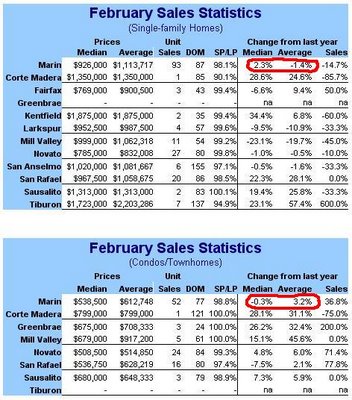

Vision RE, on the other hand, reports that the year-over-year median sales price appreciation is 2.3% for SFRs and -0.3% for condos:

For total sales (SFRs and condos, using Vision RE's "Recent Sales" listing) median sales price appreciation in Marin is down about -5%.

I like using Vision RE's data because there is so much of it and it spans a significant period of time; it is a terrific data source. So I was wondering why calculations based on it differ so much from that of DataQuick (also, because the Marin IJ seems to rely on DataQuick's data and so understanding the reason for the discrepancy might prove insightful). So I asked someone over at Vision RE what might be going on. He didn't really know where DataQuick gets its data or how they do their calculations but he did have this to say:

The recent sales by city is not the entire Marin county, but the selected cities that we track on a monthly basis.So my calculations and those of Vision RE are in good agreement. But I don't know what to make of DataQuick's calculations.

We are confident that our numbers are coming directly from the Marin MLS sytem and of course have no idea where dataquick is getting the numbers form.

Lastly , we show 145 total sales of condos and single family homes compared to their [i.e., DataQuick's --Marinite] 207 sales. We don't include anything that's not in the MLS such as new construction not sold on the MLS ( those sold through direct sales agents for the developer) and FSBO's. Also, we exclude from the MLS: farms and houseboats

So I want to ask you readers: Should I continue to track median sales prices for Marin in this way? If not, what better alternative should I use?

24 comments:

Nice research, and based on your conversation, I'd think Vision RE has a more direct source. After all, why would they intentionally downgrade Dataquick's stats? Again, this puts Dataquick's collection methods in question; what did they omit from their sample? I wonder what would the IJ say to that Vision data--nothing?

For me, the final, confirming data will be from the county assessor. Until then, those Vision stats suggest an interesting trend.

In the words (paraphrased) of Monty Pythons' immortal Dead Parrot sketch...

"Sir, this Bubble is deceased"

"No, it's restin. it's pinin' for those lower rates'"

'it's not pinin'! 'it's passed on! This Bubble is no more! It has ceased to be! 'Its expired and gone to meet 'its maker! 'It's a stiff! Bereft of life, 'it

rests in peace! If you hadn't nailed 'it to an ARM 'it'd be pushing up the daisies! 'Its metabolic processes are now 'istory! 'It's off the twig! 'It's kicked the

bucket, 'It's shuffled off 'its mortal coil, run down the curtain and joined the bleedin' choir invisibile!! THIS IS AN EX-BUBBLE!!

LOL.

"No, no.....No, 'e's stunned!

You stunned him, just as he was wakin' up!"

Just you wait...May will be "different".

listen to..

the original Dead Parrot

For me, the final, confirming data will be from the county assessor. Until then, those Vision stats suggest an interesting trend.

Fortunately, the Marin Assessor's Office's stats tend to be in much closer agreement with West Ba...err...Vision Re's data than DataQuick's.

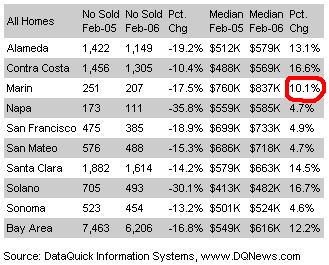

BTW, to me, this is the most telling piece of DataQuick's Bay Area report:

The typical monthly mortgage payment that Bay Area buyers committed themselves to paying was $2,889 in February. That was up from $2,798 in January, and up from $2,460 for February a year ago. Adjusted for inflation, mortgage payments are 16 percent higher than they were at the peak of the prior cycle sixteen years ago.

Indicators of market distress are still largely absent. The use of adjustable-rate mortgages has decreased significantly the last three months. Foreclosure rates are coming up from last year's low point, but are still below normal levels. Down payment sizes are stable and there have been no significant shifts in market mix, DataQuick reported.

