to a global economic meltdown. It's time someone talked about it.

People understand their own personal debts. They have wants and needs that exceed their paychecks, so they take mortgages on homes, accept a monthly car payment and run up their credit cards. But they believe that public debt is an abstraction for bureaucrats in Washington to worry about, if they're aware of it at all.

The relationship between the two begins with the fact that Americans make up one twenty-fifth of the world's population, but our consumer spending accounts for a fifth of the global economy. We purchase many more goods and services from abroad than we sell. That private consumption has remained high even as most of our wages have stagnated--meaning that it is increasingly financed with debt.

According to Business Week, overseas central banks now hold about a third of Fannie Mae's and Freddie Mac's debt. Those are government-sponsored agencies that give many Americans the chance to become homeowners, so it counts as public debt. But it's also entirely possible that China owns your living room.

It's all related. High budget deficits put pressure on interest rates. Millions of working families took second and third mortgages in recent years --we essentially spent and refinanced our way out of the last recession, and now those rates are slowly creeping higher, in part due to the budget deficit. That means that Americans will feel more of a pinch in their pocketbooks as the cost of servicing their debts increases.

Our debtor culture is an issue that doesn't fit on a bumper sticker or make for a pithy 30-second sound byte. What's more, on the consumer side you're talking about a tough, structural problem, with no easy fixes. Seventy percent of our economy is consumer-driven, and if folks started borrowing less and saving more, it would push us right into a recession.