A -44.55% decline from the peak in single family residence prices in the San Francisco Bay area in just 18 months! Anathema!

A -44.55% decline from the peak in single family residence prices in the San Francisco Bay area in just 18 months! Anathema!

A place for residents of Marin County, CA and others to express their views regarding the real estate bubble and in particular the Marin real estate market

Wednesday, December 31, 2008

Price Decline from Peak

I found the following graphic over on Mish's blog. Please check it out for the whole story.

A -44.55% decline from the peak in single family residence prices in the San Francisco Bay area in just 18 months! Anathema!

A -44.55% decline from the peak in single family residence prices in the San Francisco Bay area in just 18 months! Anathema!

A -44.55% decline from the peak in single family residence prices in the San Francisco Bay area in just 18 months! Anathema!

A -44.55% decline from the peak in single family residence prices in the San Francisco Bay area in just 18 months! Anathema!

Friday, December 19, 2008

November YOY Results for "Immune" Marin

More year-over-year declines for Marin. Rather surprising considering we were supposed to have "dodged the subprime bullet". At least that's what the Marin IJ once quoted our esteemed local real estate industry as saying.

More year-over-year declines for Marin. Rather surprising considering we were supposed to have "dodged the subprime bullet". At least that's what the Marin IJ once quoted our esteemed local real estate industry as saying.From the Marin IJ:

Another month of plummeting home sales in Marin included a price drop of nearly 30 percent from November 2007, as discounted foreclosure sales continued to drive the Bay Area market. The median price of a single-family home in Marin last month was $790,000, down from $975,000 last year, MDA DataQuick reported Thursday. In October, the median single-family home price in Marin was $850,000. Realtor Peter Harris in Novato said bank-owned properties and short sales have made up about 85 percent of his business over the past year. ‘Prices are half of what they were,’ Harris said. ‘Condos are selling in the low $100,000s. We haven’t seen this for a long time.’From DataQuick:

By the way, the graphic for this post is from a May 16, 2007 IJ article. I saved it knowing this day would come.

By the way, the graphic for this post is from a May 16, 2007 IJ article. I saved it knowing this day would come.

Friday, November 28, 2008

This Thanksgiving I Give Thanks to All of You Who Made this All Possible

This post over at the Mess That Greenspan Made blog is down right scary -- by some estimates the potential cost of the bailouts will reach $8.5 trillion. Can we survive that? No way that is going to get paid back. Or this at Calculated Risk showing that the current bear market is the worst ever (on a percentage basis).

It seems to me that the genesis of this "crisis" was in the 1980s, the rise of yuppiedom, and has gotten progressively worse by an ever growing populous that more and more chose to finance their lifestyle with debt vs. wealth earned until it reached the point where people willingly paid ludicrous prices for houses, a college education, etc. For kids who came of age during this 28-year span, living on debt has been the norm. I feel the most sorry for them, the unwinding will be the hardest on them as they don't know any better. But for the rest of us boomers who have witnessed, and in far too many cases gleefully participated in, the entire life-cycle of this debt-investment craze, I have little sympathy. Blame Wall St., bankers, financiers, etc. all you want but in the final analysis no one held a gun to your head, no one made you agree to pay a stupid price for your house.

Really, is cheaper housing such a bad thing? Maybe it is for you who listened to the self-interested persuasion of a realtor/agent, you who bought in to the ludicrous pricing and was hoping to retire on the sale of a house. But think past yourself (if you're able). Think about your kids and your grandkids. Do we really want a future where so few can afford something as simple and as basic as a house? Do we really want to live in a nation so impoverished by desperate attempts to prop up prices that we know in our heart of hearts are insane, even still? Besides, we have truly important things to worry about, like a world wracked by global warming, the solutions to which will require personal sacrifice on a scale we of the post-war generations can hardly imagine, and an ability to think beyond our own selfish wants and desires.

But at the very least let's not ever forget the people who got it right, early, when action could have made a difference:

I hope you all enjoyed your Thanksgiving.

It seems to me that the genesis of this "crisis" was in the 1980s, the rise of yuppiedom, and has gotten progressively worse by an ever growing populous that more and more chose to finance their lifestyle with debt vs. wealth earned until it reached the point where people willingly paid ludicrous prices for houses, a college education, etc. For kids who came of age during this 28-year span, living on debt has been the norm. I feel the most sorry for them, the unwinding will be the hardest on them as they don't know any better. But for the rest of us boomers who have witnessed, and in far too many cases gleefully participated in, the entire life-cycle of this debt-investment craze, I have little sympathy. Blame Wall St., bankers, financiers, etc. all you want but in the final analysis no one held a gun to your head, no one made you agree to pay a stupid price for your house.

Really, is cheaper housing such a bad thing? Maybe it is for you who listened to the self-interested persuasion of a realtor/agent, you who bought in to the ludicrous pricing and was hoping to retire on the sale of a house. But think past yourself (if you're able). Think about your kids and your grandkids. Do we really want a future where so few can afford something as simple and as basic as a house? Do we really want to live in a nation so impoverished by desperate attempts to prop up prices that we know in our heart of hearts are insane, even still? Besides, we have truly important things to worry about, like a world wracked by global warming, the solutions to which will require personal sacrifice on a scale we of the post-war generations can hardly imagine, and an ability to think beyond our own selfish wants and desires.

But at the very least let's not ever forget the people who got it right, early, when action could have made a difference:

I hope you all enjoyed your Thanksgiving.

Thursday, November 20, 2008

It's Official

I'm sure you all remember that classic April 10, 2007 Leslie Appleton-Young quote in the Marin IJ that went "When is the 30 percent decline in Marin County's [real estate] market going to happen? Not in my lifetime"? I promised you then in a post that I would be "keeping this link for future use so we can rub it in her face when the time comes". Well, that time has come:

I'm sure you all remember that classic April 10, 2007 Leslie Appleton-Young quote in the Marin IJ that went "When is the 30 percent decline in Marin County's [real estate] market going to happen? Not in my lifetime"? I promised you then in a post that I would be "keeping this link for future use so we can rub it in her face when the time comes". Well, that time has come:Leslie Appleton-Young: Consider your face officially rubbed in it.

From DataQuick:

Saturday, November 08, 2008

Two Ways to Say the Same Thing

Here are two ways of saying the same thing. The first in 2007 and the second in a letter written 1802.

Withdrawal's a bitch, ain't it? Price things based on what people actually earn for themselves and it would all be reasonably affordable and "the economy" would still be humming along nicely. Stop meddling in the market Mr. and Mrs. Congressperson, Mr. Bernanke, Mr. Paulson. Let the free markets work; let them discover the correct prices of assets. Yes, it would be painful in the short term but we'd all be better off for it in the end.

As credit tightens and the credit pendulum swings the other way, those of you who bought with borrowed dollars thinking the sky's the limit and those of you who are planning to do so now had better watch out.

“I believe that banking institutions are more dangerous to our liberties than standing armies. If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around [the banks] will deprive the people of all property until their children wake-up homeless on the continent their fathers conquered. The issuing power should be taken from the banks and restored to the people, to whom it properly belongs.”The reason why we are in this mess is credit -- too much of it, too cheap. That's why housing, tuition, etc. went through the roof. Now our country is desperately dependent upon it and doing everything it can to prop up these phoney prices.

Thomas Jefferson, Letter to the Secretary of the Treasury Albert Gallatin (1802), 3rd president of US (1743 - 1826)

Withdrawal's a bitch, ain't it? Price things based on what people actually earn for themselves and it would all be reasonably affordable and "the economy" would still be humming along nicely. Stop meddling in the market Mr. and Mrs. Congressperson, Mr. Bernanke, Mr. Paulson. Let the free markets work; let them discover the correct prices of assets. Yes, it would be painful in the short term but we'd all be better off for it in the end.

