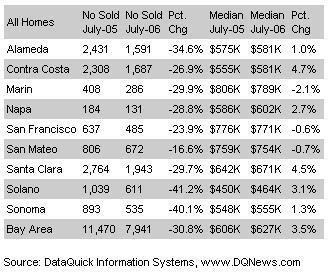

Home sales in the Bay Area slowed to their lowest level in ten years as prices increased at their slowest pace since spring 2003, a real estate information service reported.Here is DataQuick's tabulated data; for Marin, the year-over-year percent sales continues to be negative at -29.9% and price "appreciation" comes in at -2.1%:

Last month was the slowest July since 1996 when 7,682 homes were sold. The average July sales count since 1988 is 9,158.

"One of the questions being asked is how much future activity was drawn into the present in 2004 and 2005 when interest rates were at their lowest levels in decades. How much of today's demand has already been met? If the market is indeed going into a lull, expect low sales and flat prices through fall and on into next year," said Marshall Prentice, DataQuick president.

The median price paid for a Bay Area home was $627,000 last month. That was down 2.6 percent from June's record $644,000, and up 3.5 percent from $606,000 for July a year ago. Last month's year-over- year increase was the lowest since May 2003 when the $427,000 median was up 3.4 percent.

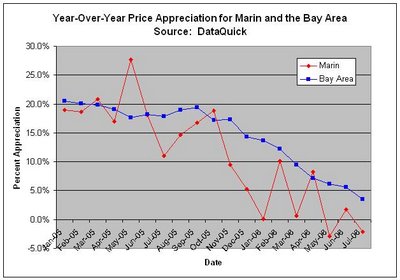

The following graph shows year-over-year price appreciation for the Bay Area and Marin:

The following graph shows year-over-year price appreciation for the Bay Area and Marin:

Here is what Vision RE has to say about Marin markets (don't you just love how they use exciting adjectives like "soaring", "rocketing" etc. when describing even small increases but when the results turn negative it is de-emphasized?):

After posting record highs in June, prices for re-sale single-family homes gave back most of those gains in July. The median price of single-family homes in Marin County posted a 12.6% decrease to $940,000. The average price for homes dropped 8.3% to $1,267,585.There are a lot of minus signs in the above tables (which were compiled by Ron Parks of the Vision Real Estate Group).

Sales of single-family homes took a nose-dive, down 27.8% from the month before. Year-over-year sales were off 24%.

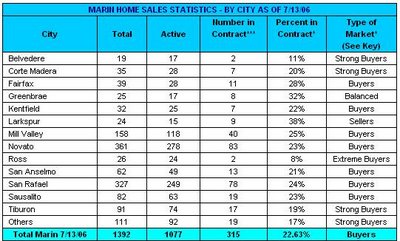

And while I'm at it, here is the current Marin Market HEAT Index broken down by price range and for the whole county (keep in mind that the HEAT Index represents what the market is like now whereas the rest of the data shown in this post represent sales that closed in July and so contracts were signed in May and June):

Recall that the HEAT Index scale is like so:

Recall that the HEAT Index scale is like so: And you know, since this is turning in to a Marin-real-estate-agents'-tabulated-data post, why not show this one too? I've never seen "Extreme Buyers" applied to Marin before:

And you know, since this is turning in to a Marin-real-estate-agents'-tabulated-data post, why not show this one too? I've never seen "Extreme Buyers" applied to Marin before:

20 comments:

woohoo, its really starting to get fun watching the sales and prices sink. Now I know how homeowners felt when the numbers were going up. Couple more years of this and I'll be buying in.

It's going to be a brutal winter.

It's going to be a brutal winter.

--And a Spring of dashed hopes.

And a Spring of dashed hopes.

Given the negative percent sales figures and how entrenched they are now, it would seem to be a certainty IMHO.

Next year we see sellers' depression and capitulation; what we're seeing now is nothing by comparison IMHO.

A mania is a mania, human psychology is the same be it stocks or houses.

Did I read it right regarding Marin Heat Index which is close to 0.00?

Did I read it right regarding Marin Heat Index which is close to 0.00?

You probably did but it's not right I am sure. I think it is currently at 0.54 for the whole county. Their java applet seems to have troubles once and a while.

It's now the Marin COLD Index (tm)!

It'll be interesting to see how that SP/LP metric holds up. For now it doesn't look too bad, even though volume is way down.

"SP/LP metric"

That metric is bullshit. It's meaningless. It's even more useless than most DOM statistics.

It is BS. Just look at the data for, say, Ross in the Vision RE chart. The SP/LP ratio is basically 0.97. The median and average prices were down YOY by -57.5% and -57.2%, respectively. The ratio will almost always be near 1.0 because as the seller drops their price (sometimes commensurate with a new listing agent), when the house finally does sell guess what? The sale price is very close to the last listing price which has been dropping.

"Couple more years of this and I'll be buying in."

