From The Chronicle (emphasis mine):

From The Chronicle (emphasis mine):Meanwhile, the decline in new-home sales in the Bay Area has been apparent in Contra Costa County, where the price of a new home fell 20.5 percent from $717,000 to $570,000 between October 2005 and October 2006, according to DataQuick.The article also mentions that in the Sacramento area new-home prices have fallen more like 33% presumably due to the greater supply there.

The market is strongest in the South Bay, where developers say they are offering few, if any, price breaks.

In both areas builders are saying "Buyers have all the power at the moment". At the moment? Buyers have always had all the power because they are the ones with the money.

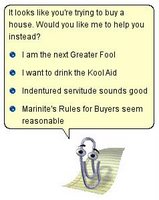

It seems worth reiterating Marinite's Rules for Buyers (with help from Athena in Sonoma):

- First, as a buyer, realize that you have the money and so you have the power. You dictate the terms of the deal.

- The asking price is not the price that you should pay. It's the price the seller hopes (for whatever reason) you will pay. It is the "wishing" price; the greater fool's price.

- Understand that the actual sale price is not determined by what the seller owes or by how much the seller wants to profit; the sale price is determined only by what you, the buyer, is willing to pay.

- Figure out how much that Marin house you are interested in cost five years ago when Marin was just as special as it is now, when the sky over Marin was just as blue, the beach was just as close, people wanted to live here just as much as now, the constraints of "no more land" were just as constraining as now, the weather was just as nice as it is now, the intangibles were just as intangible, and incomes were about where they are now.

- Adjust that price from five years ago by +25% to conservatively take into account five years of inflation. If improvements were made, adjust the offer price by how much those improvements are worth to you now, today and not by how much it cost the seller to put in those improvements. You are done; that's how much you should offer to pay.

- Don't worry about angry or so-called "insulted" sellers or even an embarrassed agent. Who the heck cares? It's not your fault if the seller overpaid for the house and/or HELOCed out most or all of their equity and don't want to sell for less. Why should you overpay just because the seller did? If the seller overpaid (or even squandered their equity), you are not obligated to do the same nor are you required to absolve them of their foolishness by paying off their debt. If they paid for their lifestyle with funnymoney how is that your problem? It’s not, so don’t pay for it.

One thing I can say for sure: If it was me out looking to buy a house in Marin today, I wouldn't even bother to consider a house that was purchased within the last five years or so. Why? Because anyone who bought in Marin in the last five years bought into bubble pricing and cannot cut their asking price to where it needs to be without selling for less than they owe. Such sellers will not negotiate and I wouldn't waste my time with them. The sellers who are willing to wheel-and-deal are the ones who bought more than five years ago (and presumably who also didn't extract all of their equity to live beyond their means). But that's just me.

7 comments:

Fwo favorite parts:

First, the graphic. I have no idea how you did that, but I really got a kick out of it! Hahaha!

Second, this line:

The asking price is not the price that you should pay. It's the price the seller hopes (for whatever reason) you will pay. It is the "wishing" price; the greater fool's price.

Exactly.

oh, fred -

In a way, in Marin anyway... they already are "regulated by the government"!

I'm thinking NIMBY'ism, backed by restrictive growth laws - those certainly keep home prices "regulated" (higher).

fred -

I've had to promise myself not get drawn into another one of your black vs. white, you vs. me sorts of arguments. But this yields a good opportunity to make a point of how screwed up this whole thing is.

You see, if you consider all the tax breaks, the GSEs, etc., all government sponsored...there already is government regulation. The housing market, even Marin's, is anything but a free market.

Mish, in his blog, says it best:

...We do not have a free market here, not with 300 government programs promoting housing. The free market did not cause this housing bubble, stupid government policies did. There should not be a Fannie Mae or a Freddie Mac for lending institutions to dump mortgages on. There should not be a HUD guaranteeing below cost mortgages. There should not be programs as there are in Illinois guaranteeing low cost loans to illegal aliens...

Here is the link:

http://tinyurl.com/y54d6b

Scroll down to the part entitled "The Role of Government".

You just refuse to get it, don't you fred?

And to push it just a litter farther...I would love for nothing more than to see the housing markets return to a state in which one's earning power and one's ability to save money determined what one could buy in the way of housing, when those indicators of financial responsibility determined how much money you could borrow. I'd like to see all the tax breaks for housing go away and I'd like to see the taxation of houses go away too. Let houses be bought and sold like anything else and taxed no differently. That way, housing would be more directly tied to what one earns and people would be less inclined to buy houses for speculative reasons.

Granted, the above just skims the surface of what I am thinking and it is easy to poke holes at it given the superficial treatment I just gave to it above, but you get the gist. I'd like to see all the socialist aspects of the housing market stripped away and for the markets to return to that good 'ol, red blooded, true-blue American spirit of free markets returned. But that takes my blog into territory that I never intended for it to go; it gets too political.

Too political? When mexican invaders are provided social services while american soldiers protect the borders of Korea how can anything be too political?

One cousin crippled by a drunk mexican driver and another blown up in Iraq. How rude of me, I might have become too political disturbed someone in Marin.

The article also mentions that in the Sacramento area new-home prices have fallen more like 33% presumably due to the greater supply there.

Not surprising, given all the acres of McMansion tracts I've seen sitting in the middle of the Delta along I-5 with nothing else but rice fields clear to the horizon. All of them empty -- like leftover sets from Over the Hedge -- except for billboards touting "INVESTMENT REAL ESTATE!!!".

I have found that if you play the house owners off against themselves you should be able to get up to 20% discount on the final price for a property.

Anyway a good informative article, and one of the best ones that I

have researched. I have bookmarked this blog for further browsing.

Share your information at YourBroadcaster - Creating, Writing & Collaborating.

Post a Comment