In case you haven't already heard, the US Senate hearings on the housing bubble (held in an open session of the Senate Banking Committee), entitled "The Housing Bubble and its Implications for the Economy", will be getting underway soon (you can find more info here). (And is it just me or are there no Californian representatives on the committee?) It will be interesting to see what, if anything, will come out of these hearings. Will they "conclude" that there is no housing bubble so it's business as usual? Will they cave to lobbying pressure from the NAR and others? Or will they find that there are sound bases for serious concern and move to a full-scale investigation? Are these hearings the first attempt at pre-election maneuvering and the covering of their collective political arses? Is this the start of figuring out who to blame, making a few indictments, and then shifting public focus to the latest crisis du jour?

In case you haven't already heard, the US Senate hearings on the housing bubble (held in an open session of the Senate Banking Committee), entitled "The Housing Bubble and its Implications for the Economy", will be getting underway soon (you can find more info here). (And is it just me or are there no Californian representatives on the committee?) It will be interesting to see what, if anything, will come out of these hearings. Will they "conclude" that there is no housing bubble so it's business as usual? Will they cave to lobbying pressure from the NAR and others? Or will they find that there are sound bases for serious concern and move to a full-scale investigation? Are these hearings the first attempt at pre-election maneuvering and the covering of their collective political arses? Is this the start of figuring out who to blame, making a few indictments, and then shifting public focus to the latest crisis du jour?The cynic in me is not expecting revelation. All these people are property owners and no doubt some of them have their fingers in the business side of real estate [unfounded speculation on my part]. The bottom-line is that they have a vested interest in seeing to it that property keeps getting more expensive. That fact will probably mean that if a problem is identified and a remedy is sought, that remedy will not involve forcing prices down to affordable levels. Instead what we will get are "band aid solutions" that sound good to constituents but have no real effect. The only real solution is to get out of the way, stop meddling with the market, and let it crash so as to get back on a healthy track.

Lawmakers behind Wednesday's hearing said that they were concerned that a steady flow of soft housing data could put the nation's economy in peril.

"The economy has been buoyed for some time by unrealistic expectations about the appreciation of housing prices," said Jack Reed, a Democrat from Rhode Island, who is helping sponsor the meeting. "Now that the housing market is cooling, the economy may be headed for a bumpy landing."

...the same committee will hold a hearing on the growth of innovative mortgage products that have mushroomed along with the housing sector.

The lawmakers will hear from several chief economists like Richard Brown of the Federal Deposit Insurance Corporation, Patrick Lawler of the Office of Federal Housing Enterprise Oversight, Dave Seiders of the National Association of Homebuilders and Tom Stevens of the National Association of Realtors.

I was planning on posting the above yesterday but the post about the Marin real estate broker in San Rafael was too much fun to watch unfold. Today, we now have some info about what is being said to the Senate by RE industry shills. No surprises. Here are some examples:

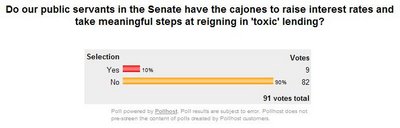

“For the past five years, the housing market has been a steadfast leader in the U.S. economy,” says Thomas Stevens, president of NAR, in testimony Wednesday before the U.S. Senate Subcommittee on Housing and Transportation and the Senate Subcommittee on Economic Policy. “After five years of outstanding growth, the housing market is undergoing a period of adjustment and becoming more and more of a balanced market between buyers and sellers.”"...a significant shift in interest rates or a change in the economy would change this forecast. NAR notes that a soft landing is possible under the right circumstances...". So in other words Mr./Ms. Senator, don't raise interest rates or crack down on "toxic" loan products or else houses will lose significant value.

“While recent developments raise concern, it is important to remember that the housing market varies significantly across the country,” Mr. Stevens says. One-third of the country (by population) is still seeing rising home prices, including Alaska, New Mexico, Vermont and many states in the South, excluding Florida, he says. But states like California that experienced the greatest increases in home prices in recent years are experiencing significantly lower sales, he says.

“Contrary to many reports, there is not a ‘national housing bubble,’” says Mr. Stevens. “We were seeing home prices and mortgage debt servicing cost-to-income ratios increase to unhealthy levels in some housing markets, which precipitate an adjustment.”

Also contributing to the cooling housing market is an increase in mortgage rates of nearly one point, speculative investors pulling back and first-time buyers being priced out of the market, the Realtors group says.

NAR warns that a significant shift in interest rates or a change in the economy would change this forecast. NAR notes that a soft landing is possible under the right circumstances and affordable mortgage financing is an important component in achieving this.

So I ask you:

It is not a surprise to me that these hearings are going on. What is surprising is that these hearings are happening now, so soon; usually you have to wait until the fecal matter hits the high RPM air pushing machine.

It is not a surprise to me that these hearings are going on. What is surprising is that these hearings are happening now, so soon; usually you have to wait until the fecal matter hits the high RPM air pushing machine.I think these hearings are a tacit admission that there is something terribly wrong in America today.

5 comments:

I'm pretty sure you're aware that the Senate does not have the authority to raise interest rates and are speaking rhetorically about the Senate sitting on it's hands on the housing bubble issue. Right?

I don't think the Senate has any business trying to affect the housing market per se. Certainly they could tighten up the lending laws, but I'd rather not have the gov't trying to influence individual market prices too much. The "cure" is often worse than the disease.

Back to interest rates though, there are many other reasons, aside from housing, that the Fed considers when looking to raise or lower rates. Inflation for instance. Do you think the housing market must be the primary arbiter for the Fed's decisions on interest rates?

Right?

Right.

Do you think the housing market must be the primary arbiter for the Fed's decisions on interest rates?

No. I think the dollar and its credibility is of greater concern.

I'd agree, but that is probably tied more to the attrocious state of our current account deficit and concurrent trade imbalance.

pothead-

I watched the hearings yesterday and it certainly seemed that, although the Senate may have no business trying to influence interest rates in an effort to prop the bubble, that in fact was what some were doing.

Sen. Sarbanes actually was very concerned that the NAR and Homebuilders have more access to the Fed to plead their case on lowering interest rates.

The whole hearing was a very scary foree into "How can we prop the bubble?" territory.

So, apparently there are those in Congress who have no problem with Americans being absolute debt slaves on inflated housing while their incomes stagnate or go lower.

In the Lending hearings next week we will find out just how far they are willing to go to screw Americans with toxic mortgages just to keep this bubble alive.

Post a Comment