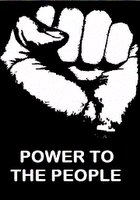

Well, it looks like Marin buyers are maybe, just maybe starting to wise up. Yes folks, you buyers have the power to dictate this market if you choose. You have had this power all the time. Now it's time to flex your muscles. YOU have the money so YOU have the control. It's about time things were in your favor. Now is the time to screw all of those greedy sellers who for the last few years have been screwing you. Go re-read the previous post on this blog. Get angry, get worked up, and demand that 15% price reduction and stick it to the sellers. Do you really want to pay for the lifestyles that they (the sellers) couldn't afford in the first place? It's pay-back time.

Well, it looks like Marin buyers are maybe, just maybe starting to wise up. Yes folks, you buyers have the power to dictate this market if you choose. You have had this power all the time. Now it's time to flex your muscles. YOU have the money so YOU have the control. It's about time things were in your favor. Now is the time to screw all of those greedy sellers who for the last few years have been screwing you. Go re-read the previous post on this blog. Get angry, get worked up, and demand that 15% price reduction and stick it to the sellers. Do you really want to pay for the lifestyles that they (the sellers) couldn't afford in the first place? It's pay-back time.Here is what West Bay RE has to say about February, 2006 results in Marin. But basically, in summary, the only things selling are the extremely nice houses or the houses that are so marked down in price that buyers cannot resist; pretty much everything else is not selling. The double-digit price appreciations are history. We are now in a long, long overdue buyer's market. And the best part is that it is only going to get better (for buyers, that is).

West Bay RE seems to have just changed their data format, now making it impossible to do year-over-year comparisons (unless that data is now hidden somewhere else on their site). Fortunately for us I still have their data and I will post the graphs later as they will put things into proper perspective. But for now, here is what West Bay RE has to say about February, 2006:

Do you remember your first junior high school dance? The girls stood on one side of the gym, the boys on the other. The teachers cajoled the boys into asking a girl to dance. A few boys made the move, and soon there were a few boys and girls dancing in the middle of the basketball court. That's what the real estate market is like in Marin County right now. The only difference is you have to pay for this dance.This is neither a "buyer's market" nor a "seller's market". At this stage in the game it is a fool's market. Now we find out who the biggest fools are.

Sellers are on one side with their houses all prettied up waiting for buyers to come make an offer. Buyers are on the other side looking, looking, looking. Buyers are now bringing magnifying glasses with them so they see every detail of the home. No longer are buyers rushing in to dance. They are sizing up the playing field and then choosing. If they don’t get the first dance they just wait for another.

This behavior is perfectly normal when the market turns from sellers to buyers: sellers can't believe the double-digit gains of yesteryear are over, while buyers can afford to stand pat. In fact, the only property selling right now falls into three categories:

1. very high-end property; Over $2,000,000

2. excellent properties that are priced right at, or even a tad below, the market; and,

3. the homes of people who have to sell now.

The market is in transition The transition is causing confusion. That's perfectly understandable. . Even most of the real estate agents who do this for a living are not sure where the market will be going. They are waiting to see what the buyers are going to do. Sellers' have been enjoying themselves for the past few years and, as we transition to a more balanced market, they will have to adjust their expectations. Buyers', on the hand, are sitting on the sidelines waiting to see if this transition is the beginning of the big "bubble", we don't think so [of course you don't think so; it's not in your commission-based self-interest -- Marinite].

Prices have come down about 8-9% from their peaks reached last summer. During 2005 Marin County saw an average price increase in ingle family homes of 16%. But, as we've mentioned repeatedly, like every month at the end of this report, the real estate market is very hard to generalize. It is a market made up of many micro markets, both geographically and in price range. Just because the median price for homes has fallen doesn't mean that well-priced, fabulous home on the corner will go for 8-9% less than the selling price. That house will still go for close to asking price with, possibly, multiple offers [yes, as long as that asking price is reasonable -- Marinite].

The median price for single-family homes in Marin County rose 6.4% to $926,000 in February from the month before, a year-over-year gain of 2.3%. Home sales fell 19.1% from the month before, and were off 14.7% year-over-year.

17 comments:

Advice to would be buyers:

Take the power you now have. Show it to the seller...and put it in your pocket. Do not give it to the homedebtor. Do not line his pockets, do not buy him another escalade... tell him to not pass go...and do not collect any more funny money dollars. Just say NO to High on the Hog Swindlers!

excellent post marinite!!!

nah... not bitter. I own a home the old fashioned way- bought within my means, and don't have to lose sleep at night trying to figure out how to hold on to a financed mirage of a life.

Foolish people are amusing. After this is over? There will still be foolish people. Perhaps we will be the next fools... or perhaps we will be nearby pointing and laughing again.

I am waiting with a big down payment.

I will wait until a fair deal comes along!

I am the buyer they are waiting for.

I have excellent credit and no debt.

I will not sign on to this insanity.

lol so bitter.

Bitterness--or well-founded concern?

