After months of dishing out a false sense of security with their feel-good writing about housing for so long this article in Business Week strikes me as too little too late. Hey, Business Week, you're a Johnny-come-lately. But still, I strongly urge everyone to read it in its entirety; there are some surprising details in the article, like this one (underlining is mine):

After months of dishing out a false sense of security with their feel-good writing about housing for so long this article in Business Week strikes me as too little too late. Hey, Business Week, you're a Johnny-come-lately. But still, I strongly urge everyone to read it in its entirety; there are some surprising details in the article, like this one (underlining is mine):[Re option ARMs] There was plenty more going on behind the scenes they didn't know about, either: that their broker was paid more to sell option ARMs than other mortgages; that their lender is allowed to claim the full monthly payment as revenue on its books even when borrowers choose to pay much less; that the loan's interest rates and up-front fees might not have been set by their bank but rather by a hedge fund; and that they'll soon be confronted with the choice of coughing up higher payments or coughing up their home. The option ARM is "like the neutron bomb," says George McCarthy, a housing economist at New York's Ford Foundation. "It's going to kill all the people but leave the houses standing."I won't bother quoting any more from the article as it has already made the rounds in the bubblesphere and has been analyzed every-which-way, but it still depresses me...

...the CFA found that option ARM customers at all income levels said the loans were the only way they could afford their homes...

After prolonging the boom, these exotic mortgages could worsen the bust. They also betray such a lack of due diligence on the part of lenders and borrowers that it raises questions of what other problems may be lurking. And most of the pain will be borne by ordinary people, not the lenders, brokers, or financiers who created the problem.

It used to be, not so long ago, that home loans were about building communities and were only given to people after a careful risk analysis was done based on the borrower's income, current assets, credit history, etc. It used to be that moderate income people could fairly easily afford a moderate home...even in Marin. But then the speculative fever hit. Without missing a beat, lenders, real estate agents, the NAR, the CAR, etc. shamelessly exploited peoples' emotions, most particularly fear, with such statements as "being left behind", "priced out of the market forever", "renting is throwing money away", "real estate only goes up", etc. We were told that borrowing money was financially savvy, saving money was a waste, debt is good, and that actually paying off a mortgage meant you were doing something wrong. Lenders obliged, "poured gasoline on the fire", by offering more and more toxic loans with almost nonexistent due diligence. As a result, in the world we live in today housing is all about points, fees, investment, speculation,...profit.

At first it was just the flippers and "specuvestors" who were so focused on only the profit. Their numbers were fairly small and so their actions had a fairly small effect on everyone else. But thanks to the fearmongering and related emotional manipulation by the real estate/lending cartel over the last five or so years, the nearly non-existent lending standards, the "housing ATM", etc. the profit mania spread to a much larger group of house buyers who, at any other time, would have just wanted a place to live and who hoped only that when the time did come to sell that they didn't lose money. Whereas before the middle and working classes could fairly easily afford a moderate home, now the prices of even ordinary upper-middle to middle class and working class homes have been bid up to obscene levels and overall affordability is now lower than it has ever been. Not surprisingly, the excess liquidity, lax lending standards, fearmongering, and the upside panic resulted in ordinary people desperately trying to secure a home for their families before they completely lost (or so they feared) the ability to live in the communities where they grew up, where they have family, roots, history.

And thanks to the unfettered greed of others and the official sanctioning of that greed by the Fed, lenders, the real estate industry, etc. these ordinary citizens had to take out what is now commonly referred to as "toxic" loans that are now beginning to force people to default and lose their homes; and it's expected to get much worse. One could legitimately argue that if these people took out these loans and lost their homes because they did not do their own due diligence, then they get what they deserve. On the other hand, one could argue that many were misled and/or too trustful. If they were too trustful was their misplaced trust due to expectations built up after decades of past history when home loans were only given after a serious amount of risk analysis was done on the part of the lender? Were they too trustful because they did not perceive how rapidly lending reality has changed for the worse? Can we blame them for that? No, I don't think we can. These ordinary people were robbed because the system changed so rapidly that it made it easy to rob them. But what about the lenders, the Fed, real estate agents, mortgage bankers, appraisers, flippers, "specuvestors", etc. who either knowingly or through their own negligence helped to fan the flames? Should they be blamed? I think so. What about the folks who were willing to pay what they realized were absurd prices but rationalized it away with their expectation that prices would continue to increase? That's a harder one.

