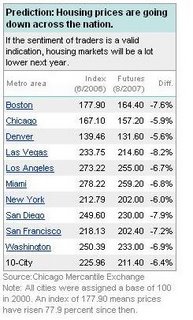

Investors are betting that real estate is going down as indicated in this article:

Investors are betting that real estate is going down as indicated in this article:Home prices will be lower a year from now in the nation's leading markets - at least that's what investors speculating on residential real estate believe.And I thought the info contained in the next graphic from that same article for San Francisco was interesting:

The S&P CME Housing Futures and Options, launched this past spring, enable investors to hedge against a drop in the value of residential properties in the future or to bet that those values will go up.

The investments are tied to the the Case-Shiller Home Price Indices. According to Robert Shiller, author of "Irrational Exuberance," the results of the trading in housing futures have substantial predictive value. "It gives us a finger on the pulse of the markets," he says. "We've never had that before."

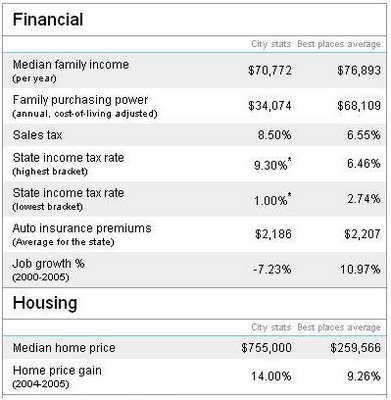

The median family income in SFO is $70,772 yet family purchasing power is only 48% of that as compared to 89% on average for all other "best" places to live. SFO's job growth is a negative -7.23% from 2000 to 2005 whereas it is a positive 10.97% for the average of the other "best" locations. Despite that, housing prices increased 14% from 2004 to 2005.

The median family income in SFO is $70,772 yet family purchasing power is only 48% of that as compared to 89% on average for all other "best" places to live. SFO's job growth is a negative -7.23% from 2000 to 2005 whereas it is a positive 10.97% for the average of the other "best" locations. Despite that, housing prices increased 14% from 2004 to 2005.Welcome to the Bay Area where you can earn a princely income but you must live like a pauper (unless your house keeps appreciating at double digit rates year after year allowing you to make up for the shortfall with a nice HELOC).

5 comments:

Larry, Too funny!

I guess you get the facts.

This is way out of line and will have to correct.

"Says a study"

Please don't screw too many other folks as you do your thing.

LOL

Hi Larry - I guess you're back, minus the blatant link to your web site this time. Still, your reasoning and sources leave a lot to be desired in terms of objectivity and completeness. Oh wait - I forgot - pitching real estate is how you make a living! Silly me...

Pertaining to the graphic concerning avg. income in SF, It could be predicted a few ways. I think it's more like there are some people making an absolute killing- as in 200, 300, 400, or even a million bucks or more per year right along with the other side of the equation, which is an enormous amount of people making chicken feed wages, as in 20k or less per year. That could very well explain the median. Then again, I know tons of people making decent salaries, as in 100k or more and are STILL struggling to live in SF. I am in agreement that the average income of the average BA resident is about 50% of what it should be in a healthy financial environment. This of course gets disguised and covered up in the form of little pieces of folklore like:" everyone wants to live here", and: "Silicone valley will save us"-Thus the supposed quality of life here is he supposed reward you get for a lifetime of slaving for substandard living conditions.

The chart compares SF to "best" places to live, which in retrospect, I totally agree with. Most of my family still lives in the Southeast where unemployment is now less than 2%, the economy is experiencing double-digit growth, and the cost of living is still, even during what many there are starting to consider a regional bubble, about 4 times cheaper than California, even if you consider the diffrence in wages.

I think the biggest threat to the future economic development in California is these new, formerly ignored parts of the country that in most part thanks to their local governments whom are all too happy to almost pay businesses to migrate there, will likely compromise California's "cutting edge". In essence, I see california getting mired in it's own state-wide recession as a result of not being able to control it's residential housing issues.

Oh, I love that last paragraph:

"Welcome to the Bay Area where you can earn a princely income but you must live like a pauper (unless your house keeps appreciating at double digit rates year after year allowing you to make up for the shortfall with a nice HELOC)."

Formerly known as "The Best Place on Earth."

Post a Comment