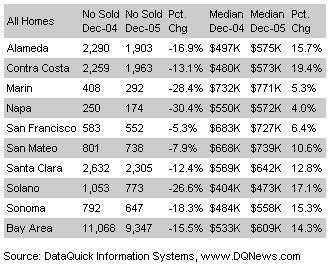

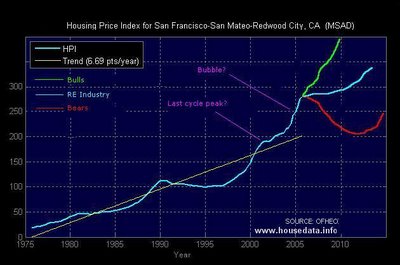

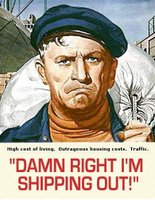

According to this Marin IJ article (and this), Marin's so-called 'intangibles' are not enough to keep people from wanting to leave -- 53% of North Bay residents have given serious thought to leaving because the quality of life here has so eroded due to such things as egregious housing prices, horrendous traffic, etc. Maybe that explains the recent rapid increase in Marin's housing inventory.

According to this Marin IJ article (and this), Marin's so-called 'intangibles' are not enough to keep people from wanting to leave -- 53% of North Bay residents have given serious thought to leaving because the quality of life here has so eroded due to such things as egregious housing prices, horrendous traffic, etc. Maybe that explains the recent rapid increase in Marin's housing inventory.Some choice quotes:

Fifty-three percent of those polled in Marin, Sonoma, Napa and Solano counties said clogged freeways and sky-high home prices have them thinking about the color of the grass on the other side of the East Bay hills, according to the survey conducted by the Bay Area Council.

The "epidemic" of high-cost homes has spread like wildfire across the Golden State, north to south, west to east. And a healthy percentage of those with itchy feet point to local government as being the source of their discontent. "Many residents are ready to squarely point the finger at their own city or town," the council says. "Only 5 percent think their own city is doing an excellent job encouraging affordable housing. Whereas 67 percent give their town a grade of very poor, poor, or fair."

Dissatisfaction with local government is higher in the North Bay than elsewhere. Throughout the Bay Area, according to the survey, 35.6 percent say they feel their local governments are doing a "fair" job, whereas in the North Bay the percentage is 37.8 percent. Bay Area-wide, 9.9 percent said they feel the job done is "very poor," compared to 12.1 percent in the North Bay.

Peter Richmond, of Pacific Union Real Estate Group in Mill Valley, said he had heard of people moving out of Marin because they no longer wanted to cope with traffic and housing cost. "The housing crisis has continued, without pause, through economic upturns and downturns," he said. "If we are to affect it, it will require major legislation in Sacramento."