Imagine that it is February 7, 1996

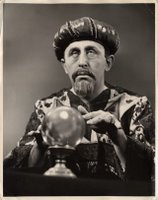

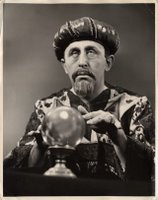

Imagine that it is February 7, 1996. You want to invest your money so as to become a gazillionaire in 10 years time. Fortunately, you have a crystal ball and you are able to see into the future but you can only see what is in the news today (February 7, 2006). Would you still bet on a soft landing in real estate?

Imagine that a decade ago, you had had a crystal ball and could have read today’s news -- unspun and uncommented on. The first story is about Iran being at odds with the West over its nuclear programme. The president of Iran, you discover, would like to wipe Israel off the map, as would the new ruling Palestinian party, Hamas.

The next story is about growing concern in the US over the number of military casualties in Afghanistan and Iraq: two countries that neighbour Iran. As a switched-on reader, you wonder what all this is doing to the price of oil. Turning to the financial pages, you find out. Oil prices are no longer $20 a barrel, but touching $70, with expectations that they may go higher.

Staying with the business pages, you find that Alan Greenspan, the grand old man of the Federal Reserve, is about to retire. He will mark his departure by raising US short-term interest rates for the 14th consecutive meeting.

Greenspan, the report says, cut interest rates to 1% in the wake of the terrorist attacks in September 2001 and cheap money has pumped up the US property market, allowing homeowners to borrow money against the rising price of their main asset. The US is now running a current-account deficit of 6% and rising, the cost of military action and clearing up an immense natural disaster blamed on climate change has been to push the budget deficit to 3,5% of the gross domestic product and the savings rate has fallen to zero. You read the figures again because you can’t believe they are true. They are.

What does this mean for the dollar? Surely, you think, it must be dropping like a stone. It isn’t, because, as you discover, central banks in Asia are buying greenbacks in huge quantities so they can keep their own currencies at artificially low levels in order to keep enjoying export-led growth. The ability of American consumers to continue living beyond their means, you find, is now dependent on the actions of the communists still in power in Beijing.

A couple of other stories catch your eye. There is concern about something called avian flu which, according to the World Economic Forum, has the potential -- small, admittedly -- to turn into the 21st-century equivalent of the Black Death. And Russia is playing hardball with its neighbours over gas supplies.

What’s your response? Yes, there’s a bit of encouraging news from Germany and reports that Japan may have, at last, turned the corner after more than a decade in the doldrums. But that’s not what leaps off the page. The world of 2006, seen from the perspective of 10 years ago, has a profoundly unbalanced economy, high energy prices and a volatile Middle East. It is threatened by climate change, terrorism and a pandemic.

Perhaps you would be sanguine about all this. Perhaps, though, you would be worried sick that any one of these risks could set off a chain reaction that would make 2006 a year to forget. One thing is for sure. You wouldn’t bet too much money on a soft landing. And rightly so.

In addition to the above, you would be seeing that the

stock market seems to be realizing that the housing bubble is busting as the stocks of major house builders continue their sell off,

declining interest in US treasuries by foreign central bankers, there are

more tales of people selling their insanely over-priced houses at a loss, people resorting to using

good luck charms to sell their houses,

questions over a new Fed chief and the

real state of economic affairs in our Union, etc.

Imagine that it is February 7, 1996. You want to invest your money so as to become a gazillionaire in 10 years time. Fortunately, you have a crystal ball and you are able to see into the future but you can only see what is in the news today (February 7, 2006). Would you still bet on a soft landing in real estate?

Imagine that it is February 7, 1996. You want to invest your money so as to become a gazillionaire in 10 years time. Fortunately, you have a crystal ball and you are able to see into the future but you can only see what is in the news today (February 7, 2006). Would you still bet on a soft landing in real estate?

8 comments:

And if that crystal ball had told you that a $40,000 (20% down on a 200,000 house investment would be worth $600,000 in ten years?

Coulda, woulda, shoulda is a children's game. In 10 years a breakthrough in photovoltaics or superconduction or fusion or hydrogen catylisis or any of a hundred other things would change the world so profoundly that all the things we worry about today will seem silly. While I cannot predict which or when it is near certainty that at least one will bear the fruit.

bunk.

So the future will change much more quickly than the past? For the better or the worse?

In the last ten years there has been nothing that has dramatically changed the world so profoundly as you describe. The internet, and especially computers, are much older than that.

Plus, your $200,000 POS would need a lot of mortgage, maintainence and taxes to get you to the finish line.

Imagine it is February 7, 1986....

November 21, 1995 - The Dow Jones Industrial Average gained 40.46 to close at 5,023.55, its first close above 5,000. This makes the 1995 the first year where the Dow surpasses two millennium marks in a single year. It would do it again in 1997 and 1999.

December 30, 2005 - The lowest ever UK temperature of -27.2°C was recorded at Altnaharra in the Scottish Highlands. This equalled the record set at Braemar, Aberdeenshire in 1895 and 1982.

January 7: One of the worst blizzards in the US hits the US.

France continues to test nuclear weapons at the Muroroa atoll over the objections of the rest of the developed world

Recently defected Iraqi weapons program leader and son-in-law to Saddam Hussein, Hussein Kamel, returns to Iraq. Within days of his return, he is murdered along with his brother, father, sister and her children. Kamel had forced Iraq to reveal portions of its illegal nuclear and chemical weapons programs.

2/26: Another record breaking snowstorm

2/9: IRA bombs Canary Wharf in London killing two

2/18: IRA briefcase bomb in a London bus injures 9 in the West End

March - Iraq disarmament crisis: Iraqi forces refuse UNSCOM inspection teams access to five sites designated for inspection. The teams enter the sites only after delays of up to 17 hours.

March 20: The British Government announces that Bovine spongiform encephalopathy was likely to have been transmitted to people.

And, most notable:

December 5 - Federal Reserve Board Chairman Alan Greenspan gives a speech in which he suggests that "irrational exuberance" may have "unduly escalated asset values".

(source: wikipedia.org)

There is crappy news every year. And hindsight is 20/20.

Oh give me a break already. The point is not about how much has changed in the last 10 years. The point is not that there won't be other changes in the next 10 years. The point is not how well we can foresee the future. The point of the article was simply that the current situation for housing is fragile and there are a lot of things that could go wrong any one of which would be sufficient (in the author's view) to tip the balance and given that, would you still bet on a soft landing?

Ok, so a bad choice of things to post on. Lesson learned.

But that picture is classic. IMO.

Marinite-

Fair enough. Yes, the excessive debt held by China, the heavy borrowing by not only US consumers but the US government, high oil prices etc., are all risks. OTOH, large American corporations are flush with cash that they don't know what to do with, US per capita net worth is at an all time, inflation-adjusted high (caveat: alot of that is coming from home price rises). So it ain't all bad.

In the past, we got through the Asian financial crisis, the Russian financial crisis, numerous South American crises, 9/11 and the ensuing drop of the DJI to 7700-ish, SARS, massive job offshoring, two wars and Hurricane Katrina. The US economy has shown itself to be pretty resilient in the face of alot of worldwide uncertainty.

And past performance is no guarantee of future results, as they like to state in an investment prospectus...

And yes, love the photo.

Hi.. thats an interesting post

Idaho Real Estate

Post a Comment