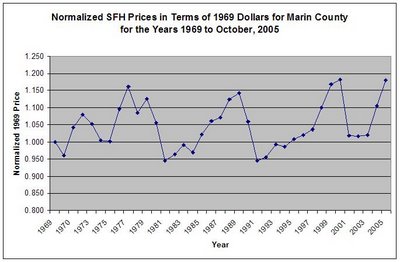

At some point in time during the last few years real estate prices became unhinged from their fundamentals (rents, income, etc.). People willingly paid what they knew, either consciously or not, were ludicrous prices for houses for no other reason than the belief that prices would continue to increase and, if worse came to worse, they could always sell their overpriced asset for more than what they paid; there'd always be some "

bigger fool"; right? At least, that's how a lot of people rationalized it to themselves. Friends and relatives saw other friends and relatives seemingly making money and so they wanted a piece of the action too and dove into the frenzy with full gusto. Never mind the fact that higher prices only benefit people who are willing to sell and then either buy down, move some place less expensive, or rent... or people who were speculating with something other than their primary residence. This cycle was repeated over and over and fed back into itself with the final result being that real estate entered into a speculative mania seemingly with a life of its own. I think we can now all safely say that the real estate market is in fact a speculative financial bubble the likes of which the world has never seen.

The main stream media were there front and center fueling the hype by publishing a disproportionate number of articles that reinforced what people wanted to believe and what their sponsors wanted people to believe; no care was given to the risk people were taking nor to the cost to society. Prominent RE talking heads with seemingly impressive credentials, like David Lereah (who is labeled as "chief economist" of the National Association of Realtors but who, IMO, is more properly labeled as "chief salesman" for the NAR), gave seemingly rational reasons for why the mania made sense and why everyone should be jumping into RE without asking questions -- debt is the new wealth, so don't worry about it; if you paid off your mortgage then you were doing something wrong. No one bothered to point out that such people have a vested interest in promoting that particular point of view. Lereah even published

three books to make his case (the themes of which seem to change as the housing situation changes) and to make a few extra dollars for himself -- "

Are You Missing the Real Estate Boom?: The Boom Will Not Bust and Why Property Values Will Continue to Climb Through the End of the Decade", "

Why the Real Estate Boom Will Not Bust -- And How You Can Profit From It", and more recently "

All Real Estate is Local: Why Understanding the Housing Trends in Your Area Is Essential to Building Wealth". Leslie Appleton-Young (chief economist of the California Association of Realtors) was there too spewing the self-interested party line. Even your local realtors and agents were there saying the same things. Everyone in the entire RE industry was doing what they could to bolster what they wanted you to believe. Everyone was gambling and everyone was making money and so who cared? It's different this time, right?

And as long as prices kept rising, it all made sense; it worked, at least for those willing to play with fire.

And so here we are. I ask you, what is worse...that prices fall to levels that make sense in terms of fundamentals, such as income, or that they stay where they are at the utter extreme of unaffordability for many years to come?

***

I was out walking today. I sat down at the side of the trail and wondered to myself why I started blogging. I wondered why do people care whether or not I stop blogging or even slow down? Why did I start blogging anyway? I certainly didn't start out wanting to be a blogger. The last thing I want is notoriety or fame or public attention. And I don't entertain grandiose notions that I can actually affect the course of the housing market. As one callous reader said, any inane person can start a blog. I'm not a particularly good writer and I certainly don't have profound insights like some of the bloggers over in the right-hand margin of this blog (e.g.,

Mish,

The Mess Greenspan Made,

Charles Hugh Smith,

iTulip, and too many others). Nor do I have access to privileged data. I guess I was a bit disturbed by the fact that my blog (and many others) was recently

mentioned in

SFGate. It's just that like a lot of people, I woke up from "the Matrix", questioned my assumptions and what the so-called experts claimed as the truth, spent a lot of time collecting the data that the RE industry doesn't want anyone to have access to, and wanted to share it. And the fact that I owned property during the last RE bust and lived through the