And now, it seems, it is all in danger of crashing down. Some of the enablers of this speculative mania in housing will get burned if not outright ruined. They'll get no sympathy from me. And I won't shed a tear for the people who paid prices that they knew were obscene but were willing to gamble that prices would continue to rise. But what about Joe Average who just wanted a place to live, a place to raise his family, and who trusted the system and its "experts" too much?

To me, that is the crime and a shame of our time which I hope won't be forgotten in history. Many of these ordinary people weren't being greedy, they weren't hoping to never have to work again, they weren't hoping to "retire on the house", etc. Their expectations were grounded and not extreme. They will be the big losers.

The winners in this housing fiasco are:

- The real estate cartel -- lenders, mortgage bankers, real estate agents, appraisers

- The securitization industries

- Flippers who were able to get out in time

- Retiring baby boomers who are selling now and who will be benefiting from social security (which later generations will never benefit from), Prop 13 and its ilk, and who (as voters) did nothing to discourage the nation running up its debt

- Everyone else

- Future generations

- The nation

Well, perhaps this situation will take care of itself. Just today as I was driving home from the airport I saw a large billboard advertising "Housing Prices Are Dropping Like a Rock Here's How You Can Profit From It" or something like that. In the Bay Area? Where everyone wants to live?! How can it be?

11 comments:

And why isn't San Francisco featured?

I'll share this one detail, and you may interpret it as you will. My previous employer, the publisher of that article, has their main W.Coast office in SF, including a very profitable construction subsidiary. You may also notice stats on NYC are absent: that's their home office location.

I was talking with a fellow investor over the weekend and we have agreed that some sort of laws will come out of this. As a foreclosure investor we have laws that we follow or we face heavy fines and possible jail time. Civil Code 1695:

"if such

person, by the terms of such transaction, takes unconscionable

advantage of the property owner in foreclosure."

And the punishment?

1695.8. Any equity purchaser who violates any subdivision of

Section 1695.6 or who engages in any practice which would operate as

a fraud or deceit upon an equity seller shall, upon conviction, be

punished by a fine of not more than twenty-five thousand dollars

($25,000), by imprisonment in the county jail for not more than one

year, or in the state prison, or by both that fine and imprisonment

for each violation.

This is a good law, I know people who break it to get a deal done...If you want to read more see:

http://www.leginfo.ca.gov/cgi-bin/calawquery?codesection=civ&codebody=1695

I'm no lender and I know there are preditory lending laws...But I'm confident that many lenders are taking unconscionable advantage.

~caddis

Marin... thanks for your article. My sentiments EXACTLY! This real estate boom has been awful here on Long Island. It has ruined so many lives and made life so difficult for so many here. And for what? The handful of sharks that have prospered? We have made it an impossible place for young families to live.

The good paying jobs we once had here are dissapearing. I work for the Tribune and we got letters from managment last week saying that Customer Service has been outsourced to the Philipines.

Many large employers are leaving because of the high costs associated with running a business here.

I ask coworkers who are deliriously ecstatic that their homes have tripled in value over the past 4 years if they care that THEIR KIDS will NEVER be able to afford to live here. NO ONE SEEMS TO GIVE A SH*T!

-I will stop now... thanks,

Liz

Liz, I understand exacly!!

These people will need more and more money to pay for the prices of these houses, and then the companies will outsource even more jobs because they wont be willing to pay the salary increases they need to continue buying more expensive houses at which they'll need another pay increase.

where are our children going to live?

"...the profit mania spread to a much larger group of house buyers who, at any other time, would have just wanted a place to live and who hoped only that when the time did come to sell that they didn't lose money."

That is good stuff there, that last part is just classic. What part of Fantasyland does this group of people supposedly inhabit?

