There is an absolutely fantastic article over at Professor Piggington's that should be read by anyone interested in the housing bubble. If you read nothing else, then you should read this.

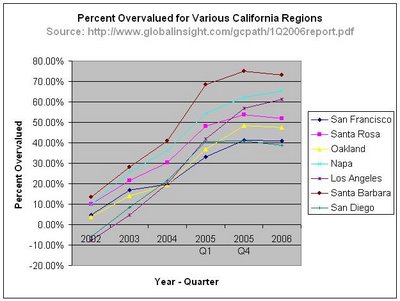

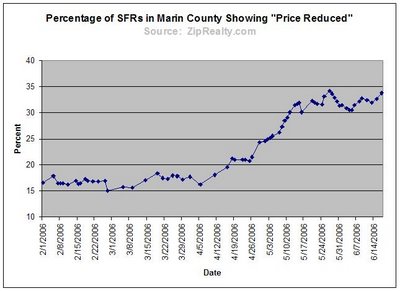

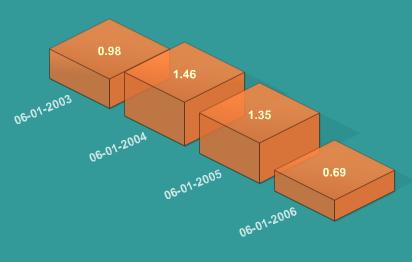

There is an absolutely fantastic article over at Professor Piggington's that should be read by anyone interested in the housing bubble. If you read nothing else, then you should read this.Basically, the article makes an excellent case for why the meteoric rise in prices in the housing markets of SoCal has been due to a classic speculative "bubble" and nothing else. The same argument can easily be made for the Bay Area in general and Marin in particular -- over the months I have produced many of the same graphs for Marin that you will find in the Professor's article and they all tell the same story (please check out the Marin Real Estate Data blog). Every argument to the contrary that you might have heard is debunked.

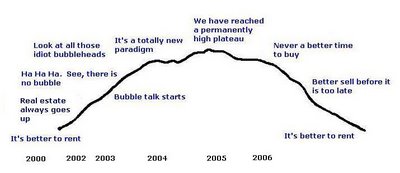

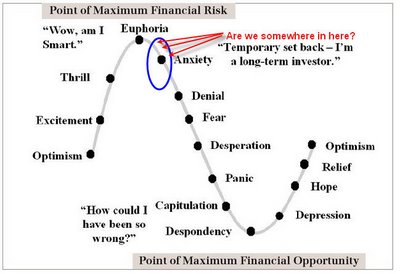

In the past five years, it can easily be seen, people have been willing to pay more and more for an owned home as compared to a rented home. Why? Because now, much moreso than in 2000, an owned home is now considered far more than just a roof over one's head. A home is seen as a way to get rich, and people are accordingly willing to pay that much more to buy a home. Given that there is no fundamental underpinning for the price increases of recent years, it is clearly this "speculative premium" that has driven home prices to their current levels.

When prices are high only because market participants expect prices to go even higher, that's called a bubble. And Californians have bought into this bubble with great enthusiasm.

And most importantly, as anyone who has read a newspaper or gone to a party knows, it has become a widely accepted fact both in the media and among the Southern California populace that real estate A) never goes down and B) is the place to be if you want to get wealthy. This entrenched expectation of huge, risk-free equity gains has become priced into the housing market.

Home prices have been driven to current levels not by fundamentals, but by ubiquitous optimism, a complete lack of risk avoidance, a staggering amount of debt accrual, low lending standards, an enormous increase in market participation, widespread misconceptions about what drives home prices, and an utter dependency on continued price gains. Southern California is experiencing a classic speculative bubble.