Bizzaro World that was the NASDAQ stock bubble didn't hurt either. Someone once left a comment on this blog (or was it an email; I forget) that said that I was the only rational voice in Marin. Ha! I'm sorry, but no, there surely are a lot of people in Marin who see the absurdity of our RE market but who just kept their mouths shut. I started blogging because I wanted to share what information I had and because I wanted us to return to a world where houses are seen as places to live, to raise a family in, and not as objects of speculation or an ATM. I want to again live in a world where a person does not have to earn a top 10% income to even begin to hope to afford a median (or is it now less) priced house in a run-down "working class" neighborhood. My esteemed (and opinionated) fellow blogger, Keith of the Housing Panic blog,

said it well:

I want an America where a young couple out of school can save for a down payment, take out a 30-year fixed, and for a reasonable share of their monthly income buy the house of their dreams again. A place they can raise a family, and make a home.

I don't ever in my lifetime ever want to see people treating houses as get-rich-quick lottery tickets. I'm sick of watching over-consuming Americans, and their obsession with physical things, and how they look to others.

In a way, I am proud to have taken a stand. This real estate bubble will be talked about and analyzed for generations to come. It will be one of the prominent text book case studies in future economics courses. It may even be a defining moment for us as a society. Who knows?

***

There is now a

propaganda war being waged by the real estate industry. I am not going to go to a lot of effort to prove it to you but it's true all the same. As just one (glaring) example: the National Association of Realtors has been waging a

propaganda campaign for some time now with the sole purpose being to get buyers to come back in to the market and start buying again.

I ask you, if house prices are justifiable based on sound economic fundamentals, if incomes are rising, inflation contained, the economy is doing just dandy, if people are moving here in droves and they aren't making any more land, then why is it necessary to appeal to emotions and popular mythical talking points to get people to buy?

This is what our own Peter Sealey of the

Sausalito Group, Inc. had to say about the NAR's latest propaganda campaign:

"It’s preaching to the choir and goes in the face of objective reality"..."‘I predict it will have zero effect on the marketplace."Some RE professionals are even

blaming buyers now for their RE woes.

And as a reaction to bloggers, many RE professionals have suddenly become hip having discovered blogging which, after reading quite a few of them, seem to be nothing more than a new attempt at "spreading the faith", to promote their pro-sales talking points. And never mind that comments made by readers who disagree with the RE-affiliated blogger are generally deleted.

Even the

Marin Independent Journal now has a real estate blog that is run by the Marin Association of Realtors. There you will find all sorts of reasons for why Marin is special, different, and immune to price declines...the data be damned. There you will not find any mention of facts such as that this speculative mania in housing was fueled by loose lending standards and a seemingly endless pool of credit all of which is agnostic to location. And if ever there was reason to believe that the Marin IJ is in bed with the local real estate industry, that the IJ is the local RE industry's poodle, then its allowing itself to be an exclusive forum for industry blogging has got to be it.

The fact is that realtors are hurting; buyers are no longer buying at a rate that supports their commission-based income. In general, most of them don't care about you, about whether you can sell for a profit, about whether you can really afford that suicide loan. They don't give a damn about declining affordability. They care only about their commission and to get that commission, a sales transaction must be made. You see, the RE markets are finally changing. Buyers seem to be finally, slowly waking up from their debt-intoxicated slumber and are realizing or finally admitting to themselves that it no longer makes sense to pay ludicrous prices for houses; why take on insane amounts of debt when houses aren't appreciating at a rapid clip anymore? When the time comes to sell because of some change in one's life circumstances, how can the debt be repaid during the transaction? And so buying has slowed down and realtors and agents are whining about it. Hence, the propaganda campaign.

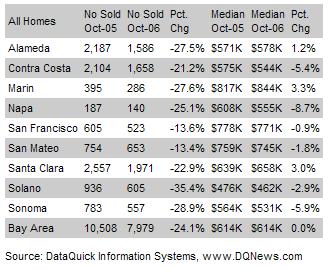

Real estate markets in the "bubble zones" are stalling/falling from their own weight. They are not falling because of rising mortgage rates (they are still relatively low). They are not falling because lenders have finally grown a conscience and are tightening lending standards (such tightening is still a "work in progress"). They are not falling because the rates on ARMs are resetting (only the first wave is resetting). They are not falling because suicide loans are no longer popular and, frankly, a necessity (something like 80% of loans last year here were some form of suicide loan). No, the markets are falling because prices have gone so far beyond absurdity that they are at last exhausting themselves. Just imagine what will happen when mortgage rates do reach significantly higher levels, when lending standards really are tightened, when ARM rates reset en mass.

