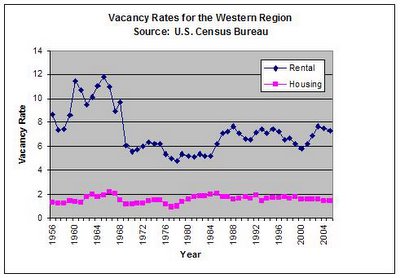

The rental vacancy rate series increased during the housing bubble years. It is unlikely that people were leaving rentals for rented housing since if that were the case then you would expect to see a corresponding decline in housing vacancy rates during those years; instead, the data suggest that people were buying houses to live in.

Of more interest -- it seems to me that both the housing vacancy rate series and the rental vacancy rate series argue against the theory that there has been high demand for housing during the recent housing boom (by "demand" I mean the housing bulls' argument that the population has been increasing due to mass immigration/migration to the region and not "demand" due to speculation). If there had been high demand for housing then you would expect vacancy rates (both housing and rental) to decline from roughly the year 2000 to the present. Instead, what you see is that rental vacancies actually increased during that time and housing vacancy rates remained unchanged. Additionally, if housing demand had been increasing you would expect the cost of renting to increase but it has in fact been decreasing, at least in Marin.

Of course, a rival hypothesis to the above is to suppose that the supply of rental housing has increased to compensate for increased demand (either by building new units or by conversion of existing units). If true, then for rentals rental supply seems to have surpassed demand whereas for rental housing the supply has matched demand. (The current data as plotted here cannot resolve this other interpretation. If anyone has the required data or knows where to find it, then please share with me.) But my counter argument to that is if rental supply equals or exceeds demand, then the extreme increase in housing prices over the last few years is not justified by an argument based on non-speculative demand for housing.

Share your thoughts.

Enjoy.

Enjoy.

27 comments:

Interesting...

Look at the effect of Baby Boomers "coming of age" between 1965 and 1971 (for those born beginning in 1946 and the following years).

A significant drop down in vacancies for rentals as they, as a group, hit the rental market for the first time in the late 60's.

Is this the right question to ask (perhaps not for Marin)? What *is* going to happen to the housing market when they begin downsizing in a significant manner?

And look how vacancies stay consistently below or just at 6% for the next 20 years, all the way until the mid-1980's - or just when the last of the Boomers are entering their early 20's (as group, born at the latest in 1963/'64).

I updated the "rival hypothesis" section because a thought occurred to me. Ugh. The more I think about this data, the more confused I make myself.

Why Homeowners Get Rich and Renters Stay Poor

http://finance.yahoo.com/columnist/article/millionaire/2585

I read the article on why homeowners get rich and renters are poor. Of course, what the author does not compute is the lost investment income renters should earn, e.g. 8% per year in stocks, on the savings they realize from renting vs. owning. If he had, his analysis may well show renting leads to greater net worth than owning.

The writer of the abover referenced link surely isn't familiar with marin real estate, and his use of examples proves it.

Spend $1500 to rent a house that you can buy for $200,000?

Yeah, maybe you could make a case for buying in that scenario.

But here, I pay $2150 to rent a house that has a "market value" of approximately $950,000. No rent increases. No property tax. No maint.

And given the state of CA and the fed budget, it will only be a matter of time before yearly tax rates go up and eventually, the cap gains exclusions on RE reduced or eliminated. Not even to mention the virtues of not having leverage in an unstable or declining market.

Going forward, renting will make you rich.

Thanks for posting the above link.

I am with you marinite, I can't really draw anything more than very hypothetical guesses from the vacancy rate data.

The writer of the abover referenced link surely isn't familiar with marin real estate, and his use of examples proves it.

I recall reading articles like that in 2004; what's happened since?

The writer of the abover referenced link surely isn't familiar with marin real estate, and his use of examples proves it.

He is probably Marina Prime, HITMAN or similar troll.

Buying versus renting?

Let's deal with reality here for a minute - for it appears there is a "gaping difference".

