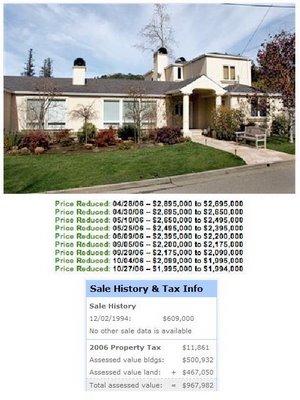

The above listing languished on the market for well over 200 days. It was then taken off the MLS, relisted, and it's new DOM statistic now shows less than a week. The sellers are currently asking $1,895,000 -- $1,000,000 off the original asking price -- a 35% reduction from the original asking price, and it still hasn't sold!

When this house was taken off the MLS and then relisted, it appeared as a brand new listing, its DOM statistic reset, and it's pricing history was effectively erased to all but the most inquisitive people. Shouldn't the pricing history of such houses like this one be made easily available to anyone thinking of buying a house? Isn't this pricing history useful and relevant information to buyers? Can this (resetting the DOM statistic, that is) be considered a long-entrenched form of fraud or at least deception? When will the buyers' interests be more fairly represented in this pro-seller system of buying and selling houses that we have?

So which is it? A new listing or a 233 DOM listing that has gone stale?

Bottom line: Until we have a system that treats buyers' interests equally to those of the sellers', if you are thinking of buying a house in Marin, do your homework first. All the information you need is on the Internet (as reviewed elsewhere on this blog):

- Find out how long the house you are interested in has really been on the market.

- Find out what its real original listing price was.

- Find out how much the sellers owe on the house and if you can, what kind of loan(s) they have.

- From the above you can determine how much the sellers can really afford to sell the house and how desperate they are.

- If what you think is a reasonable offer is below the seller's break-even point, don't make an offer, just move on. There's plenty of inventory out there and Marin sellers are still in denial and feel entitled to their asking prices.

The more information you have, the better you can make an informed decision.

Thanks to the reader who sent this one in!

26 comments:

A realtor told me this past week that if a house is taken off the market for at least 30 days and then relisted, then it's considered a new listing. If it's less than that, the old listing will be revived. Finding out about the prior listing/pricing can be tricky, but worthwhile.

Finding out about the prior listing/pricing can be tricky, but worthwhile.

If you don't have the previous listing, sometimes it will turn up in Google's cache. It would also be cool if someone developed a site that regularly pulled all the online mls data for a locale and stored it for later research. I bet there would be a market for that info.

Marinite,

For us less savvy people, could you do a post that shows how to find on the internet (which sites) the relevent information on a house one is considering buying.

Look up the address on Zillow.com, Domania.com, ZipRalty.com. From those sources you can get pricing history, sale history, tax history, etc. There are other such resources online.

For Marin, go to the recent sales data at Vision Realty's web site (was West Bay RE). For other areas, find the equivalent.

There are various pay-for services that can be used to get loan information. For various reasons I cannot recommend one. But for the trivial fee that they require it is money well spent considering it will save you 10s if not 100s of thousands of dollars.

caddis, if you are reading this thread, perhaps you can enlighten readers on how to get loan info for an address.

Also, I forgot to mention that the Marin Assessor's Office has loads of info. But it takes them a long time to update their site. You can physically visit them and request the info.

www.ziprealty.com

www.zillow.com

www.domania.com

http://westbayre.com/frame_main.htm

http://www.co.marin.ca.us/depts/AR/main/Sales.cfm

Thank you.

Shouldn't the pricing history of such houses like this one be made easily available to anyone thinking of buying a house? - DOESN'T MATTER

Isn't this pricing history useful and relevant information to buyers? Can this (resetting the DOM statistic, that is) be considered a long-entrenched form of fraud or at least deception? - YES IT IS, AND PROBABLY VIOLATES THE COMMISSIONER'S RULES AS WELL.

$1,000,000 off the original asking price

"Ladies and Gentlemen...In one corner: desperation, and in the other: Schadenfreude...are you ready to rumble?!"

It certainly would be nice to know the history of every MLS offering. However, absent this information, we still have the basic Marinite formula which determines how much a house is worth.

Take the value of the house as of 2001 and multiply this figure by 1.3. This formula uses a starting time which is pretty much pre-bubble and then allows the traditional yearly appreciation of inflation plus 1%.

I found a Mill Valley cottage, which Zillow says is worth around $2.9 million today, but was worth $1.6 million in 2001. If the 2001 value is multiplied by 1.3, today's value should be around $2 million, give or take -- mostly take -- a few hundred thousand. The formula seems to be more accurate when used on houses whose current bubble value is under $1 million.