As credit tightens and the credit pendulum swings the other way, those of you who bought with borrowed dollars thinking the sky's the limit and those of you who are planning to do so now had better watch out.

Tuesday, October 28, 2008

Canadian L33t

I've tried very hard not to get political on this blog, but....

I think I found a program that should appeal to Bay Arean ego in the unlikely event that the republican candidate for the US presidency is elected:

I think I found a program that should appeal to Bay Arean ego in the unlikely event that the republican candidate for the US presidency is elected:

Sunday, October 26, 2008

Where Are You?

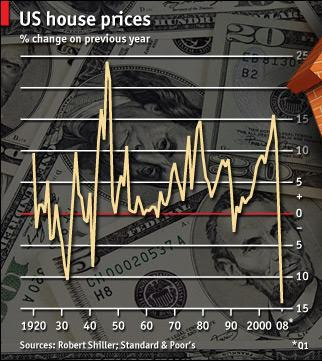

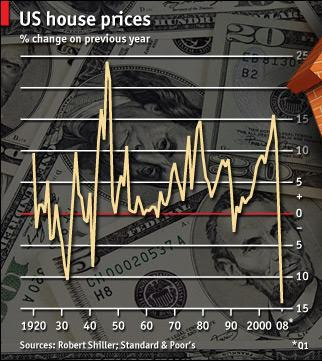

Starting with some quotes from someone who has been nothing but sober and sane (Robert Shiller) when the majority of people were drunk on the notion that houses were going to make us all rich and 20% per year appreciation was our God given right:

Starting with some quotes from someone who has been nothing but sober and sane (Robert Shiller) when the majority of people were drunk on the notion that houses were going to make us all rich and 20% per year appreciation was our God given right:What have we learned from all this?And one from another independent thinker:

I think we've learned some very elementary lessons. Don't think that because something didn't happen for the last 30 years it won't happen. It's amazing how people thought home prices can only go up.

One thing people haven't learned very well is home prices can stay down for 30 years, too. I'm not saying it will. It certainly can happen. Most people still think this is just a temporary interruption and real estate prices are going to soar soon. The real estate market is not cheap yet. It's not to where this bubble started (in late 1998).

"People are saying the reason prices are falling are because of all of the foreclosures, but the foreclosures are happening because the prices are falling.Enough bad news. Now for the good news, care of our friends at DataQuick (these days I like using DataQuick's numbers because when the bubble was still in inflation mode here in Marin, Marin RE bulls liked to use it as proof-positive that real estate in Marin can only go up because we are so damn special): Marin real estate was down only 16% last month (so sales that were committed to in late summer, before the recent financial shister hit the fan):

They've got it backwards. The prices are falling because they're too freakin' high."

Chris Thornberg, August 27, 2008

I think it is now safe to say we have a trend here in Marin. I eagerly await the unambiguous cratering of South Marin. Only then can our arrogance and hubris be taken down a notch or two (I can hope, can't I?).

I think it is now safe to say we have a trend here in Marin. I eagerly await the unambiguous cratering of South Marin. Only then can our arrogance and hubris be taken down a notch or two (I can hope, can't I?).Oh, and lest I forget some choice quotes from our local rag that has been nothing but a flagrant cheerleader of the housing market when "things were good" and the Marin real estate industry's poodle. But first, the article's title:

"Condo sales buck up Marin home sales as prices continue to fall"Since when do condo sales "buck up" real estate in Marin? Isn't that ars-backwards for us? What does that imply for single family residences? So bottom fishers are buying the cheapest properties. Isn't that a little like the floor dropping from under your feet?

Marin's home sales increased on the strength of condominium sales last month while prices continued to drop...So where are the Marin RE bulls who used to visit this blog and try to explain how confused the rest of us were? RE Junkie? Where are you? Fredtobik, where are you? (For me, the two most memorable ones; perhaps you recall others.) You were all so (how do I put this politely?)... "adamant" about your opinions. And what about the legion of anonymous realtor cowards? Where are you? You can still wear your shorts in the winter and play golf; and it's still only a two hour drive to the slopes! All your self-serving justifications and rationales are still intact. Ok, so maybe the "gas prices are going up so people will want to live in South Marin" thing isn't working out for you at the moment. But where are you? And where's that fellow who fairly recently came on this blog explaining to us why CDOs and other financial wizardry were such great ideas and, despite what we thought, were here to stay? Where are you?

DeSalvo [a Coldwell Banker broker] said county foreclosures weren't [!!!] confined to condominiums or property sales in San Rafael or in Novato, where foreclosures and short sales make up 30 percent of the real estate market.

"Houses that were selling for $675,000 are on the market for less than $450,000," he said.

In Marin, foreclosure sales - homes sold in September that had been foreclosed on in the prior 12 months - accounted for 14.9 percent of total sales, continuing a steady increase from 13.5 percent in August and single digits a year ago.

"My personal opinion is until buyers' fears are allayed and the jumbo loan market is at equilibrium, we're going to continue to see uncertainty. We're going to see this for the next 18 months."

Look, others had the courage to start blogs saying "it's not necessarily so" at a time when house prices were doubling about every year or so; true mavericks like Patrick.net, BubbleMeter, The Mess Greenspan Made, Mish, Calculated Risk, just to name a few. Now is your best opportunity to show us what you're made of, to stand up for what you really believe. Lay it on us...

Just one rule, spare us the "things will get better, prices always go up eventually" line of reasoning. No one here will disagree with you as it is necessarily true given our inflationary system.

Friday, October 10, 2008

Welcome Again to the "Ownership" Society

No need to discuss recent events (of course, you may if you wish); they speak for themselves. Suffice it to say that Patrick.netters said it best: the American people got "owned" yet again.

No need to discuss recent events (of course, you may if you wish); they speak for themselves. Suffice it to say that Patrick.netters said it best: the American people got "owned" yet again.I encourage you to re-read the U.S. Declaration of Independence (here to see the original) for inspiration. It's a beautiful document; it represents the founding spirit of our nation; read it with pride.

The following sentence represents the essential message of the document:

But when a long train of abuses and usurpations, pursuing invariably the same Object evinces a design to reduce them under absolute Despotism, it is their right, it is their duty, to throw off such Government, and to provide new Guards for their future security.In other words, for those who have the means it is not just their right but their responsibility to effect change.

Recent events are the culmination of "a long train of abuses". The only real question now is what do we do about it?

Monday, September 22, 2008

"The Mother of All Bailouts"

Nope. Housing prices make a whole lot of sense; completely justified. Yup. No housing bubble here.

Nope. Housing prices make a whole lot of sense; completely justified. Yup. No housing bubble here.WASHINGTON (AP) — The Bush administration insisted Sunday that Congress must move quickly to approve what one lawmaker called the "mother of all bailouts" — a $700 billion proposal to buy a mountain of bad mortgage debt in an effort to unfreeze the nation's credit markets.And

However, congressional leaders said the administration's spare three-page plan must be expanded to include help for people on Main Street as well as the big Wall Street financial firms who have lost billions of dollars through their bad investment decisions.

The plan the administration has developed with support from the Fed would have the government buy up to $700 billion of the bad loans, taking them off the books of financial firms... Sen. Richard Shelby of Alabama, the top Republican on the Senate Banking Committee, said the government's efforts would be the "mother of all bailouts" that could well cost $1 trillion when the cost of the government takeovers of Fannie, Freddie and AIG were included.