********

"In the Bay Area of California, a typical family that buys a $1 million house - which is average in some towns - will spend about $5,000 a month to live there, according to the Times analysis. The family could rent a similar house for about $2,500, real estate records show, and could pay part of that bill with the interest earned by the money that was not used for a down payment.

This gaping difference helped persuade Eloise Christensen to sell her century-old Victorian cottage in downtown Larkspur, Calif., for $1.05 million this year. Now she rents a two-story house in Stinson Beach for $2,400 a month. From her living room, she can sip tea and watch the waves from the Pacific Ocean."

From:

"Is It Better to Buy or Rent?"

By David Leonhardt - New York Times

September 26, 2005

http://tinyurl.com/dwwqo

Or:

http://www.nytimes.com/2005/09/25/realestate/25cov.html?ex=1143345600&en=de711efe83526259&ei=5087&excamp=GGREbuyingvsrenting

Why homeowner's generally DON'T get rich:

http://tinyurl.com/l8q63

http://thereisnohousingbubble.blogspot.com/

Homeowners will always get rich because debt = wealth!

sf jack-

Good article you cited and almost accurate. They did not appear to factor in inflation in rents (which are bound to accelerate more strongly now for the same reason prices are slowing down) nor the closing costs and agents fees in selling. Also, their examples of rent versus property value do not agree with my real world experience. A $1m house in Marin rents for more than $2500, unless the landlord is not too sharp. The house I paid $865k for last year rents for $2800. So, using my actual numbers for property tax, mortgage, rent, etc., and factoring in 4% annual rent increases and 2% annual property tax, insurance and maintentance increases, I come closer to 17% gain over 4.5 years to break even versus renting, which is not at all an unrealistic expectation (3%/year). Of course hanging on to the property longer than 4.5 years is more beneficial to be an owner, so the conclusions the NY Times draws are pretty spot on -- if you have a long term view (> 5 years) you may want to consider buying, otherwise renting is a more financially sound option.

I expect rents will rise faster then 4% however, as they are at 20 year lows, factoring in inflation. And we know what happened after the historically low cost of buying a home in 1996...

rejunkie -

Isn't the average amount of time that people tend to live in a house before moving again around 5 years?

marinite-

I don't really know. I used to hear 7 years being average but it could well be less than that today. I have never lived anywhere longer than 5 years.

In any event, I (and the NY Times) neglected to mention that despite the 5 year break-even, if you have set yourself up for a structural deficit with a negative cash flow (i.e. tapping equity each month to subisidize the purchase vs. renting), you won't own that house for very long before you have to sell, even if it is for a profit. In other words, if you are spending extra to own AND you can't afford it, you will still lose your house, a stressful event that a renter of that home would not have to endure. My numbers assume you can afford the monthly nut of ownership.

Bay area statistics say that far fewer than the # holding mortgages can afford to the monthly nut.

junkie -

Rents - perhaps more instructive to look at what BA rents did from '90 to '95?(I recall not much movement)

I do know that the local economic times of late 90's were not anything like the near future around here (and maybe general "inflation" may have more to say about rents, however).

Over the next five years, is your place going to be up 18%? Including gains in the last year, sounds like a possibly for sure. But from right now or the recent past? From '91 to '95 or so, how many places exceeded that in Marin? Almost none, I would guess from all the data I've seen. How about from '82 to '86 or so?

Then again, maybe this time "it is different."

But somehow I doubt it.

junkie -

Re: Marin landlords

How sharp are they?

Maybe $2500 in rent for a $1 million place is low. What should it be? Maybe the better question is what will the house price of a $1 million house today be in the near future. If rents really take off and homes come off their peaks 10% or so in the next couple years, then buying would make more sense.

Rents do seem lower in Marin vs. the City for comparable places, in my experience - but that's not saying much. Or maybe it's saying something about the factors for living in Marin are outweighed (for most people) by the extra commuting, etc., at least at those levels of rent.

What is unusual about this cycle is that prices and rents did not move in concert. In the late 80s, rents and prices moved up in tandem, ditto late 90s. From 2001 on, something I have not seen (or don't remember) in 30 years of observations, happened -- the rise of values seemed completely disconnected with rents.

