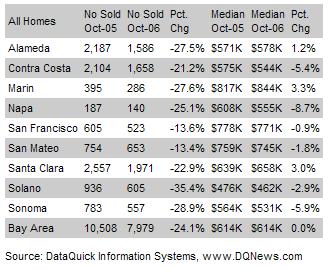

One thing I'd like to know about the above data is how is it that for 6 out of 9 Bay Area counties the YOY percent change in the median price is negative yet for the entire Bay Area it's 0%? Something doesn't add up.

One thing I'd like to know about the above data is how is it that for 6 out of 9 Bay Area counties the YOY percent change in the median price is negative yet for the entire Bay Area it's 0%? Something doesn't add up.Anyway, here is the price "appreciation" history, based on data like the above, according to DataQuick:

This is what DataQuick had to say about their results (emphasis mine):

This is what DataQuick had to say about their results (emphasis mine):Bay Area home sales held steady at a five-year low in October as buyers and sellers circled each other in a game of wait-and-see. Prices remained flat...And here is what the surprisingly candid Marin IJ had to say about DataQuick's results (emphasis mine):

A total of 7,979 new and resale houses and condos were sold in the nine-county region in October. That was up 0.9 percent from 7,907 for the month before, and down 24.1 percent from 10,508 for October last year...

Last month's sales count was the lowest for any October since 2001...

"The market is in the midst of its post-frenzy rebalancing phase. The sky is probably not falling, as some have predicted. But there will be those who bought near or at the peak, and who could find themselves in financial trouble if they need to sell and move sooner than they had planned," said Marshall Prentice, DataQuick president.

Indicators of market distress are still at a moderate level.

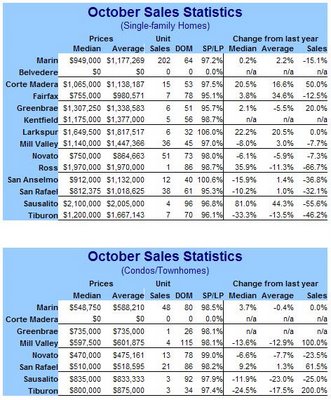

The median single-family home price in Marin County rose slightly in October, reflecting a housing market that was stagnant but at least not declining, a leading research firm reported Wednesday.So according to the Marin IJ YOY SFR results for September were down -3.3% and were flat YOY in October. Thus, the only reason DataQuick can report Marin being up 3.3% in October is because condos were up YOY in October by 4.2%. So in other words, if you were trying to sell a Marin SFR in October you were probably bumming unless you were selling one of the nicest of the nice in the nicer locations.

The median home price was $915,000 last month, compared with $914,250 in October 2005, according to DataQuick Information Systems of La Jolla. Single-family home prices in Marin declined 3.3 percent from September 2005 to September 2006.

Median condo and townhouse prices in Marin rose from $530,000 in October 2005 to $552,000 last month, DataQuick reported. That represented a 4.2 percent year-over-year increase, helping to pull Marin's overall real-estate market up 3.3 percent.

…

[Patti Cohn, a broker with Frank Howard Allen said] "It's [the Marin RE market] turned over. We're probably going to be [in] a flat cycle for several years, but at least it's stabilized and buyers can feel confident it's not going down any more."

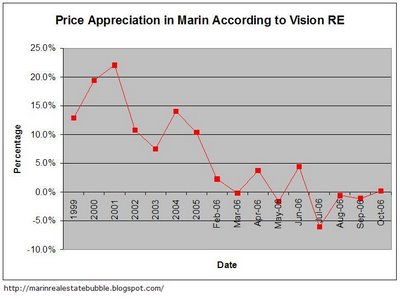

Ok, moving right along...here are Vision RE's results (a subset of the overall Marin market):

And here is what Vision RE had to say about their results:

And here is what Vision RE had to say about their results:Home Sales Bounce Back in OctoberNow, is it just me or is Vision RE trying to claim the opposite of what DataQuick and the Marin IJ are saying? And are terms like "bounce back", "rebounded", "so much for...", etc. really what a sane person would use? I'm sorry, but I think Vision RE has hit a new all-time low for shameless, unabashed public relations-isms. If it were not for the fact that Liz McCarthy now works for them I'd have lost all respect for that organization. But I am grateful that they publish their data, such as it is.