The whole congressional debate [on the bailout] is occurring just weeks before voters go to the polls.

(CBS) Treasury Secretary Henry Paulson defended the Bush administration's proposal to spend up to $700 billion to buy up bad debt of financial institutions struggling with illiquid assets (such as defaulted mortgages), saying not acting would have jeopardized the possibility of anyone getting a loan - and may have jeopardized Americans' savings and retirement funds.Oh, and while we're at it, let's have the U.S. taxpayer bail out foreign financial institutions and governments too.

Of course, bailing out incompetence, failure, fraud, speculators, and the like (foreign or otherwise) is wrong as wrong can be. But for some reason that last quote from CBS really got to me... the one about how we have to save people's retirement accounts.

Don't get me wrong. Despite what you read on this blog, I don't like the idea of people losing their house and/or their retirement funds any more than the next gal. But come on! People gambled. People have been gambling with their retirement! That's what it means to pay obviously ridiculous prices for houses (and doing so as part of your retirement plan). That's what it means to put you retirement in the stock market (401K, mutual funds, what have you). It's gambling and no one can claim ignorance as people make a point of highlighting the risky nature of the markets even clear way back when the move to 401Ks first started and was viewed with some skepticism. The stock and bond markets (etc.) are inherently risky. It's little different than putting your entire retirement on red 99 (refer to the graphic for this post). Don't put your money into those markets if you cannot afford to lose it. That's rule numero uno in the investing world.

[Begin sarcasm]

But if we are going to bail out risk-takers who lost, then shouldn't we just bite the bullet and remove all risk from the stock market? Let's make it more like the housing market which is rigged to (almost) always go up. Let's say that it is now illegal (not just temporarily stopped) to short the market; no more puts. Let's say that you can only buy a stock as long as you are willing to only pay more than the last price paid for that stock. In fact, let's call it what it is and not call it a "market" anymore... certainly not a free and open one. Let's call it "Social Security 2.0".

I like kleptocracy*. You will like it too (not that you have any choice anymore). And besides, Paulson will make for a good king of America.

*"A kleptocracy (sometimes cleptocracy, occasionally kleptarchy) (root: klepto+kratein = rule by thieves) is a term applied to a government that extends the personal wealth and political power of government officials and the ruling class (collectively, kleptocrats) at the expense of the population.

*"A kleptocracy (sometimes cleptocracy, occasionally kleptarchy) (root: klepto+kratein = rule by thieves) is a term applied to a government that extends the personal wealth and political power of government officials and the ruling class (collectively, kleptocrats) at the expense of the population.The effects of a kleptocratic regime or government on a nation are typically adverse in regards to the faring of the state's economy, political affairs and civil rights. Kleptocracy in a government often results in a severe deficit of foreign investment prospect, and drastic weakenings in the market and exportation/importation affairs. As the kleptocracy often embezzles its money from its citizens by misusing funds derived from tax payments, or money laundering schemes, a kleptocractically structured political system can be degrading to the quality of life of the general populace. In addition, the stolen funds that kleptocrats take to their own gain is often removed from funds that were to go towards public improvements, such as the building of hospitals, schools, roads, parks and the like, bringing about yet further adverse effects on the quality of life of the citizens living under a kleptocracy."

[End sarcasm?]

Update: Mish has a convenient way for you to blast emails, all at once, to all senators with a single click of a link. Check it out.

Thursday, September 18, 2008

August Results for Marin Care of DataQuick

According to DataQuick, Marin prices were down -25% year-over-year in August; 13.5% of sales in Marin were foreclosures. Sheesh! Alt-A and Prime resets haven't even started yet.

"Mortgage money for homes above the half-million-dollar mark is hard to come by right now, even for well-qualified buyers..." said John Walsh, MDA DataQuick president.And if bailing out incompetence and failure right and left (at taxpayer expense) isn't enough of a show for you, well how about Paulson's latest grand scheme to set up an entity to buy all that toxic paper from the current bag holders at the lowest bidding price? Don't want to mark to market? We'll let you do it to each other! Since that cannot really be allowed to happen, because, you know, everyone has to be a winner and our rickety system cannot tolerate losses of any kind, you know there is going to be a lot of behind-the-scenes monkeying around. I can't wait.

The use of so-called jumbo mortgages, until recently defined as over $417,000, has plummeted since the credit crunch hit in August 2007, making jumbo loans more expensive and harder to obtain.

The typical monthly mortgage payment that Bay Area buyers committed themselves to paying was $2,121 last month, down from $2,218 the previous month, and down from $3,171 a year ago. Adjusted for inflation, current payments are 18.5 percent below typical payments in the spring of 1989, the peak of the prior real estate cycle.

Foreclosure activity is at record levels, financing with adjustable-rate mortgages is near the all-time low, as is financing with multiple mortgages.

Sunday, September 07, 2008

Today is Your Day

As anticipated a couple of years back, Fannie Mae and Freddie Mac have finally failed, are getting bailed out, and we are one big step closer to nationalizing the mortgage market; from here on out, you and I will be supporting the U.S. mortgage market. Welcome to what will likely be revealed to be the (second) largest public bailout in the history of the world (this might have been bigger)!

As anticipated a couple of years back, Fannie Mae and Freddie Mac have finally failed, are getting bailed out, and we are one big step closer to nationalizing the mortgage market; from here on out, you and I will be supporting the U.S. mortgage market. Welcome to what will likely be revealed to be the (second) largest public bailout in the history of the world (this might have been bigger)!To those of you who argued that there was no housing bubble, that it was a New Paradigm, that property prices are justified because of blah, blah, blah bogus, mythical, because-my-realtor-said-so, wishful thinking sorts of reasons: your collective work has come to fruition. Aren't you proud to have contributed to it all? Aren't you happy to have been able to ignore all common sense, logic, and data to the contrary so as to so willingly and blindly pay such a patently stupid, ridiculous price for a house? Today is your day! Celebrate.

Generations to come will remember us all as the most callous, profligate, spoiled, narcissistic, and self-entitled generation in the history of America (or maybe even all of mankind). When thinking of their ancestors, your children, your grand children, and your great grand children will look back at you in their dusty old genealogy books and photo albums with hatred and disgust for strapping them with your crushing debt.

But you will be dead; so what do you care? Right?

Update 09/09/08: Here is what Jimmy Rogers had to say about the Fannie & Freddie bailout:

"America is more communist than China is right now. You can see that this [the F&F bailout] is welfare of the rich, it is socialism for the rich... it's just bailing out financial institutions."You can hear him yourself by watching this video.

Wednesday, August 20, 2008

July, 2008 Results

According to DataQuick Marin prices are down -13.2% this past July, year-over-year:

The following graphic, also from DataQuick, shows that Bay Area prices are down almost to the peak of the last, normal, housing cycle (2003-04 timeframe) from which the recent housing bubble launched prices to the stratosphere. So it seems reasonable to wager that we have much further to fall:

The SF Chronicle had this (and this) to say:

I know I should not give that hack, Leslie "over my dead body" Appleton-Young, any of my attention, but:

There is no way in hell anyone (other than sellers, of course) should want lending standards and practices to return to the way they were during the bubble. This is exactly the sort of false hope people like Hickman are trying to instill and is akin to the fear mongoring ("buy now or be priced out forever", etc) his industry routinely engaged in during the run-up. The fact is, Mr. and Mrs. Marin Seller, the only way bubble-level pricing can be maintained is to return to bubble-era lending practices. Of course, there are other ways to support your wishing prices, such as buyers suddenly getting a mass windfall, 300% raises, etc., but I wouldn't count on it.