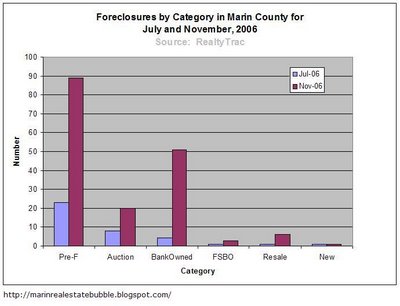

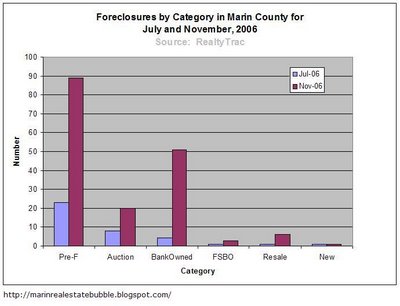

Below is a graph showing the number of properties in some stage of foreclosure in Marin -- like the

rest of California, there has been a steep increase in foreclosure activity. The data for the following graph comes from

RealtyTrac. Unfortunately, I only have the RealtyTrac data broken down in this way for July and November of 2006; it didn't occur to me to start collecting this data in a more systematic manner until recently. I will now be collecting this data on the first day of each month so as to track Marin foreclosures as rates begin resetting and Marinites struggle to sell their over-priced POSs at their break-even point. I should also say that these data are consistent with the

Marin IJ's report in late October where the headline read "

Foreclosures Spike in Marin".

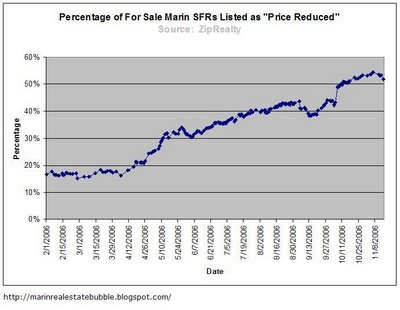

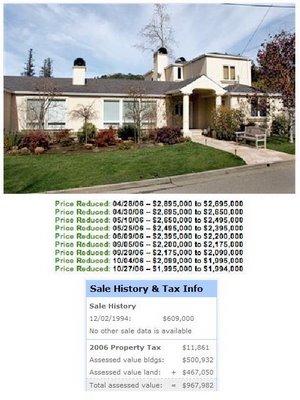

According to ZipRealty SFR inventory is about 35% above normal for this time of year and 54% of all SFRs currently on the market, more than half, are currently advertising "price reduced".

And so is this what we have to look forward to? People losing their homes, ruined credit ratings, going into bankruptcy just because we have an RE industry that is engineered to push prices ever higher? An industry that sides with the seller with almost no representation of the buyer's interests? Is this right? I only hope that when the pain reaches its maximum that there will be some meaningful effort to restructure and regulate (or something) the RE industry so that it fairly balances the interests of both buyers and sellers.

***

I wanted to work these quotes into the above post somehow but couldn't. I think they are quite telling, as relevant to Marin as any other housing market, and so worth reproducing.

The first is from the

SacBee:

“Real estate agents have spent much of the year complaining that homeowners were in denial and refusing to cut their price despite daily evidence to the contrary. Many are still resisting. (Broker) Mike Lyon says the market may decline another 10 percent, and still sellers aren’t convinced.”

“‘About half the sellers are out in la-la land,’ he says. ‘That’s better than before. Half are serious and are starting to reduce their price. I still think only 10 to 20 percent of the market is priced to sell.’”

“That doesn’t surprise Barry Schwartz, professor of psychology and economics at Pennsylvania’s Swarthmore College, who has studied the issue. For most people, he says, the joy felt when investments such as housing gain in value is greatly outweighed by the pain felt when those same investments lose money, even when the loss isn’t real at all.”

