As suspected, the party

continues according to

Vision RE (was

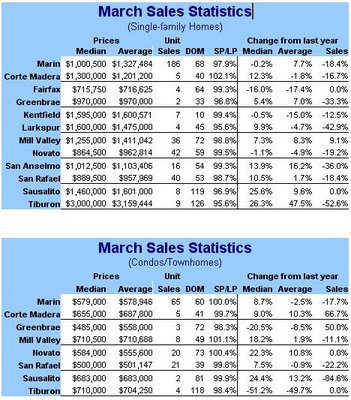

West Bay RE). Is Marin getting its Spring bounce? Year-over-year, the median sales price of SFR is down -0.2% (so let's call it "flat") but the average sales price surged over 7%. Dang!

Vision RE assures us that the reason for the surge in the average sales price is due to an abnormally large number of multi-million dollar houses selling (which makes a lot of sense given that the calculation of an average is hugely sensitive to outliers). So is it a fluke? Sales volume is down -18.4% year over year; that makes for

five straight months of negative YoY sales. Also,YoY inventory over the last three months in Marin is about 46% greater on average (I'll post that chart later; it is based on a different realtor's data).

I'll try to chart all of this up tonight so as to put it in recent historical context.

It's odd because I've been communicating by email with a realtor (who prefers to remain anonymous) who tells me that most of her clients have not been out house shopping because of the rain (especially those with kids) and that many buyers are having to buy houses that are significantly smaller than what they wanted due to the rising interest rates (suggests people are stretching to get in to a house, any house). As interest rates continue to rise and so-called "exotic" loans get phased out the market should turn interesting. We'll see...

12 comments:

I'm holding on.

Was I a fool not to buy 2 years ago?

I had a chance, but it would have been a ARM and I'd be paying through the teeth now.

Is it really going to keep going up and up and up?

Who can afford this?

I'm losing my faith in the bubble.

No.

No.

Good question.

Look around here at the charts, tables and graphs that marinite has put together - and see how the cycles (up/down) of real estate "come to life" in the figures.

And finally, yes, you have to be even more patient.

You should be encouraged that the Spring bounce in Marin has been such a dud so far.

anon 9:43 -

That's true. So far Marin sales have been a "dud" as you say. Hardly a "Spring rally" as they say. I bet April will be strong. I think this Spring is likely the last hoorah.

It's hard to ignore history:

http://tinyurl.com/eelmd

http://tinyurl.com/fug2t

And the increasing interest rates haven't worked their way too far into the system nor have the somewhat tighter controls on exotic loans.

Don't worry. Those ARMs are a disaster waiting to happen:

http://tinyurl.com/gauu6

I have been told by realtors (who insist on remaining anonymous) that most buyers in Marin (other than the uber-wealthy who don't care how much they have to spend to get what they want) use some sort of exotic loan type and are stretching to the max. I'm really worried about what may happen to them (some are friends and acquaintances of mine) but then again they are adults and they can make their own decisions.

@marinite

Would you be willing to share the names of some realtors who you are talking with offline, if we were to e-mail you directly?

Some of us don't have any trust in this industry, and finding a realtor who is honest, works for the buyers / sellers best interest, and has a high level of personal integrity, would be a great relief. Obviously as this advice is free it would be up to us to vet any recommendation, but at least it would be a start....

I talk mostly with three on-line and they all know about this blog. I have promised all of them that they would remain anonymous. Sorry. My relationship with them is not all that good as you can imagine.

Two others I talk to are acquaintences of mine and they don't know about my "alter ego" here; they provide the best "insider" info.

I recently invited one of the "communicate by email only" agents to hold an open question-and-answer session for one post but she was worried that doing so 'would hurt her business' and she 'still has to deal with other realtors on a daily basis'.

And I thought I would add a few things here.

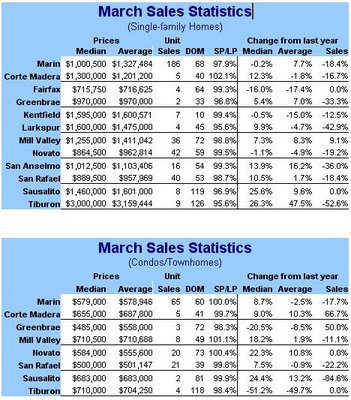

That the condo inventory in my neighborhood in the City has doubled in the last few weeks. Is the pace "quickening" for those comptemplating heading toward the exits?

I ask that because the inventory in the recent past this time of year, or any time of year, has been very low.

Also, a co-worker recently mentioned that a City realtor told him that "anyone north of California Street is going to be OK" (perhaps the analogous statement for Marin is "anyone generally south of Sir Francis Drake..."(?)).

I suppose since this guy owns one block north of California Street, he admitted he was nervous and noted the open house/homebuying activity had really slowed in his neighborhood as of late.

To assuage him, I said "maybe flat for five years? And then in 10 you'll see some gains?" He intimated that is generally the feeling he's gotten from the realtor and others.

And then he just shook his head and was silent. I'm certain the guy does very, very well.

I'm guessing he must have a big, fat, mortgage payment.

sf jack -

It wouldn't be a problem if people these days didn't think of their house as an investment. The only people who worry are those who bought with the intention of making $$$ (i.e., as an investment). They've made life extremely difficult for those folks who just want a place to live. I wager that investors are more willing to over pay for a property than are people who are just looking for a place to live.

Some of us don't have any trust in this industry, and finding a realtor who is honest, works for the buyers / sellers best interest, and has a high level of personal integrity, would be a great relief.

There's a realtor we've used here in Marin that we really like. I'm not advertising for the guy, but I'll provide the name on request--as long as the rest is up to you.

marinite -

I agree with much of your last comment.

I also believe that a lot of people who just wanted to have a place they could call home "over-stretched" dramatically.

Every situation, obviously, is unique and I don't know this guy well enough to know his overall thinking, but I would guess he's not a big risk-taker type. Though he did buy in the last couple years, if I recall.

Perhaps his silence was indicative that he's only thinking "what if" he, his wife and couple little kids want to (or have to) leave SF in a few years.

For another job, or whatever.

It might not be pretty. We've talked about this before - in the early 90's, there were sellers around here (and granted, maybe not many north of California Street) who brought checks to the closing.

I wager that investors are more willing to over pay for a property than are people who are just looking for a place to live. -marinite

Actually, I would argue the contrary. Investors don't need to

buy an investment property. Young families starting out will do whatever it takes for fear of getting left behind. Most investors base their decisions on cold hard facts, including rent ratios and appreciation -- if it does not look profitable in the long-term, they (we) wouldn't do it.

When I bought my last investment, I was in a bidding war(of course). I was prepared to make a reasonable offer but not do whatever it took to get it -- I was happy to walk away from the deal. Owner-occupiers get swept away with the emotion of imagining themselves living there -- that can cause some very irrational decision-making and justification.

Rejunkie here -- that was my post above. Put the verification in as my username, I did.(sigh)

Post a Comment