The following graphic, also from DataQuick, shows that Bay Area prices are down almost to the peak of the last, normal, housing cycle (2003-04 timeframe) from which the recent housing bubble launched prices to the stratosphere. So it seems reasonable to wager that we have much further to fall:

The SF Chronicle had this (and this) to say:

The percentage of households able to buy an entry-level residence in the state reached 48 percent during the second quarter, double the level from a year ago, according to the California Association of Realtors. The Bay Area remains the least affordable part of the state, but 32 percent of its households can now afford a first home, up from 18 percent during the second quarter of 2007, the report said.Now is that affordability calculation based on the one using your new method (which is now invalid given that it depends on the existence of the loose lending standards which got us into this mess, almost nothing down, non-fixed rate loans; refer to item 14 in the linked-to post) or the traditional method?

Andrew LePage, an MDA DataQuick analyst, said he thinks the bottom is not imminent - and is unlikely to usher in a quick turnaround. "Recent history suggests you could be looking at at least two or three years of price stagnation," he said. "It’s looking like the bottom will feel more like a bog than something you just bounce off of.""The bottom is not imminent"? Now there's a change of tune.

I know I should not give that hack, Leslie "over my dead body" Appleton-Young, any of my attention, but:

"People are off the sidelines, stepping in, trying to gauge the bottom of the market and feeling that, even if this isn’t quite the bottom, it’s looking great," said the group’s chief economist Leslie Appleton-Young. "They’re able to get into something they never thought was possible a year or two ago."Sorry Leslie, at the moment those "knife catchers" are mostly in places like Napa where people are buying the discounted houses thus solidifying the new (lower) price structure:

Sonoma County’s summer home sales surge continued in July as buyers snapped up discounted properties shed by lenders and financially strapped homeowners.And I hate to do it, but here is what the Marin IJ had to say (after weeding out their attempts at happy-talk and feel-good journalism):

In Marin, foreclosure resales were 11 percent of total sales. Valerie Castellana, an agent in Greenbrae and past president of the Marin Association of Realtors, said sellers need to be "really astute in their pricing strategy these days."Yes, in other words sellers need to substantially lower prices if they hope to sell sooner rather than later.

Buyers remain anxious. "They want to make sure they’re not overpaying," she said. "Many of them are holding off because of that anxiety level."Smart buyers.

He said such buyers are facing a more restricted market for home loans. "We’re in a knee-jerk reaction from where we were before," Hickman said. "The pendulum has gone back 180 degrees. It’s extremely difficult to get money right now."I beg to differ. Lending is returning to what it was prior to the bubble and where it should be. We are not even close to where it was at the start of the last, normal, housing cycle. So the pendulum has swung only about 90 degrees; we have another 90 or so to go.

There is no way in hell anyone (other than sellers, of course) should want lending standards and practices to return to the way they were during the bubble. This is exactly the sort of false hope people like Hickman are trying to instill and is akin to the fear mongoring ("buy now or be priced out forever", etc) his industry routinely engaged in during the run-up. The fact is, Mr. and Mrs. Marin Seller, the only way bubble-level pricing can be maintained is to return to bubble-era lending practices. Of course, there are other ways to support your wishing prices, such as buyers suddenly getting a mass windfall, 300% raises, etc., but I wouldn't count on it.

Wednesday, August 06, 2008

Chronicle Chart

The SF Chronicle's chart of our "immune" housing market:

The important columns to look at are the percent change in sales and price/ft^2.

This is just a "flesh wound" from the subprime bullet (that wasn't even aimed at us) and the resultant disintegration in the financial markets. What will this chart look like when the real problem, Alt-A loans, etc., soon begins to blow up I wonder?

The important columns to look at are the percent change in sales and price/ft^2.

This is just a "flesh wound" from the subprime bullet (that wasn't even aimed at us) and the resultant disintegration in the financial markets. What will this chart look like when the real problem, Alt-A loans, etc., soon begins to blow up I wonder?

Sunday, August 03, 2008

Conflicts of Interest

I saw this Glenn Beck video posted over at the Housing Panic blog (kudos). Very funny.

Takeaway message:

Of course, the irony of all this is that people like me, who have spoken out against the biases and the inherent conflicts of interest in the real estate industry and who have tried to make the case that a real estate bust was likely, had to rely on data that came, for the most part, from the real estate industry (the "REIC") itself. This is sad for two reasons: 1) It indicates how much we need an unbiased, third-party source of real estate information; and 2) The "REIC's" own data, spun and massaged as it was by realtors and agents, still made the case for a real estate bust.

Takeaway message:

"If you want honest advice about your home, don't listen to the people who are trying to make a living selling them."Lawrence Yun, Leslie Appleton-Young, David Lereah, and all you Marin six-percenters, take note.

Of course, the irony of all this is that people like me, who have spoken out against the biases and the inherent conflicts of interest in the real estate industry and who have tried to make the case that a real estate bust was likely, had to rely on data that came, for the most part, from the real estate industry (the "REIC") itself. This is sad for two reasons: 1) It indicates how much we need an unbiased, third-party source of real estate information; and 2) The "REIC's" own data, spun and massaged as it was by realtors and agents, still made the case for a real estate bust.

Saturday, August 02, 2008

"Honey-poo, Why Is the Kitchen Glowing?"

Granite countertops were all the rage and the latest brain dead, "must have", keep-up-with-the-Joneses housing accouterment here in Marin (and pretty much everywhere else in bubble markets). Well, it seems that if you are shopping for a trendy Marin house you would be wise to bring your Geiger counter with you.

Granite countertops were all the rage and the latest brain dead, "must have", keep-up-with-the-Joneses housing accouterment here in Marin (and pretty much everywhere else in bubble markets). Well, it seems that if you are shopping for a trendy Marin house you would be wise to bring your Geiger counter with you.Thanks to a reader for sending me this link.

Tuesday, July 29, 2008

Case-Shiller Index for May, 2008

Here's the latest on the Case-Shiller Index.

Here's the latest on the Case-Shiller Index.Line up all those lying real estate "economists", realtors, and agents who said it couldn't happen here, it's different this time, a permanently high plateau, etc., and just cover them in tar and feathers and parade them around their neighborhoods (metaphorically speaking, of course). All they managed to do was to line their pockets with another 6% and screw a lot of people.

Monday, July 28, 2008

Where I've Been and Some Quick Thoughts

Some people are wondering where I've been. I've been traveling. No internet. No laptop. No cell phone. So I have had little information regarding all things housing bubble.

Looking at recent past news, it seems prices in Marin went up ever so slightly (5.8%) back in May -- I bet the local housing bulls and the Marin real estate industry wet their collective pants over that. Too bad prices lost -12% the following month in June. No doubt the worthless Marin IJ made excuses.

I was not at all surprised to see the latest panic bail-out of Fannie Mae and Freddie Mac. No surprise there that these two GSEs went or, at the very least, were on the brink of insolvency. This bail-out represents the pinnacle of my disgust with the US government. Yes, letting the bubble self-correct would be painful. But it would not be disastrous; it would, in the medium to long term, be healthy. All the government has done is to prolong the inevitable and thereby, in the end, make it worse than it would otherwise be. But that will be a problem for another administration.

Oh, and runs on banks, here in the US. And more to come. We haven't seen those in a long while.

But really, this has been playing out as expected. And thanks to the ineptitude of the US government and its inability to identify and address the causes of the housing bubble (not to mention its refusal to take responsibility for its own role in this mess along with its systematic dismantling of what little of a free-market we have in housing) it's just going to take longer than it otherwise would.