I absolutely don't think a 17% gain over 5-ish years is a guarantee -- I just think it is within the realm of possibility, just like I think a 10% decline is a possiblity too.

However, the fact that rents in real terms are probably as cheap as they ever have been in the past 15-20 years leads me to believe the only direction they can go is up. Anyone has ever contemplated buying has pretty much done so (as evidenced by the crickets heard at most open houses) which means they will rent, and as more households form with affordability at 10%, they will have no choice but to rent. This should help drive up occupancy and therefore, rents.

So you lose on capital gain but the improve the cash flow -- at least that is my theory.

What will be interesting is to see what rents do when the first wave of the overextended start to feel squeezed by interest rates.

My hunch is that some will try to rent first before opting to sell to see if they can get their albatross to pay for itself... I imagine the homedebtor will look in the IJ and craig's list... determine that their chithole is worth more than the others for rent, and try to price it above the market to get as much of the payment covered as possible.

Obviously those who bought low enough and with a fixed rate low enough will be in better shape. But those who have payments well above the rental market will try to stop the bleeding by renting as well I think...

if they get the prices then we will see rents start to rise...

However, I remember that while the home prices didn't really tank in marin during the last cycle bust... the .com thing made living near the city and all other tech centers very desirable... I remember SF's rental rate going down to 1% vacancy, and people were clamoring over each other to find a hovel to rent and it paid off for marin, and rents were way high!

I rented a place down there in 1999-2001 for $1800 a month, and it was not worth that much... now what I would find in marin for that price would be heads above it.

I think marin was able to stay afloat at that time because there was a job/economic boom at that time that made people flock closer to the city and there was demand for the housing, both rental and purchase. I don't see that right now... and my crystal ball is strangely silent so I can't forsee the next job balloon for the area.

I think rents have lowered quite a bit in the last 5 years because people moved out of the area, the jobs went away, and they haven't come back to my knowledge... so who is going to be there when squeezed debtors try to raise rents to cover their a$$?

However, the fact that rents in real terms are probably as cheap as they ever have been in the past 15-20 years leads me to believe the only direction they can go is up.

Maybe the reason why rents are as cheap as they are is that salaries and wages have not increased much; certainly not to the degree house prices have increased. Maybe the reason why house prices were able to shoot through the roof in such a very short time when rents could not is because "exotic" lending practices have allowed monthly mortgage payments to stay very low (at least for the short term) so low in fact as to be reasonably comperable to rents.

Whether your Crystal ball is silent or not, there is already evidence of a tighter rental market -- as of last Fall, occupany was around 96%. Anything in the low 90s is considered a renters market, 98%+ is full occupancy (and a landlord's market). It has moved up a few %age points in the past two years. Gimmicks such as one free months rent have also gone away.

There is a realtors newsletter that expands upon this topic (I know, they are the scourge of society, but it seemed pretty detailed) and from that I quote:

This same apartment owner said

that he rented a one bedroom

view unit with a fireplace just 18

months ago for $1,195. When

the tenants moved out to buy

their first home recently he was

able to re rent the same apartment

for $1,425.

I also use realfacts.com for data on this topic, although they only have stats for large apartment buildings, not the mom-and-pop landlords such as myself.

My aforementioned rental in San Anselmo was rented within two weeks of advertising on craigslist and I did not give away time rent-free, as I had to do with one of my condos last year. I also had the fortunate "problem" of competing applicants, one of whom wrote me a very nice letter as to why she should get the place.

So, although I have not been able to raise rents on the existing stuff yet, this recent experience leads me to believe things are tightening.

I wonder what is behind it? I mean are they new people moving into the area? People with increases in salary able to afford to upgrade to a nicer place? Are there new jobs? How many real estate/mortgage industry/construction jobs do you think were added in Marin in the last 4 years?

Do you think the prices will be affected if there are more slowdowns and layoffs in these industries? How hard would Marin be hit by the loss of these types of jobs?

Maybe people aren't buying as many houses in Marin and are choosing to rent instead. That would increase demand for rentals which would put upward pressure on rents. But rents can only go up to what people can afford to pay since you cannot get an exotic loan from a bank for rent.