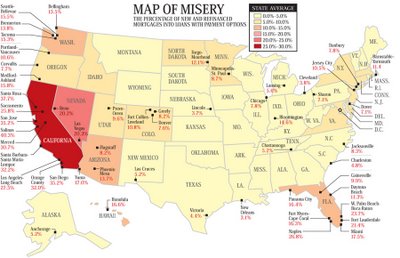

I really like that Map of Misery.

Not the misery part, but what it shows... that the financially self-delusional are HQ'ed right here in California.

Not surprising, really.

*********

"Well, perhaps this situation will take care of itself. Just today as I was driving home from the airport I saw a large billboard advertising 'Housing Prices Are Dropping Like a Rock Here's How You Can Profit From It' or something like that. In the Bay Area? Where everyone wants to live?! How can it be?"

* * *

That reminds me of the time, for about a year after the NASDAQ peak in early 2000, that a local over-the-air network affiliated television station (if I recall) used a particular "tagline" of sorts when it began or promo'ed its nightly newscast.

Something like:

"Coverage of the Bay Area: living in the best place on earth."

I mean... even if one believes it, how smug can one be?

Well, once again, that smugness will fade as this thing unwinds.

Thankfully.

We have a culture of homeownership in America where buying a house is our rite of passage, where one is distinguished as a financial citizen over those who merely rent. It's like something you *have* to do, else live among the ragtag marginalized.

Hopefully, attitudes and values will shift toward looking at the pros and cons of owning vs. renting from a rational perspective. Of course that includes me! I share the cultural valuation of owning over renting, for the sole sake of emotional superiority from holding a title to a house.

BUT, it is these exact beliefs that the financial industry has exploited over the past few years, extorting everyday people who share this dream and want to buy so badly with option ARM loans that will lead them to financial ruin. This is all one big psychological mindF by the realtors and bankers against the American people.

I have sympathy for no one who overpaid in this crazy bubble. These greedy folks did it to themselves, that's right greedy. Anyone who bought into the mania with little or no down, and used a toxic mortgage wanted a piece of the action, not just a place to live. The coming years are going to teach a lot of people what personal responsibility, capitalism, and common sense are all about. There is never a free ride, and for every winner there is a loser.

I too have no sympathy for gamblers when they finally bust out but those of us who are financially responsible will be forced to pay for this by the government.

Think back to the african loan forgiveness that took place during the last year. The taxpayers of the U.S and the U.K. paid off the world bank which lent money to corrupt african governments. The money was used to buy overpriced goods and services from western corporations after the skim for the african and western government criminals and business people was taken off the top.

Now that their credit card has been paid off the game can start all over again. Over 3000 years ago the Lord told us in the book of Ecclesiastes that corruption would always be part of human government and His truth stands forever.

Wow, that last comment was kind of scary, but anyway: unfortunately this has the looks of a real estate Enron, with the consumer getting screwed while the real crooks laugh all the way to bank. Like Enron, a couple of people *might* go down, but most likely the real players will get off.

Meanwhile they will tighten lending standards (necessarily) but this in turn will lead to a widening gulf between the have and have nots. I agree with SFMechanist's first paragraph: owning is a right of passage that separates the wheat from the chalf in our society. Loose lending standards have allowed the masses to over-leverage themselves to own. As lending standards tighten, only the wealthy will be able to own property. I believe in financial responsibility, of course, and proper due diligence in lending, of course, but I can't help wonder how this is going to come back and bite the little guy a second time.

Well, my $0.02

a couple of comments:probably 75% of the loan brokers still out there have been in the business 5 years or less,and all of their training is provided by lenders and title companies that give classes and seminars,with breakfast or lunch thrown in...also as far as points,usually an option arm has no points,instead there is a rebate from the lender...and the loan broker can quote a rate that provides him or her with a 1% to 3% rebate..."hey man,i'm not charging you any points on this deal!" the rebate allowed varies with the lender/originator.it is pretty much the same deal on the hybrid loans.personally,i have never charged more than 1% unless it was a hard money,short term loan.

Post a Comment