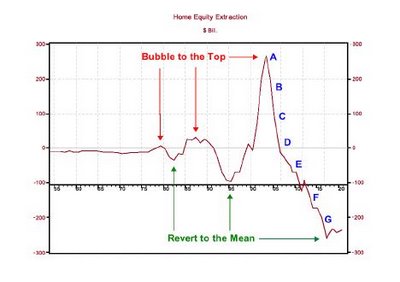

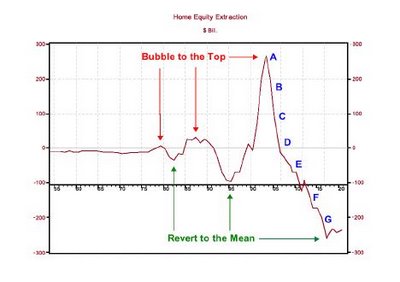

The following prediction came from

this article. I'm not saying Marin will follow this trajectory; we all know that at worst it will move horizontally from point "A" into the foreseeable future. But the rest of the country is so screwed:

Step A: You are here.

Step B: As housing prices begin to decline, sales will continue, though more slowly and less frequently. Old habits die slowly. One year into the decline, housing speculators will have left the market, but home owners will generally still believe that prices will either resume their rise or at least flatten out, not continue to decline.

Step C: After prices have declined for two years, large numbers of buyers who purchased near the top of the market will begin to feel the psychological effects of being underwater on their mortgage...As transaction volumes continue to fall, demand for housing-related employment will decline too. The first signs of labor market distress will start to show up, as more and more of that 43% of the private sector who found jobs in the housing industry are no longer needed.

Step D: Three years into the decline, marginal home buyers will learn what owning a home really costs, versus renting when housing prices are declining and jobs are more scarce. Rent is a fixed cost, whereas home ownership presents many variable costs, including increased interest payments on ARMs, and rising tax, insurance, and energy costs. Also, upkeep for the average home typically costs five to ten percent of the price of the home, annually.

Step E: Five years into the downturn, rising unemployment will begin to more seriously affect the market...As unemployment rises, homeowners will leave housing bust regions to move to areas where there are more jobs. Many houses will be sold at a loss, or even abandoned, as the market price falls below the loan value.

Step F: Ten years into the downturn, real estate will be widely regarded as a terrible, "can't win" investment. McMansions will be subdivided for rental as multi-family homes.

Step G: Ten to fifteen years after the start of the decline in housing values, prices will bottom out, setting the stage for the next boom. Time to buy.

12 comments:

I agree on the chart, but I think the decline is too steep and the timeline is too long.

I'm not saying Marin will follow this trajectory; we all know that at worst it will move horizontally from point "A" into the foreseeable future. But the rest of the country is so screwed:

So there is NO bubble in Marin after all..

I'm sure it will all work out for everyone.

Owners and renters will join hands and realize that we are all one.

Yep. The time line is too long. Things got too insane and the US economy is too screwed with debt for this to be anything but a quick reversion to mean.

And it's going to be a "reversion to mean" that we may not recover from in our lifetimes.

The US Empire is over.

The "chart" ends at point "A." Everything to the right of point "A" is conjecture. "Peak Oil" science.

So there is NO bubble in Marin after all..

My sarcasm was too subtle I guess.

Yep.. by golly - renters are the smart ones. RIGHT! LOL!!!

Overshooting that much on the downside WILL NOT happen with housing because the *floor* for house prices is determined by sustainable household incomes.

Instead, look at the prior two dips as the likely bottom in the future, followed by perhaps a longer period of stagnation--but even then there's constant housing demand as the population increases so they could well start on the upside a few years after reaching past lows.

Instead, look at the prior two dips as the likely bottom in the future, followed by perhaps a longer period of stagnation

For Marin, see

http://tinyurl.com/qvw4j

or

http://tinyurl.com/eelmd

anon #290,113 said:

"Yep.. by golly - renters are the smart ones. RIGHT! LOL!!!"

I quote for your benefit something I read today:

"It is dumb to buy overpriced assets with low interest rates."

When did a home become an asset?

Oh, around 2001 or so.

Post a Comment