So much for the "seasonal" slow-down! Home sales gained 24.7% over an abysmal September. Year-over-year, home sales are off 15.1%, and year-to-date sales are down 18.8%.

The median price for single-family homes also rebounded in October, gaining 6.6% to go back over $900,000. The median price is now 0.2% higher than last October. The average price for homes fell 4.5%, an annual gain of 2.2%.

Condo sales plummeted 14.3%, but were flat compared to last year. Condo prices also fell with the median price down 0.3% to $548,750 and the average price dropping 1.1% to $588,210.

Just for fun, here are the YOY percentage median price "appreciations" for all of Marin County from Vision RE's own tabulated data (which I save each and every month). When I had a whole year's data I show that whereas for 2006 I switch over to monthly data (and no, I am not hiding January, 2006's data; I just don't have it for some reason):

Now that (the above chart) is pretty dang pathetic if you ask me. That is Vision RE's own data! I mean, this is Marin after all, MARIN! I think a more somber tone is more appropriate than their upbeat wording.

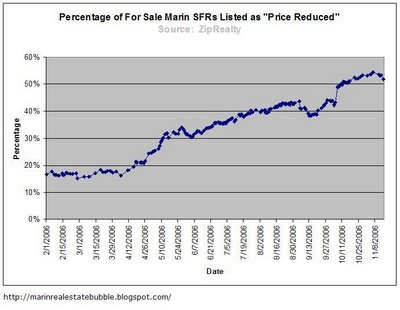

Now that (the above chart) is pretty dang pathetic if you ask me. That is Vision RE's own data! I mean, this is Marin after all, MARIN! I think a more somber tone is more appropriate than their upbeat wording.And lastly, here is my historical chart of the percentage of SFRs advertising "price reduced" care of ZipRealty:

Looking at this overall, it seems to me that there was some pent-up demand last month as people were not sure about the Marin market and so held off buying. But they came in at the last moment before the holidays. Sales were way off again YOY (how many months in a row is that now?) and that excess inventory will likely be added on to the market next year in addition to the "normal" inventory that one can usually expect. And lastly, for an economy that we are told is doing just fine, inflation contained, salaries and wages on the rise, jobs aplenty, mortgage rates are still low, suicide loans (which we here in the Bay Area are so dependent upon) are still widely available, and everything is essentially peachy-keen economy-wise, then why are the housing markets in the Bay Area faltering? Why are foreclosures way up?

5 comments:

A one-month "rebound" in sales does not a trend make. And sales are still off versus YAG and prices are flat lining. This will take time. Today's headline in the SF Chronicle was downright scary: "Home Sales Plummet." And further burried in an article about the state's budget woes was a nugget about housing weakness and how the gov't is projecting it will last for a few years, based on previous RE busts. Also not reassuring, but I'm sure most readers never saw that today.

I really believe that once people digest the fact that 15% or 20% annual appreciation is GONE, these prices will seem more and more insane. Foreclosures are up, and banks may start tightening standards on their own accord, as they have to "buy back" failed loans. The pool of buyers will shrink further.

We've gone from raging sales and huge appreciation to a slump in about a year. 2007 will be the year of reckoning.

marinite asks:

"One thing I'd like to know about the above data is how is it that for 6 out of 9 Bay Area counties the YOY percent change in the median price is negative yet for the entire Bay Area it's 0%? Something doesn't add up."

******

I didn't look at the data too closely, but I think it is because the two largest market segments by volume of sales, Santa Clara (2,557) and Alameda (2,187), were up in price... though not by much (3% or so and 1-something % respectively).

Contra Costa, at number 3 in volume (2,100 or something) was down 5.4% and all the others were smaller than CC County by at least one half (again, in volume).

sf jack -

Thanks.

I'm loving the life here in Marin living in my beautiful home in a high end area since 1991. Don't really think or care about the value since the quality of life takes top priority. Of course it doesn't hurt that the value has appreciated more than I could ever imagine (4 fold increase at least) but since I never plan to sell it is somewhat irrelevant . ENJOY!!!!

Marinite, you're not really forecasting a 40% drop in prices, are you? No one else seems to be going that far, and that's UK, not US.

Post a Comment