Not another "bitter renter" here, but someone who's simply amazed this fiasco would immediately follow on the heels of the dot-bomb--and swallowed hook, line, and sinker by the masses. It was a real-world case study that was immediately forgotten. Then again, these credit-driven consumer follies have been going on for some time, and housing isn't the real issue. It's the way people look at finances, and how credit is abused for reasons of "self-worth".

reskeptic --

Well said.

Yes, this bubble is fascinating and if for no other reason than the lessons of the .com bubble never seems to have registered with the masses. And then there is watching people fool themselves into believing whatever it is they want to believe, that makes them feel good, instead of working for their success. And then there is the complicity of The System. And then there are the people who make apologies and excuses for it all...

For me it is not biterness. I vascillate between anger and utter, jaw-dropping amazement which shows up in the vascillating tone of my posts over time; amazement due to the reasons mentioned above and anger at what other people's foolhardiness on a massive scale is doing to our communities, our state, our country, and those of us who resisted and stayed out.

the lessons of the .com bubble never seems to have registered with the masses.

They never registered because as soon as the .bomb hit the ground Greenspan threw money at people with the interest rates hitting as close to subzero as they could. The loan industry kicking in with state income no doc loans... and it didn't matter if someone lost their shirt or their a$$ in the .bom... they no longer needed real money.

Now those bozos have been playing with funny money so long they have confused it with the real stuff, and also they have forgotten that they also didn't earn it.

Greenspan simply POSTPONED the .bomb reality.

We are all going to pay for it now.

Greenspan simply POSTPONED the .bomb reality.

Athena--

I suspect the same. Instead of letting the markets swallow that bitter pill five years ago, it's grown into a mess that continues to engulf more sectors of the economy, as documented ad infinitum. In reality, what hasn't the bubble touched? Oh, I suppose those who have so much money they can weather any financial storm. Then again, even the big shots may be heavily invested in businesses that profit from feel-good consumerism. But, could this affect Marin? No, no, not possible!

Then again, perhaps we should toast our good fortune, and spend that "equity" while Marin continues to pump out wealth from thin air--undoubtedly for years to come. What a comforting thought.

Greenspan is still at it. He got an $8 million advance on his forthcoming book. Then there are all the talks he is giving.

ok... ReSkeptic- what hasn't it touched?

It hasn't touched Greenspan.

the boomer phuck!

Reality check - By trying to work for a good purchase price you will not be "screwing all of those greedy sellers who for the last few years have been screwing you." Remember, the "greedy sellers" have not necessarily ever sold a house before and were most likely "screwed" themselves by "overpaying" a few years ago. As a buyer, simply try to negotiate the lowest possible purchase price possible instead of getting "Angry" and "worked up", which will inevitably end in irrational decision making.

In fact I'd love Marinite's definition of "greedy." Is it not reasonable for a seller to contract with the highest bidder?Would it not be worse for him to sell based on other criteria such as race, age, beauty? The market may go through irrational periods, but eventually things will correct. Just be happy that you haven't bought into the bubble and spare us the bitterness and Schadenfreude!

"Just be happy that you haven't bought into the bubble and spare us the bitterness and Schadenfreude!"

anonymous coward -

Spare yourself. no one forced you to read this blog or any of the many like it.

Calm down folks.

And I've been accused of worse.

In fairness to Marinite: It's a great forum and I appreciate the work put into it. I also happen to agree with the main thesis that we are in a bubble. It's just that the bitterness doesn't really forward the argument.

"backstairs said... anonymous coward - "

OK I'll try to come up with a clever name such as "Upstairs" or "Marinlover" so that I'm no longer "anonymous."

It's just that the bitterness doesn't really forward the argument.

Point taken. I'm only human and my feelings on these matters vascillate. I also think that an objective, dispationate analysis of the facts and numbers would be Boring. This isn't an argument to be proved or disproved. This thing is of social relevance and is the result of mass social behaviour as well as federal manipulation and fiscal decision making

Re Schadenfreude:

Watch this:

http://tinyurl.com/np8fh

Now just tell me you didn't laugh.

I guess I don't see a problem with bitterness here.

It isn't bitterness at not being one of the bubble profiteers. But I make no apologies for being bitter about the prospect of cleaning up a mess made by financially foolish people. I think if this pops as big as the potential- I think many people will be cleaning up the financial mess for years to come. I don't think we are heading for a bubble burst that will simply result in dropping prices and renters swooping in to scoop them up. I don't think financial faux pas on the scale of billions of dollars crash that neatly. I am bitter that if it comes down ugly we will hear the same people who were running around proclaiming the divine blessings of real estate holding their heads in their hands down on their knees and joining the cult of victimhood. THAT thought makes me bitter.

I have a family member or two who have been financially foolish and for some reason they also have a sense of entitlement for others to clean up their mess. I resent the heck out of that too.. I pay my own bills, I live responsibly. I don't buy things I can't afford, and I do this old fashioned thing called budgeting and living within my means.

Who really isn't bitter at the prospect of hard work being smacked in the head, and foolishness being rewarded?

watch this

"Like some sushi with that?"

lmao.

Post a Comment