This appears to be how the house in the example started out at $2,895,000 and then followed the market down for 7 months to $1,994,000 with further reductions sure to come. The bottom line is that a house is worth only what someone is willing and able to pay for it.

"Take the value of the house as of 2001 and multiply this figure by 1.3. This formula uses a starting time which is pretty much pre-bubble..."

There's a conservative formula. Of course, anyone who was around for the dot-com boom also knows how much Bay Area real estate skyrocked before '01. We thought prices were outrageous back then, and I now find it hard to calculate the instability of current prices. If this Kentfield example suggests anything, there's a huge gulf between seller expectation and market reality. Reduced by $1M and no takers? Wow.

Great tips. The 5 things you suggest doing are right on the money, and it's what I help buyers do before we write the offer. I don't know if I've ever laid it out so crisply, so I might throw a link back from my blog this week.

Good post.

Sure! I pay for my information though Dataquick. I'm in the business so the ~$150 per month I spend is worth every search. But...You could go to the Recorders Office at the Civic Center and look for Trust Deeds. These will be the loans that are attached to the property... or deed. Because I like to dig ( and it's my cash I'm spending ) I typically chain title back to the last recorded Trust Deed. Then I work forward. Looking for Trust Deeds & Reconveyances. The Reconveyance cancels out Trust Deeds, then a new Trust deed is put in place...Typically a much LARGER Trust Deed. Marin has a website you can go to if you have the name of the person on title, you'll get the title of the document but cannot view it unless you're at the recorders office.

Caddis

Repo4Sale - Aside from shameless self promotion, your posting is of no value at all. You cite no data whatsoever to support your conclusions about value. No one credible anywhere that I know of is forecasting such huge drops in prices. Perhaps there's a reason why you're an X so many things. Couldn't make a go of it in any profession, eh? Your promised profits speak to times past - investors beware!

Marinite: he's promoting his sketchy investments and his comments should be removed, yes?

anon 7:27,

Yes, of course. They have been deleted and all such posts will be deleted when I find them.

Saw an interesting offer in Ross Valley this weekend. There were a ton of little signs up on SFD saying something along the lines of

"Auction this weekend. Home will be sold to the highest bidder on Sunday night. Inspections Sat-Sun 10-5"

Not sure if it was a scam or desperation or a brilliant marketing ploy. It stood out though.

Auctions are being tried in other bubblicious markets with mixed success.

Home will be sold to the highest bidder on Sunday night.

A clever angle to revive bidding wars in late '06. Of course, setting a marketable reserve price will be critical to their success. It won't be easy to push through a quick sale in today's market. This particular Kentfield home could be seen as a protracted bidding war down.

$1&2M Mill Valley cottages were $130K and going begging in 1992. You have to take your rate of inflation plus 1% from there IMHO.

of course you also have to factor in something for the improvements since then...

hanks marinite! I look at the money end of it as a loan broker,and believe one factor that will have a larger effect than most sales agents expect is the availability of money for real estate loans.A very large percentage of the $ fueling this boom has come from hedge funds and private investors.this is "hot" money,and it can and will go to some other form of investment in a hurry.i have seen credible estimates that show that without the carry trade traditional 20% down 30 year fixed loans would be at 12%,which in my judgement would appropriately reflect the risk,assuming a credit score of 720 plus,and solid employment.hard money loans are now 15%,at 50% ltv,with 3 points.

Hmmmm...

This houe seems to have been pulled off the MLS.

Wonder why?

some sucker fell for the relisting... as the house went into escrow. I wonder if they figure out that they didn't buy a 'hot' new listing - but got duped by an MLS trick!

This house was soooo overpriced to start with it was ridiculous!!! I actually showed it to a client (silly me as I hadn't seen it first), it was touted as an "estate" and it is so far from an estate. It's on a very busy corner, with a tiny lot, the pool is nestled in with hardly any other space at all.

I agree with you Marinite, that the overall DOM should reflect the TOTAL time a property has been on the market. A good buyers agent should be able to help show a buyer the real stats behind the house before putting in an offer - so who are the seller's agents kidding when it's pulled and then relisted! come on!

I know I always look up the entire property history for my clients to show the entire time a house has really been on the market and give them all the data upfront so they can make an informed decision.

Liz McCarthy

I know I always look up the entire property history for my clients..."

Liz, that's admirable...there should be more people like you. Eventually there will be enough homeshoppers adept at collecting data that agents cannot pull the reset DOM trick.

"it was touted as an "estate" and it is so far from an estate"

LOL...another Marin home pretending to be something it's not. It becomes all the more ironic when many far better homes in this price range. It must be that "I live in Kentfield, which is the next best thing to Ross" mindset.

"Liz, that's admirable...there should be more people like you."

Which must be why her's is the only web site that is listed in the links section of this blog.

Post a Comment