Source.

Quote of note:

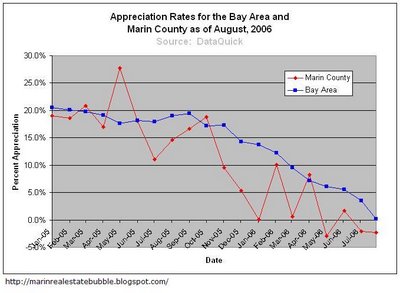

"Several things are going on. Many homes are being offered for sale at unrealistically high prices as sellers try to game the peak of the market. Buyers appear to be taking a wait-and-see approach as sellers get real with their asking prices. The market seems to be going into a lull, until this all shakes out. It does appear that the strong appreciation of the recent past is leveling off," said Marshall Prentice, DataQuick president.

12 comments:

With appreciation off the table, what's the compelling reason to buy a home at these insane prices?? Why assume all that risk and debt?

With sales down, I don't see how prices can just stay magically suspended where they are.

Lisa,

That's exactly why nobody is buying. Everyone that hasn't bought is in a rather rosey position. Group mentality has changed dramatically from :" Oooooh.. I just gotta' buy a home to pop out some babies before they get too expensive!" to- so.. the market is slowing? I can wait until it crashes.

personally, I look forward to watching this thing unfold dramatically. Just be sure that you have a lot of money saved up in advance because the economy will probably take a major dump right along with the crash.

"Oil is coming down in price, and inflation threats appear less worrisome than they were a few months ago."

I think the correction in oil and other commodities is temporary. When the Fed stops raising short-term interest rate, the US dollar will get hammered. This will invite inflation due to the fact that most oil and other raw materials are imported. Ironically, long end interest rates would start going up. We are in a vicious cycle that is not going to be "rosy" in the future.

YAHHOOOOO!!!!!

The national debt counter just went over 8.5 trillion!

I'm sure the economy is going to be zooming up!

House prices will soar...

Debt piled on debt can only be a wonderful thing.

I want a couple of Mercedes and BMWs and Porsches too.

I want a big Marin house with at least 3 hot tubs.

Jobs are up... oil is down...

YEEE HAWWWW!

Thanks Georgee Bush...

I had my doubts, but now it is all falling into place.

from the IJ this morning:

Quote from Barry Crotty, He said that while the number of single-family home sales fell compared with last year, the increase in sales from July indicates a shift in the market.

"We definitely had a falling off in the summertime and the numbers suggest in August we are coming out of that dip," Crotty said. "People feel confident that there is not a bubble about to burst, that the economy is going well, interest rates are coming down and it is a good time to buy housing and that is what happened in August."

Not willing to say it's a buyer's market, and it's always a good time to make a transaction because that's how realtors make money.

"We definitely had a falling off in the summertime and the numbers suggest in August we are coming out of that dip," Crotty said. "People feel confident that there is not a bubble about to burst, that the economy is going well, interest rates are coming down and it is a good time to buy housing and that is what happened in August."

Sorry, but what a total crock. Is he smoking crack? that's NOT at all inline with the reality of the housing situation.

People feel confident that there is not a bubble about to burst,

Actually, people should feel very alarmed if that's the case. If housing keeps pushing higher, the correction will be all the more painful.

In the past, the IJ has been quick to quote pundits on the future of Marin real estate. Now, with that same journalistic rigor, they've managed to find a realtor who can't remember that last 9 months. Well done!

To me, the scary part about this new era is that there is still people out there that must think that paying 700-800k for a so-so house is still a great idea. Very, very few homes are selling in my neighborhood in Alameda, but still- last week, a house went up on the market. It was just an ok house. 3 bedrooms, sort of boring style. Right on the corner of a busy intersection. pricetag: 760k. 3 days later, a "sale pending" sign swings from it. It's perplexing because surely-just surely EVERYBODY must be seeing the news that sales are way, way down, inventory is way up, values are starting to slip, and so on. yet some people are STILL buying?! what the hell?

if you really want to take the doom and gloom up a notch go check out peakoil.com or LATOC, especially the forums. They'll have you thinking that this little housing thing is a red herring

As mentioned before, the homes that are selling are from people who want to live in them, not "invest" in them.

In what I am seeing - the ones that are selling in marin are are in great shape. None of these type of buyers want a $700-800k marin home that has an ancient kitchen and bathrooms, and needs a lot of work. There are too many marin sellers right now still trying to sell their dumps in this price range and no one is buying. In my estimation most of these 3 to 4 bed, 2 bath homes in marin should be in the $550k range, and then they might sell, because most need a lot of work to be put in.

The ones I see selling were going for a lot more back in '05 and are fully in great shape and have modern updates and good grounds. The days of passing your circa 1960's marin home that has little or no updating for top dollar are gone - as it should be.

"There are too many marin sellers right now still trying to sell their dumps in this price range and no one is buying."

That's good news. Since prices are set at the margins, when these dumps do sell they will send the comps down.

marinite -

Great work again, with the data, as usual.

Thanks!

Post a Comment