I leave you with Ron Paul's comments on the recent bail-out and the changes now entered into law:

Does it really matter? And does anybody remember how many times we had to suffer through the imbecilic "it's different this time" mantra spewed by the real estate industry?

Looking at recent past news, it seems prices in Marin went up ever so slightly (5.8%) back in May -- I bet the local housing bulls and the Marin real estate industry wet their collective pants over that. Too bad prices lost -12% the following month in June. No doubt the worthless Marin IJ made excuses.

I was not at all surprised to see the latest panic bail-out of Fannie Mae and Freddie Mac. No surprise there that these two GSEs went or, at the very least, were on the brink of insolvency. This bail-out represents the pinnacle of my disgust with the US government. Yes, letting the bubble self-correct would be painful. But it would not be disastrous; it would, in the medium to long term, be healthy. All the government has done is to prolong the inevitable and thereby, in the end, make it worse than it would otherwise be. But that will be a problem for another administration.

Oh, and runs on banks, here in the US. And more to come. We haven't seen those in a long while.

But really, this has been playing out as expected. And thanks to the ineptitude of the US government and its inability to identify and address the causes of the housing bubble (not to mention its refusal to take responsibility for its own role in this mess along with its systematic dismantling of what little of a free-market we have in housing) it's just going to take longer than it otherwise would.

I leave you with Ron Paul's comments on the recent bail-out and the changes now entered into law:

Does it really matter? And does anybody remember how many times we had to suffer through the imbecilic "it's different this time" mantra spewed by the real estate industry?

Tuesday, June 10, 2008

Affordable Housing, It's the Right Thing to Do

Another opinion piece in the IJ about Marin's obstinate refusal to build its state mandated "fair share" of affordable housing. This time Sausalito, Fairfax, and Larkspur are put under the spotlight.

Another opinion piece in the IJ about Marin's obstinate refusal to build its state mandated "fair share" of affordable housing. This time Sausalito, Fairfax, and Larkspur are put under the spotlight.Like a spoiled and self-indulgent child, it seems that we have to be forced to do it.

This quote jumped out at me:

Over the years, [Marin] cities and towns have approved plans for sales-tax-rich shopping centers, revenue-generating hotels and business campuses, but they have shown less interest in providing housing for workers who fill the jobs created by those projects.In other words, Marin has no problem whatsoever building property that generates lots and lots of sales tax and we don't seem to care one whit about its resulting increase in traffic. Yet when it comes to building affordable housing, of which roughly 58% of the occupants would work within 10 minutes of the jobs located on the sales-tax-rich property (according to the opinion piece), suddenly the increase in traffic argument kills the deal.

Another argument we Marinites like to pull out and dust off at times like these is The Environment... building affordable houses (but not unaffordable houses it seems) causes an increase in traffic, more pollution, loss of open space, etc. and therefore it is bad for the environment. But if we really were the environmentalists we like to think of ourselves as, then building affordable housing would be seen as the environmentally-friendly policy that it is due to the vastly shortened commutes to Marin and San Francisco jobs.

But of course, these sorts of argument are moot here in fantasy land. The real reason why Marinites are opposed to building the state mandated amount of affordable housing is their perceived loss in property values. Never mind the actual validity of such a concern as we all know that in Marin increased property value is our god-given right and we cannot do anything that might, no matter how improbable, threaten those property values.

And yes, I know Marin is not unique with regards to this form of hypocrisy; I don't pretend that it is. But that doesn't make it right and that does not mean we shouldn't bring public attention to it at every available opportunity.

Besides, given our proximity to San Francisco, a major employment center, it's the right thing to do.

Hypocrisy can only exist in a moral world. If we are not being hypocritical, does that mean we are an amoral county? Ok, now I am being weird; I admit existentialism isn't my thing; just a random, passing thought while closing this post.

Sunday, June 08, 2008

What About the 'We're Rich' Argument?

- Rep. Laura Richardson (D-Long Beach)

- Ed McMahon

- Evander Holyfield

- Michael Jackson

- Letrell Sprewell

- Aretha Franklin

- Jose Conseco

Wealthy individuals can buy more expensive houses and have more assets to draw from, but they can be just as "stretched" as any working class nine-to-fiver as they are just as susceptible to societal pressure to buy more than they need, to "keep up with the Joneses", to obtain bragging rights to their friends and family, etc.

At the very least my hope is that the pain from the housing bubble bust, and the public record provided by the housing bubble blogs, will finally and once and for all teach people to ignore all the easy, self-serving, "rational" sounding "explanations" realtors/agents, etc., peddle to the gullible masses to keep them buying and so mindlessly and willingly paying ridiculously high prices. My hope is that realtors/agents will finally and once and for all be discredited as definitive sources of real estate related information.

Monday, June 02, 2008

Map of Prime-Rated Loan Foreclosures

sf jack spotted this graphic showing areas where prime loans are starting to blow up:

Yes, Marin is one of them. If you are having trouble seeing that our tiny county is one of many in the most distressed category, according to this analysis, here's a closer view:

Yes, Marin is one of them. If you are having trouble seeing that our tiny county is one of many in the most distressed category, according to this analysis, here's a closer view:

Yes, Marin is one of them. If you are having trouble seeing that our tiny county is one of many in the most distressed category, according to this analysis, here's a closer view:

Yes, Marin is one of them. If you are having trouble seeing that our tiny county is one of many in the most distressed category, according to this analysis, here's a closer view:

Wednesday, May 28, 2008

'Prices Are Falling Because They Were... Ridiculously High'

Updated 05-29-2008, see below.

SFGate.com had this to say:

SFGate.com had this to say:

- - -

The latest Case-Shiller Index; perhaps the best authoritative measure of the housing markets (PDF can be obtained here): SFGate.com had this to say:

SFGate.com had this to say:In the San Francisco area, which Case-Shiller defines as the counties of San Francisco, Alameda, Contra Costa, Marin, San Francisco and San Mateo, the one-year price decline from March 2007 stood at 20.2 percent. The decline from February to March was 3.5 percent.Here's what the Economist had to say (emphasis mine):

The Bay Area’s year-over-year price slump was the sixth steepest of 20 major metropolitan areas tracked by the index.

"Prices are falling because they were too high - ridiculously high," said Christopher Thornberg, principal of Beacon Economics in San Francisco. "They’re now in the process of going back to a more normal level. Frankly, that’s a good thing."

Thornberg said he thinks prices could return to year 2000 levels.

AS HOUSE prices in America continue their rapid descent, market-watchers are having to cast back ever further for gloomy comparisons. The latest S&P/Case-Shiller national house-price index, published this week, showed a slump of 14.1% in the year to the first quarter, the worst since the index began 20 years ago. Now Robert Shiller, an economist at Yale University and co-inventor of the index, has compiled a version that stretches back over a century. This shows that the latest fall in nominal prices is already much bigger than the 10.5% drop in 1932, the worst point of the Depression. And things are even worse than they look. In the deflationary 1930s house prices declined less in real terms. Today inflation is running at a brisk pace, so property prices have fallen by a staggering 18% in real terms over the past year.

Tuesday, May 20, 2008

DataQuick Results for April, 2008

Here are the April, 2008 results from DataQuick:

The median price in Marin is down -13.5% year-over-year. Last month it was -4.5%, before that about -6.5%, and before that -5.5%. Marin is currently down about -29% from the peak.

The median price in Marin is down -13.5% year-over-year. Last month it was -4.5%, before that about -6.5%, and before that -5.5%. Marin is currently down about -29% from the peak.

