Just in case you thought I was making all this stuff up about a real estate bubble in Marin, in the Bay Area, in California, on the West Coast, on the East Coast, in the South East, in Arizona, in Vagas, in Nevada, in Hawaii (which doesn't get enough press IMO), in the UK, in NZ, in AU, in China, in most of the EU, etc. (must I go on?), there is this guy (thanks to sfjack for the reference; you readers are the best resource). A bursting bubble is your friend. Embrace it.

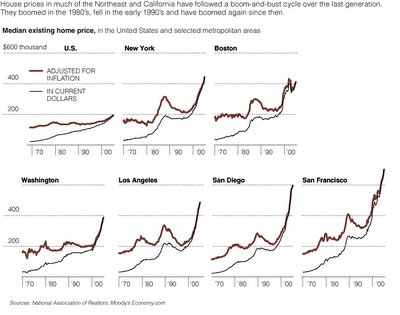

Just in case you thought I was making all this stuff up about a real estate bubble in Marin, in the Bay Area, in California, on the West Coast, on the East Coast, in the South East, in Arizona, in Vagas, in Nevada, in Hawaii (which doesn't get enough press IMO), in the UK, in NZ, in AU, in China, in most of the EU, etc. (must I go on?), there is this guy (thanks to sfjack for the reference; you readers are the best resource). A bursting bubble is your friend. Embrace it.First, here is the graph from the article (I edited it so that it would better fit into this space; just click on it to see a larger view):

Some choice quotes:

In New York, inflation-adjusted prices dropped almost a third in less than a decade. The fall was even worse in Los Angeles, and it wasn't pretty in Boston, San Francisco or Washington, either. Thousands of families were forced into much smaller homes. Many have never lived as well as they did in those giddy pre-crash years. It was a painful preview of what the dot-com meltdown of 2000 would bring.

What? You don't remember any of this? You think I just made up those numbers about plummeting house values?

I didn't. The real estate crash really happened. The median house price in the New York area fell 12 percent from 1988 to 1995, which is nearly 33 percent in inflation-adjusted terms.

But instead of panicking, most homeowners should be taking a deep breath. The real estate slump of 2006 offers a fresh chance to puncture the No. 1 myth about the nation's No. 1 topic of conversation: the idea that we should all be rooting for high house prices. The myth is good for real estate agents, but it creates needless anxiety for everyone else. It's time that most of us learned to stop worrying and love the bursting bubble... The bad news is that a big part of the country's economic policy has been built on the myth.

THE best way to think about the value of your house — at least in the short term — might be to compare it to Monopoly money. Having a big pile of it feels good, but you can't really spend it.

As long as you are living in the house, you have no way to lock in your gains. Yes, you can borrow against those gains, but new debt is not exactly found money. And when you move, odds are that you will go someplace that has a real estate market very much like yours. Whatever profit you make you will just plow back into a new home.... This is why the housing boom of the last decade, unlike the dot-com frenzy, has not made many people rich.

Worst off would be the families who have borrowed heavily against their homes. For them, a price drop could erase all of their equity, leaving them with no money for a down payment when they move. This happened to some Californians in the 1990's.

So there is a good argument that society has a compelling interest in keeping house prices from getting too high. Reasonable prices allow young, middle-class families to buy a house without going into too much debt. They also let people live where they want. Right now, there are a growing number of workers making long commutes from places like Hagerstown, Md., and Stockton, Calif., solely because they cannot afford a decent-size house in a close-in suburb.

1 comment:

Awesome graph--nothing else so clearly shows how "rich" SF homeowners have become! Why work, when my house is doing it for me?

Post a Comment