Really? Will anyone really be wanting to buy a home at all when there is an established trend of declining prices? Why put good money into an asset you are pretty sure will drop another 15% in the next 12 months?

It doesn't matter if the house price is 80% off it's peak, if the price is still declining, then it makes sense to just wait until bottom.

Personally, I don't think I will buy a house until prices have dragged along the bottom for a year or so, and maybe even begun to modestly appreciate.

t doesn't matter if the house price is 80% off it's peak, if the price is still declining, then it makes sense to just wait until bottom.

You are thinking like an investor. If you know for a fact that you will be living in the house for the long term (>10 years) AND you are not buying into the investment psychology, then it makes sense to buy if the price suits you. Just my $0.02

And by the way, to whoever posted the "bullshit" post -- normally I'd give serious thought to deleting it on those grounds but as you made a good point IMO I didn't. But why can't we make our points without resorting to profanity? I know men like to talk that way but really...

I too am elated at being able to finally see a continuous stream of "bad" RE news. That said, it is still rather irratating that prices are still not really going down that much. We're just happy to see them stall. For me anyhow, the prices would need to come down a bare minumum of roughly 40-45%, which I assume would mean that the local economy would be in deep doo-doo anyhow, so buying even at "low" prices might mean the price for the state of the economy may still be high in comparison.

Me and my wife already decided to move to Nashville, so in some ways it would sort of suck to see home prices plummet to something we might possibly be able to afford right when we were exiting the state. On the other hand I doubt you'll ever be able to buy a restored victorian home close to downtown for 100k like you can in Nashville anyway, so no matter what we'll probably be paying signifigantly less just by movving.

Price drops are small at this point, absolutely, but the shift in psychology can be huge. What justifies these prices if homes are no longer going up?? Nothing. Why buy now and take a risk with hundreds of thousands of dollars of mortgage debt? Market didn't take off overnight, and it won't drop overnight.

I am assuming the data quick sales are from when the home closes, which means the offer was put in a month or two before, which means July numbers are a lagging indicator from the high point of the summer sales season which is in June, which means it is all downhill from here.

As far as prices coming down, that can take a lot longer. Sellers aren't going to sell until they are absolutely forced to since people tend to be optimistic creatures, so they will hold on until the very end, exhauting their savings, borrowing from family, doing whatever they can hoping things will turn around.

The pool of greater fool buyers I figure will be exhausted by fall. Sales will continue to slide to a trickle. Then the standoff really begins for the next year or so, although when we get to over a year of unsold inventory, and foreclosures start coming up, I figure when we will finally start to see some price declines.

Given the complete over-extenuation of credit across that nation, and threats from the fed to tighten subprime lending this month, that's just going to cut buyers further and home prices will be closer to a freefall than an orderly decline.

It seems prices have already dropped around 10% by street standards, which even six months ago hardly anyone would have believed could happen, and this is only the beginning.

-SF Mechanist

"You are thinking like an investor. If you know for a fact that you will be living in the house for the long term (>10 years) AND you are not buying into the investment psychology, then it makes sense to buy if the price suits you."

I totally agree. Buying a house to live in more consumption than an investment. There are more factors other than just economic ones. One has to balance the economic risks with the intangible benefits. We've all bought computers and TVs knowing prices will drop. Everyone just has a different entry point.

hich means July numbers are a lagging indicator from the high point of the summer sales season which is in June, which means it is all downhill from here.

I think you are correct and last night I realized this and so altered my post to reflect this fact. It is important, as you point out, because it is an indicatin of how pathetic our Spring season was.

The August figures are sure going to be interesting.

The HEAT figures for July indicate that the mid/low market (<$800k) is holding (balanced) but above that reality is starting to hit really hard.

Mikhail said...

"Will anyone really be wanting to buy a home at all when there is an established trend of declining prices?"

A good investor isn't a sheep. The best investors will have the timing to see the signs of the end of the decline.

The August figures sure are going to be interesting...

Mikhail said....

Will anyone really be wanting to buy a home at all when there is an established trend of declining prices?

The best investors aren't sheep, they have the timing to recognize when the market's about to turn.

Shame the FDIC doesn't have lenders give a strong warning when you take out a highly leveraged mortgage, just like a health warning on a cigarette packet. "Warning - this mortgage could lead to significant financial loss, possibly even bankruptcy".

Perhaps we should thank HGTV for creating this market advocating how to get rich quick - a popular message judging from my spam. If they're responsible/accountable maybe HGTV could start a new show following the sad stories of flipping that backfired.

"Couple more years of this and I'll be buying in."

"Really? Will anyone really be wanting to buy a home at all when there is an established trend of declining prices? Why put good money into an asset you are pretty sure will drop another 15% in the next 12 months?"

For one thing, the more prices drop, the less likely they are to drop in the future. You can see this from the past downturn where most of the decline was in the first couple of years and then it was flat for a while. And common sense tells you that housing will not go to zero, so the closer it approaches zero the less likely that it will get there.

Post a Comment