I don't know about you, but I hope Leslie Appleton-Young is making regular trips to her doctor at least judging by this quote she made back in April, 2007:

The median price in Marin is down -13.5% year-over-year. Last month it was -4.5%, before that about -6.5%, and before that -5.5%. Marin is currently down about -29% from the peak.

The median price in Marin is down -13.5% year-over-year. Last month it was -4.5%, before that about -6.5%, and before that -5.5%. Marin is currently down about -29% from the peak.I don't know about you, but I hope Leslie Appleton-Young is making regular trips to her doctor at least judging by this quote she made back in April, 2007:

"It's God's country, what can I say," Leslie Appleton-Young, chief economist for the California Association of Realtors, told an audience of agents Tuesday in Terra Linda. "When is the 30 percent decline in Marin County's market going to happen? Not in my lifetime."And I can't let this, from the Marin IJ the other day, pass without some comment (emphasis mine; the graphic is from foreclosure.com -- this time last year the "preforeclosure" number for Marin was 168 compared to the 478 of today, and this time 2006 it was a paltry 35):

"Saw this coming"? What the...!? Not likely; this blog is testament to that. Your industry time and time again refused to deal honestly with the public. Your industry, and yes, I am also most certainly including the real estate industry in Marin, did nothing but engage in disinformation, overt manipulation, and general fear mongering to prop up buying activity and to line your own pockets with ever larger commissions. Need I remind you of incessant talk about how we are immune, we're "special", about how prices can only go up, about how Marin real estate will never lose value, "buy now or be priced out forever", distorted statistics, egregious propaganda sponsored by your industry in our local media? The list goes on and on and is documented to some extent here on this blog. Don't you dare now say "you saw this coming". Yes, we (the readers of this blog) saw this coming but probably not you and certainly not your industry. But if you did happen to foresee this, were you out actively warning your clients that they might be making the biggest financial mistake of their lives; that perhaps they would be better off postponing a purchase? I didn't think so.A crumbling Marin housing market is booming business for Coldwell Banker broker George DeSalvo. The veteran agent deals in real estate owned, or REO, properties that have gone through foreclosure and into bank ownership. DeSalvo described today’s market as the worst he’s seen. "I think this has close enough parity to foreclosures that took place during the Depression," said DeSalvo, a Novato resident who works out of Greenbrae.

Edward Segal, CEO of the Marin Association of Realtors, said he has seen "a big spike" in member requests for workshops on foreclosures, short sales and REOs over the past six months. One such session last month was standing-room only.

Realtor Vince Gramalia in San Rafael, has practiced real estate in Marin for more than 30 years but spends about 75 percent of his time dealing with REO properties these days.

"Being in the business for a while, I was aware of it since the early '70s," he said. "We went through a couple phases like this, and we saw this coming."

Thursday, May 08, 2008

Monday, May 05, 2008

Wednesday, April 30, 2008

"Crushing Hopes of an Imminent Turnaround"

I decided to break in my new scanner with today's Chronicle's front page. You gotta love it... falling prices that is. After all, cheaper houses are a good thing; just like cheaper gas, food, cars, etc. are good things.

I decided to break in my new scanner with today's Chronicle's front page. You gotta love it... falling prices that is. After all, cheaper houses are a good thing; just like cheaper gas, food, cars, etc. are good things.Here are some choice quotes from the print edition of the article:

Like a brick falling from the top of the Transamerica Pyramid, national and local home prices are rapidly accelerating on their way down, crushing hopes of an imminent turnaround.He was shocked, shocked!

The cost of a typical Bay Area home plunged 17.2 percent year-over-year in February, compared with 13.2 percent in January and 10.8 in December...

"Prices have a lot of room to fall," said Patrick Newport, an economist with Waltham, Mass., research firm Global Insight Inc. "We could see some really big drops."

Stephen Levy, senior economist at the Center for Continuing Study of the California Economy in Palo Alto, said the early, enormous price declines in areas like Stockton and Fresno are filtering into the Bay Area.

"Even though we don't have the high foreclosure rates, housing is a market and prices here are connected to prices in adjoining areas," he said.

Michael Carney, director of the Real Estate Research Council of Northern California, said he was "shocked" that the Bay Area number fell as far as it did, but echoed Newport in saying the accelerating decline means the worst is to come.

LOL

No shock to us. So far it is, for the most part, going according to the script. And yes, the worst is yet to come... we are still waiting for Alt-A resets which are our time bombs. Furthermore, now that the "low end" is cratering there is room for that upper end to not just crack but cave.

And what about all those sellers who have taken their houses off the market, waiting for a better market environment? Unless you are willing to wait many years, you are missing out on the best it is going to get for a while.

Perhaps it is time to re-visit that prescient The Economist article from June 16, 2005. You remember, the one that featured this cover which seems so appropriate now:

And my thanks to reader Lisa for flagging this IJ article:

Marin Assessor Joan Thayer told county supervisors Monday her department could be overwhelmed if the number of residents seeking reassessment of their homes continues to rise. Thayer expects as many as 1,000 of Marin's 74,750 homeowners to request a reevaluation of their home's assessed value by the end of the fiscal year in June - a figure she said had "doubled and may have tripled" in the past year.And I must say, isn't it about time that our local media stops with the 'well, at least it isn't as bad here as it is elsewhere' misdirection?

Friday, April 18, 2008

March Results

March results (care of DataQuick) for Marin as reported by the Marin IJ:

And I think this point made by the Calculated Risk blog about the March Bay Area sales results, and made here before as well, is worth repeating:

The median price of a single-family home last month was $862,500, down from $965,000 a year earlier, and just 110 single-family homes were sold - about half as many as the 218 sold in March 2007, DataQuick reported. Sales totals ‘were easily the slowest March in Marin,’ said John Karevoll, a DataQuick analyst, who noted the research firm’s records date back to 1988.

"This is a pitifully low sales count is more of an illustration of what is not going on, rather than what is going on," Karevoll said, noting March figures were a record low for the Bay Area as well.

"Sellers are still trying to overprice their homes and nobody is falling for it any more," said real estate agent Celine von May.

The county’s inventory of 1,401 homes for sale is up from the 1,087 properties on the market at this time last year, said Levi Swift, president of the Marin Association of Realtors.

The 213 properties in default in March is up 14 percent from February and 167 percent from a year ago, according to ForeclosureRadar.

- Marin's housing market is described as "pitiful". Check.

- Marin sellers are still in denial. Check.

- The median price of a Marin house in March, 2008 has fallen more than $100,000, or 11%, from what it was in March, 2007. Check.

- There is nearly a 13 month supply of houses on the market in Marin. Check.

- 15% of the houses on the market in Marin are currently in default. Check.

- 50% reduction in sales as compared to last year. Check.

And I think this point made by the Calculated Risk blog about the March Bay Area sales results, and made here before as well, is worth repeating:

This is why the Case-Shiller repeat home method is better than the median price method for calculating home price changes. Using the median price method, it appeared prices were holding up pretty well at the beginning of the housing bust simply because the mix changed - fewer low end homes were sold. Now it's the high end being hit. And finally ...

Saturday, April 12, 2008

Just Say "No"...

... to mortgage bailouts. That's what the Heritage Foundation is saying.