So, we are 16% above the last peak (which has been at the same number for several months now), which is worrisome. However, this does not portend a 30-40% slide in prices as some of the bears here seem to think is inevitable. I can live with a 16% near-term correction.

But prices corrected from the previous peak. If the current one is 16% greater than the last, then wont the current correction be that much worse (after inflation)?

Prices did not correct much in Marin from the last peak (and I wish I could find my stats that go back to 1975 -- marinite, do you have anything?) -- if memory serves, it only fell in one year in the early 90s. It may have crept up about 10% overall from 1990-1997 but of course, that was well below inflation so in real terms, that is a loss.

Found it! Right under my nose at greathomes.org.

These are averages, rather than medians but they give you an indication:

1989: $339k

1990: $380k

1991: $375k

1992: $370k

1993: $378k

1994: $383k

1995: $397k

1996: $417k

1997: $443k

1998: $495k

1999: $590k

2000: $723k

2001: $757k

2002: $783k

2003: $818k

2004: $929k

2005:$1078k

So, prices fell from 1990-1992 a total of $10k (or 2.7%). By 1994, a Marin homeowner would have broken even and by 1997, he/she would have been well ahead of inflation and well on their way to seeing a nearly threefold gain in the subsequent 8 years.

Of course, this is not conclusive data by itself, just more tea leaves to read. There are of course alot of other variables are different this time such as rising, rather than falling interest rates, much lower unemployment today, no recession yet, low foreclosure rates (today) versus 1991.

So, prices fell from 1990-1992 a total of $10k (or 2.7%)

If we took the '90-95 figures and adjusted for inflation, we might see something different.

Thanks rejunkie for all that work. If it were not for you this blog would probably be pretty boring and just a bunch of "preaching to the choir". Well, maybe it IS boring and preaching to the choir. You tell me. I very much respect your contrary opinion and I respect the fact that you have contributed to this blog in a substantive way from its beginning. Sorry, but I don't think I have really said that to you. So there it is.

Anyway...

You already know that prices relative to income have fallen many times in Marin as I have a graph showing that. And you already know that when adjusted for inflation (I used 1969 dollars as baseline value) prices in Marin have fallen many times, twice by -20% (the 1990-92 drop in prices was one of those -20% drops when adjusted for inflation).

Yes, there are many significant factors that are different this time:

- Interest rates are rising and it is more likely than not that they will continue to do so.

- Wages have been pretty much stagnant. (Rising interest rates in combination with flat or almost flat wage growth is a deadly combination for housing).

- Job growth is qualitatively weak (or so I would claim, I know rejunkie thinks otherwise and for good reason but we can mutually respect our disagreement on this point) and much of the job growth has been RE related.

- There has been very heavy reliance on adjustable rate mortgages some being very "toxic".

- And the loose lending is ending which will make it all the harder for people to get the loans that they have needed to just sqeeze into today's priced houses.

Also, a recession is not a prerequisite for a downturn; I think the Professor Piggington blog has shown that quite convincingly. A coming recession seems likely to me but I fully admit that is beyond my comfort zone for discussion.

So we'll see...

But this thread is supposed to be about the difference bewtween DataQuick's data and those of Vision RE. Does anyone know what DataQuick includes in their dataset? E.g., we now know that Vision RE does not include stuff like houseboats, etc. Does anyone know what restrictions DataQuick places on their data?

Also, it is really best to use medians and not averages, especially in Marin. The reason is that just one multi-million dollar priced house will cause the average to change and change significantly whereas that same house will not significantly affect the median. If you look at histograms of what houses sell (in terms of their prices) you will see the bell-shaped curve is concentrated in the low end of the price range and is centered around $850K these days. Then the right tale of the distribution trails off quite a ways out to as much as $7 million most often. There are some graphs on this site that illustrate this.

So, medians should be used as they carry more meaning.

The price increase does not mean that similar houses are up YOY. It could simply mean that while last year everyting was selling, this year only the cream of the crop is being picked up.

Marinite-

Thanks for the encouragement -- I am all about respectful disagreement. it is the disresectful disagreement I have trouble with (like the one poster who accused me of being a realtor -- that was low). The data collection and analysis you do is outstanding which is what keeps me coming back. As someone who probably has a higher exposure to the RE market than most on this blog, I need to hear the bad news and bearish commentary as well. Just because I am a long-term bull on RE does not mean I am deaf to the opinions and data that indicate trouble ahead. I might challenge some faulty assumptions and unsubstantiated claims, but the thoughtful opinions based on facts is very helpful to me.