“‘If the baseline is their initial asking price, then people are consigned to misery,’ Schwartz says. ‘They will feel their loss on what’s probably the best single financial transaction of their lives.’”

“One huge issue that most sellers don’t pay attention to: New-home builders are exempt from such personal distress. ‘They have the ability to discount more than you do,’ Lyon says. ‘They look at it more from a business sense, and it’s easy for them to cut prices because they’re not in love with their homes.’”

The other is from SF

Chronicle:

“The number of permits issued for new-home construction last month tumbled in California, the most-recent piece of statistical evidence to show that the housing market has turned sour. Builders received permits for 11,590 homes, including houses, apartments and condos, in September, down 47 percent from a year ago.”

“More than half of the decline in permits issued statewide can be attributed to a decrease in construction in Southern California, particularly in San Bernardino and Riverside counties outside of Los Angeles, as well as in Sacramento and San Diego.”

“New housing permits in most of the Bay Area also declined. New construction permits in Alameda and Contra Costa counties fell 42 percent compared with a year ago, while new starts in San Francisco, San Mateo and Marin counties dropped 71 percent.”

“‘The first and sharpest corrections are always in new homes, because existing homeowners have the option of waiting and they are wedded to the price their neighbors got,’ said Stephen Levy, director of Palo Alto’s Center for Continuing Study of the California Economy. ‘New homes have a high carrying cost and developers need to move that inventory.’”

And this one on seller and buyer psychology (from psychologists and psychiatrists no less) found

here on Ben Jones' blog is priceless (underlining mine):

“Behavioral economist say that those involved in real estate are not immune to the same pressures and need for conformity as, say, high school students sporting pompadours in the ’50s, love beads in the ’60s and platform shoes in the ’70s.”

“Real estate elation, too, inevitably faded, and fear now drives people’s actions instead. In this new era, nobody, it seems, wants to be the first on the block to lower their price, to be first among their friends to leap into a purchase. It’s in real estate, psychiatrists and economists say, that interesting psychological dynamics come into play. Terms such as ‘denial’ and ‘loss aversion’ begin to fill the notebooks of industry watchers and shrinks alike.”

“‘In a changing real estate market, buyers and sellers freak out and come up with their own strategies, which actually affect the market,’ said Christopher J. Mayer, a Columbia Business School economist. ‘Buyers waiting for prices to bottom out can cause prices to drop, and in the ’90s that led to a recession.’”

“So far, there is no recession, economists say, but there are signs of buyers and sellers slipping into well-worn psychological patterns, following their neighbors’ advice instead of solid economic fundamentals.”

“Once in, overextended buyers often become victims of ‘bubble thinking,’ said psychiatrist Richard Peterson. Buyers gamble that the value of their homes will increase, even if they’re losing money every month due to negative amortization loans and lack of equity actually accruing.”

“Sellers are another story. The word ‘denial’ must have been created for them, psychiatrist Peterson said. As applied to real estate, denial is a condition in which sellers cannot bear to part with their homes for less than what they believe they’re worth, experts say.”

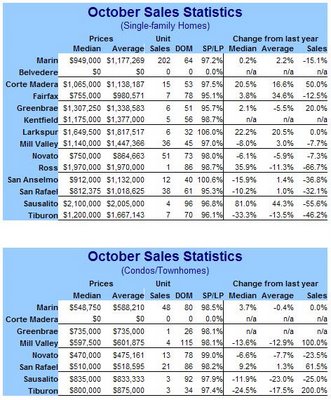

I saw this over at Ben Jones' blog. Apparently, Agassi's Tiburon house finally sold for $20 million. Since the majority of Marin houses sell for a lot less than that, expect the Marin sales price average to bump up as a result but the median to be hardly affected. Don't be fooled.

I saw this over at Ben Jones' blog. Apparently, Agassi's Tiburon house finally sold for $20 million. Since the majority of Marin houses sell for a lot less than that, expect the Marin sales price average to bump up as a result but the median to be hardly affected. Don't be fooled.