... to mortgage bailouts. That's what the Heritage Foundation is saying.And who pays for this bailout? Not ‘‘the government.’’ It’s all the responsible homeowners and renters who resisted the temptations of the housing boom, refused taking out a home equity loan to fund a vacation or new car, declined to buy a home with no down payment, ignored the low teaser rates dangled by shyster brokers. Meanwhile, the homeowners who yielded to temptation are offered an escape hatch. Who pays? In short, you pay - unless you’re getting a bailout.I am one of those responsible people; you probably are too. I absolutely do not want to pay bail out money to those people and organization who could not act responsibly; I doubt you do either. The thought of such bail outs is utterly infuriating, outrageous.

Where does the bailout business stop? Simple. It stops at the beginning - by saying no to bailouts, subsidies and slush funds.

Please visit this site dedicated to stopping the mortgage bail outs.

Friday, April 11, 2008

Losers

Those ex-Marinites, Vernon and Marty Ummel, were schooled yesterday on the meaning of the phrase "caveat emptor"; they lost. What a surprise. (Thanks to reader "w.c. varones" for spotting the article.)

Those ex-Marinites, Vernon and Marty Ummel, were schooled yesterday on the meaning of the phrase "caveat emptor"; they lost. What a surprise. (Thanks to reader "w.c. varones" for spotting the article.)Let this be a lesson to all current "owners" who have seen their house price drop and to all would-be buyers who might be worried about their soon-to-be-purchased house losing value.

It took a jury less than two hours Thursday afternoon to unanimously clear a real estate agent accused of failing in his duties to a couple he helped buy a tony Carlsbad home.There's hope yet.

"The bottom line is that you (as a buyer) are responsible when you sign a contract and purchase something."

So if the buyer is responsible for the consequences of their signing a contract, why is the US government, the Fed, the state, bailing out failed flippers, "under water" mortgage holders, banks and lenders, et al. who made bad financial decisions/bets?

Monday, April 07, 2008

Greenspan's Latest CYA

Greenspan's latest message to the world; here's the executive summary:

'There was nothing the Fed could have done to prevent the housing bubble so we didn't even bother to try.'

Friday, April 04, 2008

Marinites Elevated to Rank of "Poster Children"

Here is the latest on that spoiled, entitled Marin couple (ok, ex-Marin), who I've blogged before, Marty and Vernon Ummel, who agreed to pay a stupid price for a house in San Diego (hey, they came from Marin where people pay stupid prices all the time; it's part of their culture) back in 2005 and now that their house has lost value they are suing the realtor; jury selection has begun:

Here is the latest on that spoiled, entitled Marin couple (ok, ex-Marin), who I've blogged before, Marty and Vernon Ummel, who agreed to pay a stupid price for a house in San Diego (hey, they came from Marin where people pay stupid prices all the time; it's part of their culture) back in 2005 and now that their house has lost value they are suing the realtor; jury selection has begun:Tomorrow, Vernon and Marty Ummel, who purchased a $1.2 million home in Carlsbad three years ago, will try to convince a jury that their real estate agent defrauded them when he failed to inform them that similar houses on the same block were selling for more than $100,000 less than what the Ummels had paid.Well, I certainly do not expect the Ummels to win, and I hope they don't because they agreed to pay a stupid price for their house and they should not be exploiting the legal system to make up for their poor financial decision-making.

Jury selection is expected to begin tomorrow morning in the Vista courtroom of Superior Court Judge Lisa Guy-Schall.

Although legal experts say the case is intriguing, most doubt it will spawn a raft of lawsuits in which disgruntled buyers go after real estate agents alleging they were led astray.

Experts also question whether the Ummels will be able to prevail, recognizing that ultimately, the Ummels were the ones who decided to pay what they did in 2005 for their two-story, 3,700-square-foot tract home in a neighborhood just north of the Four Seasons Aviara golf course. In those days, prices throughout the county were still climbing.

“The plaintiffs are not victims of a subprime loan scheme, nor are they victims of the declining real estate market,” attorneys for the Re/Max agent wrote in court papers supporting their request for a delay. “Plaintiffs simply think they paid too much for their home when they purchased it. Nevertheless, plaintiffs have now painted themselves as the 'poster children' of the current crisis.”

Be that as it may, I do hope something good comes out of this: I hope agents will practice greater disclosure; I hope buyer's interests will be better represented during the housing sale process and that the inherent conflicts of interest baked into the process of buying/selling a house will be eliminated; I hope...

As one commentor said:

the laws of agency and the concept of fiduciary duty are in direct conflict with the manner in which agents are compensated. Thus, this scheme is designed to be a losing proposition for the buyer. Always.If only that one conflict of interest were to be eliminated, if agent compensation was not tied to the final selling price of a house, then we would be that much closer to a free and open market for housing. It would not take us all the way there of course (have to get rid of all the government sponsorship, tax breaks, etc.), but it would be a significant step in the right direction.

Thursday, April 03, 2008

Confidence? What Confidence?

“Federal Reserve Chairman Ben Bernanke and the Bush administration on Thursday defended the decision to rescue Bear Stearns amid questions by lawmakers about why the government was helping Wall Street investment houses but not people on Main Street.”I gagged when Ben Bernanke actually tried to defend the Bear Stearns bail-out by claiming a crisis in confidence. So exactly how confident are investors in the good 'ol US of A supposed to be now that the Fed has to bail out 80-something year-old investment firms?

Hey Ben, you want to restore confidence? Let the free markets work.

And does Bernanke even care about Americans or does he just care about those Americans who happen to work for Wall Street? Here's one reader's answer:

How do the Master Planners feel about the American household, about the little guy? Here's some of Bernanke's testimony today on the hill:Angry yet?

Mr. Kennedy (loud): "What's your recommendation? We have monetary and fiscal policy. You have responsibility in monetary, Congress does in fiscal policy. But you have to have some position in terms of the economic crisis that we're facing."

Mr. Bernanke (calm): "No sir."

Mr. Kennedy (louder): "You're not prepared to tell us, to try and provide help and assistance to the states . to try and help and assist families, working families?"

Mr. Bernanke: "I'm all in favor of assisting people, sir, but it's Congress' position."

Mr. Kennedy (at his loudest): "You don't have a recommendation?"

Mr. Bernanke: "No sir."

What they really meant:

Kennedy: "What are you going to do to bail out the American household, Ben?"

Bernanke: Nothing Ted. What are you going to do about it?

Kennedy: "I asked you first."

Bernanke: "Well, Ted, you ignorant sot, we bailed out Wall Street. That's good enough."

Kennedy: "That is not good enough, Ben, you pretentious pedagogue. You need to bail out the American household too."

Bernanke: "No, Ted, you do that."

Bernanke: "No Ben, you do that." "No, you do it." "No, you do it."

Or is any despicable act justifiable if it means that there is even the very slightest chance of saving some of your precious housing loot?

Monday, March 31, 2008

Vacation House Sales Plummet

This was sent in from a reader on the other side of the GG bridge, in some place called San Francisco:

Second home sales have taken a direct hit in the current real estate market slowdown, according the National Association of Realtors’ (NAR) annual survey of investment and vacation home buyers.Hmm, Marin has a few vacation homes. But of course, as we all know, what happens in the rest of the country, or even the state, doesn't apply to us.

The realtors group, always eager to put a sunny spin on the real estate market, was frank in its assessment of sales of second homes, which include both vacation homes and investment properties. “Second homes are discretionary purchases and there is a natural tendency to pull back from big-ticket items in periods of uncertainty,” said Lawrence Yun, NAR’s chief economist.

In 2007, some 740,000 vacation homes were sold, down 31 percent from the 1.07 million sold in 2006...