Averages get skewed, but averages was all I could find. And yes, interest rates in early 90s fell, which probably mitigated the price slide so these are definitely a different set of risks this time around.

The one thing I see discussed alot is the wage growth issue. Forgive me for asking about something you may have already posted: Do we have stats on wage growth in the Bay Area? I have seen (and posted) the falling unemployment rate there, but I cannot locate anything on actual median salaries. I have seen national stats, but not local.

Admittedly, I have a "seat-of-the-pants" bias here because me and my technology industry colleagues are having no trouble getting raises, bonuses and stock options that are actually worth something again. But even here in the Bay Area we represent a slender slice of the employment pie.

It was only 2 years ago that the papers were regularly writing stories about the unemployed-techie-turned-musician, unemployed-techie-turned-hemp farmer, etc. You notice those articles don't surface anymore? In fact the only thing I read of note recently was that Google's massive hiring has driven up the average programmer's wage 30-40% in the past few years. Also, venture capital spending in 2005 was the highest since 2000. But it is actual take-home pay for all workers where the rubber meets the road on this topic.

Thanks Marinite.

...and the Monty Python references by moonvalley. You can't go wrong with those. LMAO.

I think it would be interesting to do an unscientific survey among your readers, asking when and at what level they think prices will bottom out in Marin. Clearly most of your readers are bearish, but it would be fun to see what they are actually anticipating. I'm sure numbers will be all over the map!

Do we have stats on wage growth in the Bay Area?

This info can be obtained either by going to the Census Bureau or the BEA. I forgot which I used. Sorry but I have no time today and I am away from my data set.

The IJ had this to say today:

Marin's median home price reached a record $943,000 last month, industry analysts reported Thursday.

The median price, not including condos, was up from $867,000 in January - and up 16.7 percent from $808,000 in February 2005, according to DataQuick Information Systems of La Jolla.

I'd really like to know where they get their numbers. I mean, Vision RE's data clearly does not show such rosy results; it doesn't even come close to that nor does their write-up. DataQuick site that this post links to does not indicate such rosy results. I mean, it is looking like realtor data is more believable than the IJ's.

I'd really like to know where they get their numbers.

Me too, before I jump to conclusions and suspect there's some agenda, or simply lack of journalistic standards. This is the IJ, after all...

Thanks Fred, those are useful links. Yes, Marin median income is 40-50% higher than the rest of CA (no surprise there) which is one reason why Marin RE commands a premium. Keep in mind that the price inflation in RE due to the "bubble" is on top of that premium, or so I have argued.

mtrunner2 -

I agree that the higher end houses are tending to sell more. I would also add that it seems (both from common sense and from what some realtors have been saying) that buyers can afford to be more picky and only the nicest of the nice are what is selling and are selling for about asking price. This would cause the median price to increase.

I wonder what the value is of a house that does not sell?

RE why median prices seem to be increasing while sales are falling off a cliff, check out this thread:

http://tinyurl.com/h4qds

Thanks.

I had heard that Dataquick gets its numbers directly from realtors in the county that it is acquiring data for. This is the problem!

Found this Marin-referenced response to the Inman article regarding "The Elephant in the Room" and the fact that commissions are going to plummet:

Most of the agents that object to this commission slide are "old school" agents that are technologically illiterate and really have no clue of the tools that are currently available to buyers and sellers.

While I hate to be age bias, I really see this in areas where agents 'run a little more grey'. No place is this more visible than Marin County - 5 minutes away from San Francisco, the technology capital of the world. It's a bastion for wealthy and young tech saavy buyers and older stone age sellers (and agents).

As they say, information is power and the balance between what is available to "Joe Public" and a licensed real estate agent is really beginning to blur. Unfortunately, the "old guard" is really blind to it and want to continue operating in a business as usual mode.

While some old school sellers and buyers will continue to take comfort in doing business the way its always be done, the reality is that the world is changing.

hey Marinite - did you make or are you making ?? Hit me back

WTF?

What does that even mean?

I took a couple days off from this blog with the fam.

Post a Comment