But if people aren't buying as many houses and choosing to rent instead, then some people who are trying to sell a house may be forced to try and rent it. That would increase the supply of rentals which would have the effect of putting downward pressure on rents.

That's just what it seems like to me; I am not a landlord or anything so what do I know?

junkie -

I agree with your theory.

marinite -

I think the scenario you cast just above is starting to happen in the City. Anecdotally, I have heard more people who would normally be first time buyers (condos, etc.) are instead choosing to stay renting. I expect this could raise rents some; eventually, however, just what you surmise will happen. More rentals will hit the market as people are unable to sell, perhaps as soon as this summer or later in the year.

I have no idea if the number of rentals newly available will match the number choosing to stay on the sidelines of buying. I would guess not... so the overall effect - higher rents.

As much as rents are near historical lows on an inflation-adjusted basis (isn't that what junkie pointed out?), I suppose I would be surprised if the near future brings rent increases like we saw in the late 90's around here.

That dotcom foolishness had some amazing impacts...

Rents will stay pretty stable precisely because rents are tied to the REAl (not hallucinatory) economy, and wages are flat. Rents are paid with actual, real, feel-it-in-your-hands CASH.

Unless we get a veritable tsunami of high-paying jobs coming into the bubble areas (anyone think THAT'S going to happen?) rents will remain below what over-extended home"owners" need to stay above water.

As sby. above noted, the only people who will be sitting pretty as far as $$ goes will be those who owned and cashed out of this market in time to reap a hefty profit.

Once you run out of those people, the rent party is over.

Of course, you can always squeeze 2 or 3 families into a single family house to jack the rent up.

But then there'll be 2 or 3 families that aren't available to rent other properties. So that becomes a vicious circle.

Other than a substantial, REAL increase in good paying jobs, it is hard to see how rents can increase much in the long term.

Does anybody out there really think that good-paying jobs are due for a massive increase in the US?

Other than a substantial, REAL increase in good paying jobs, it is hard to see how rents can increase much in the long term. -anonymous

Rents are driven by supply and demand, just like everything else in a free market economy (iPods, cars and groceries are not driven by personal income, why would rents be?). Rents were escalating at 10%+ per year in the late 90s not because the median income in Marin was going up that fast, but because there were more people demanding rental housing than there was housing available to rent.

Personal income has little to do with it, just like it has little to do with prices, as we have learned recently. Inventory has tightened (pretty clear from the rising occupancy rates) so demand is increasing, whether or not personal income is increasing. And as pointed out by others, rents are a more "honest" reflection of demand since nobody considers renting an investment.

Other than a substantial, REAL increase in good paying jobs, it is hard to see how rents can increase much in the long term.

There is a substantial, real increase in good paying jobs -- I work for a large technology employer and it is getting difficult to find good people. And, the Google effect is driving up technology wages in the Bay Area (should have bookmarked the Chronicle article that came out a few weeks ago) because of their massive local hiring. I realize that two data points do not make a trend buy there aren't a whole lot of news stories bemoaning the offshoring of technology jobs these days.

I believe rents are a reflection of supply and demand. If rents have gone up it's because there are not enough rentals available for those who want to rent. I would be willing to bet the supply is lower than demand, and the reason the demand is high is that many people have been priced out of the market. Some people rent because they don't want to buy at the top of the market (like me). Wages are flat, so rents are unlikely to go up, unless supply tightens a lot, that is unlikely. Over many years rents could go up to meet the costs of owning the same house, but it is more likely that home pirces will come down to meet the costs of renting. The main reason is that many people in the Bay area are putting half of their monthly salary toward owning a house. If the boom in home values was permanent, you would have seen wages and rents go up proportionately. It didn't happen. Marin prices may be "sticky", but the prices for expensive homes decline at a greater rate. The difference is that those homeowners are not as likely to sell or move because of that loss of value. The greatest danger in Marin is if values decline more than

30%, because that is likely the amount of equity that many homeowners have. I believe a recession and a decline in values will happen in tandem this year. The increase in values over the past few years has been parabolic, and I believe the decline in values will be as well.

Post a Comment