Saturday, March 29, 2008

Irrational Obstinancy

I love how Marin County house sellers are being used in this New York Times article to epitomize irrational obstinacy (be aware: R.H., who is prominently mentioned in this article, is a housing blogger of some note):

I love how Marin County house sellers are being used in this New York Times article to epitomize irrational obstinacy (be aware: R.H., who is prominently mentioned in this article, is a housing blogger of some note):In 2005, Randolph Harrison and his wife, Pamela, decided to move north from Silicon Valley, over the Golden Gate Bridge into wooded Marin County to be closer to her new job. They found a six-bedroom house that seemed ideal except for the price, $1.875 million. The current owner, they knew, had bought the house a year earlier for $1.475 million.So are we Marinites especially prone to hurt egos? Do we take "people often go to great lengths to avoid taking a loss — or simply having to acknowledge one" to the next level?

So the couple, who both have finance jobs in the technology industry, told their real estate agent that they wanted to offer $1.575 million. He told them that the owner wouldn’t even listen to such a low bid. The owner’s attitude was “we’ll just stay here until we sell it for 1.875,” the agent said, “even if it takes years.”

In most other areas of the economy, this combination of plummeting sales and stable prices would not happen. When demand for airline tickets drops, the airlines cut their prices until they have sold their seats. When stocks become less appealing, share prices fall, sometimes sharply.

Real estate, though, is different. For both economic and psychological reasons, there is no asset more conducive to hopeful overvaluation. That means real estate slumps tend to grind on for years, until sellers submit to reality and reduce their prices.

In many ways, it would be better if the housing correction would happen more swiftly and sharply. The pain might be worse, but it would be over quickly. We seem to understand this principle when we’re removing a bandage. Why, then, is it so much harder with housing?

For starters, people have an obvious emotional connection to their house. After you have raised a family or enjoyed long meals with friends there, you are naturally going to place a higher value on it than a dispassionate buyer would. It’s your home.

“People say, ‘I don’t care about the market — my home is still worth what I paid for it in 2006,’ ” Mr. Glinert [a real estate agent] told me. “And I say, ‘To you. Only to you.’ ”

Doing what Mr. Glinert is asking sellers to do — dropping the asking price below their purchase price — is especially difficult. It’s tantamount to admitting defeat.

David Laibson, a leading behavioral economist, categorizes this sort of behavior under the heading of “the principle of the matter.” His point is that people often go to great lengths to avoid taking a loss — or simply having to acknowledge one. “Even a small loss evokes a sense of frustration,” said Mr. Laibson, a professor at Harvard. “There’s something magical about ‘at least breaking even.’ ”

Often, this hurts no one so much as it hurts the would-be sellers. They stay in homes where they no longer want to live, rather than accepting their loss and moving on. Or they move but endure the hassle of renting out their old home, waiting, usually in vain, for the mythical buyer who understands its charms. All the while, their money is tied up in the house, and inflation is eating away at its real value.

And you gotta love the comments about stubborn sellers made by the blogger who runs The Mess Greenspan Made blog:

That fact is clear to see in many neighborhoods as sellers sit and wait, either not knowing or not caring that they have little chance of getting anywhere close to what they're asking unless that one, dumb home buyer shows up who knows less about real estate market conditions than they do.

* * *

Friday, March 21, 2008

Discussion Forums

Please check out the Marin Real Estate Bubble Blog Forums (MREBBFs?). These are discussion forums in which you have a lot more control -- start your own threads about realtors/agents, specific properties, POSs, whatever you want. If you would like to see a forum dedicated to something not already provided, just send me an email.

Monday, March 17, 2008

Marin Market Heat Index Will Now Cost You $799/Year

The picture that you see above is the Marin Market Heat Index from January, 2008 (at that time the Index was around 0.41 which was essentially where it was at the end of last week). It is probably the last time you will ever be able to see it for free. You see, over this past weekend or so the Marin Heat Index became a paid service; if you want to know what the Heat Index is as of today or on any other future day, you or your realtor will have to fork over $799/year to see it.

The picture that you see above is the Marin Market Heat Index from January, 2008 (at that time the Index was around 0.41 which was essentially where it was at the end of last week). It is probably the last time you will ever be able to see it for free. You see, over this past weekend or so the Marin Heat Index became a paid service; if you want to know what the Heat Index is as of today or on any other future day, you or your realtor will have to fork over $799/year to see it.This is what real estate agents do to remain relevant and to manipulate the general public -- they covet and restrict access to real estate information. The fact that the Heat Index was free and open to the public was the main reason why I endorsed Nate Sumner and his agents as they seemed to value the free exchange of information. Clearly, I was mistaken about them -- Nate and his crew are no better than all the rest of the real estate shills.

Why did they do this? Who knows? But given that the Index has been free since around the year 2002 and only now, at the collapse of the largest real estate bubble in history, the timing of this is rather suspicious... maybe not Eliot Spitzer suspicious (the feds just happen to be cracking down on the call girl service that the "Scourge of Wall Street" just happened to use), but suspicious none-the-less. Maybe their business is so slow that they thought that they could get some extra income by charging for the Heat Index? Maybe they just don't want the general public knowing how bad our market is and is becoming. Or maybe the last six years of free access has just been a "test the waters" sort of thing and going for-fee is all part of The Plan.

Well, if you are like me and feel that if your real estate market is ever to be even close to an open, free market, then please use the contact info that they provide on their web site to express your opinion. Who knows? Maybe we can convince them that they are doing a better service for people by letting the Heat Index remain free and open. Here is the contact info in case you don't want to look it up:

That email link goes here: info@marketheatindex.com

That email link goes here: info@marketheatindex.com

Sunday, March 16, 2008

Open Thread

As we watch the Fed and Paulson desperately try to either nationalize Bear Stearns or get it merged, I am led to wonder why it is that main stream media articles keep avoiding a basic, fundamental truth about the housing bubble – they keep trying to insist that bubblicious housing prices are somehow justified, that sellers are somehow entitled to peak bubble prices and are justified in their expectation of receiving such prices, and that the only reason why housing prices are currently being threatened is because of a lack of credit. Ha! What about that 800 lb elephant sitting in the middle of the editor's office; what about income? What about the fact that the only way people could "afford" bubble pricing was with NINJA loans and the like? Why isn't income-based affordability ever given any serious consideration?

As we watch the Fed and Paulson desperately try to either nationalize Bear Stearns or get it merged, I am led to wonder why it is that main stream media articles keep avoiding a basic, fundamental truth about the housing bubble – they keep trying to insist that bubblicious housing prices are somehow justified, that sellers are somehow entitled to peak bubble prices and are justified in their expectation of receiving such prices, and that the only reason why housing prices are currently being threatened is because of a lack of credit. Ha! What about that 800 lb elephant sitting in the middle of the editor's office; what about income? What about the fact that the only way people could "afford" bubble pricing was with NINJA loans and the like? Why isn't income-based affordability ever given any serious consideration?Besides, credit really isn't all that threatened especially now that the GSE conforming loan limits have been raised to absurd levels (at least here in California). Sure you can get credit; it's available to anyone who can make a hefty down payment, can prove their income, and who doesn't spend more than about a third of their gross income on the mortgage (or no more than about 40% or so on all debt combined). What's the problem? Seems perfectly reasonable to me. The "problem", of course, is that since bubble-inflated prices are based on the exact opposite of these more traditional lending criteria, bubblicious prices cannot be supported unless one of two things occurs: 1) prices come way down or 2) everyone gets a 100%+ raise. Personally, I would prefer the latter but I am not counting on it.

This was supposed to be an open thread. Sorry.

[And please be sure to check out the Marin Bubble Forum where you can create your own discussion threads.]

Subscribe to:

Comments (Atom)